Thought Leadership

Un-Riddling Core Modernization - A Colorful Proposition of Bank Transformation Via Componentization

September 09, 2019

UN-RIDDLING CORE MODERNIZATION

By taking a fresh look at a classic, elementary brain-teasing puzzle and contrasting resolution journey paths, the value benefits of core modernization through componentization can be newly appreciated. In fact, the hypothesis that core transformation through componentization and service enablement is faster, more economical and has a longer and higher value trajectory than alternative methods will be made.

There are three primary methods of core modernization journey paths: 1) “Rip and Replace” (full core conversion); 2) “Try and Buy” (Launching a new “digital branded” bank); and 3) “Surround and Shrink” (Transformation via componentization). This article will examine the transformational benefits and values gained with a core modernization through componentization journey as compared to the herculean effort of a full core replacement.

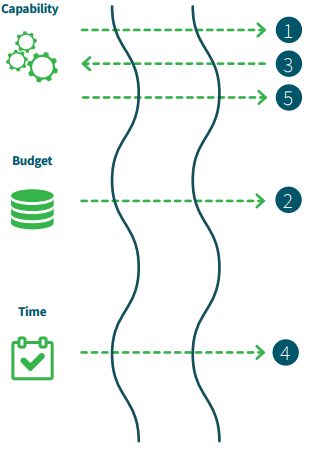

Let’s establish a baseline analogy understanding using a familiar brain teaser scenario in which a farmer who has purchased a cow, cabbage and a wolf at the market must cross a river to return home in a boat that can only hold the farmer and one other item. Certainly, there are natural constraints to the conundrum in which the cow and cabbage cannot be left alone together, nor the cow and wolf as a pair by themselves – without negative consequences. Without careful consideration, strategic planning and disciplined execution, the initiative can dramatically fail if the order of events or interdependencies become misaligned. Now, consider that we equate our cow, cabbage and wolf to capability, budget and time, respectively, and take a closer examination of the resolution in the context of a full core replacement. Yes, there is a solution to successfully bring about the desired results – hint below – but it involves a precise sequential order of events to achieve and a healthy amount of superfluous iterations between the three participants. You will note that under this scenario, even the most careful planning and an efficient and effective execution still renders a “waterfall” approach, in which full capability is not available until the final stage, budget is committed early in the process and held in suspense throughout the ordeal, and time to resolution is not fully lapsed until the very end.

Such is the weight of core transformation decision that a recent Celent report declares, “The core banking system (CBS) platform is the primary system of record for the accounts of a bank, and thus forms the technological foundation on which the entire bank operates. Because of this, the decision to change it can be difficult. The process of switching out a core system has been likened to changing the engine on an aircraft in flight. These transformations can be costly, and risky.”1 In fact, such full core replacement transformations can and have consumed over $350 million and more than five years on average in a number of recent, documented examples.2

Figure 1: Full core replacement waterfall analogy successful sequencing

Clearly, there are circumstances and scenarios in which a wholesale, full core replacement may make sense – these generally tend to include factors such as failing business/tech providers, extreme compliance/regulation deficiencies or major mergers and acquisitions scenarios, particularly in the context of a service bureau-to-service bureau, mid-market context. There are sufficient examples of success (and failure) of full core replacements conversions that give pause to bank executives and leadership teams to consider any change at all. However, current market, technology and customer factors are driving change, expectation, differentiation and regulation at such a rapid pace that financial institutions have no other alternative but to examine their strategies and operating models to embrace this opportunistic confluence of change.

Thus, financial institutions must then consider the prospect to drive toward core banking transformation with a different approach – core transformation via componentization.

According to Gartner research, “The core banking market is adapting to changes in the banking industry, especially changes in digital banking. The leading trend in establishing these critical capabilities is componentization: the decomposition of monolithic CBSs into smaller components with discrete functionality.”3

There is additional thinking that core modernization’s end goal should reflect true banking “platformification” – where bank platforms are positioned as business models endeavoring to match the right producers and consumers effectively and efficiently with a robust toolkit.4

In both perspectives, modularized, specialized, purpose-built business capability services/solutions components enable core modernization, relationship-banking and differentiation.

So, what are the hallmarks of a successful componentization strategy?

Accelerated business capability

By leveraging the inherent benefits of intentional component design, financial institutions are better able to align their core modernization strategies into incremental micro-phases that have direct impact to delivery on their most pressing business objectives and needs. While at the same time, they are progressing forward with capability that has both short-term impact and long-term viability. Due to the more focused nature and smaller footprint of components, they can be deployed in a more time- and costeffective progression that is aligned to immediate business impact levers, while establishing long-term foundational capabilities. As an example, such measurable returns on investment with a componentization approach have produced a 15 percent revenue increases in a daily banking product with optimized pricing structures, and up to 30 percent revenue increase on deposits, consumer loans and credit cards with individualized micro segmentation pricing. Further, the Harvard Business School Press book, in accordance with The Loyalty Effect, quotes, “It costs five to 10 times as much to win a new customer as it does to keep a customer, and a 5 percent increase in customer loyalty can translate into a 75 percent increase in profitability.”5 So, it seems that quicker-to-market components that enrich existing capability, which effectively creates market differentiation and/or perceived value to the end customer, is quite a successful objective.

-

Accelerated business capability

Enriched set of capability within "bitesize" modules with rapid deployment and impact drivers

-

Enterprise applicability

Fully digital-enabled API and Core/SOR agnostic design enabling bank-wide user experiences

-

Modern architecture design

Modern technologies and intentional framework design improve CapEx and OpEx and future-proof investments

Enterprise-class applicability

The most effective and efficient financial services core components can be deployed universally bank-wide due to their core/SOR agnostic and fully exposed API-enabled design. Not only do they bring accelerated business capabilities to a specific product line of business (LOB), i.e., retail deposits, but also expand their applicability across all product LOBs and areas of the financial institution (i.e., retail, commercial, deposits, lending, wealth, insurance, etc.) – creating a horizontal institutional impact. As an example, consider the universal centralization of customer preference and alert management into an enterprise customer component. Rationalization of likely isolated channel/sub-system business logic routines, functions and workflow operations are normalized and in many cases, automated. The advantages to improved customer experience only multiply when the enriched capability and integration patterns span across additional LOBs/ SORs. Further, these core components can be deployed in an incremental use-case-driven manner uniquely aligned with each financial institution’s needs and objectives. This not only centralizes many historically disparate functions/processes within a global bank environment thus rationalizing legacy processes/systems, but also introduces clarity to cross-platform integration efforts. And according to a recent Aite report, “APIs enable a bank to redesign its value chain. … APIs provide the flexibility to “unbundle the bank,” i.e., to separate the production of products and services from the delivery and user experience.” This is all well and good as long as the enriched capability, the improved operating efficiency, and enhanced products and services stem from focus on a “customer-first” perspective.

Modern architecture design

Successful core components will leverage new and universally accepted technologies that are open, digitally enabled, understood and supported by ample workforce resources, and cloud-ready to maximize deployment time, costs and scalability. In addition, they are purpose-built with global deployment applicability and seamless integration patterns in mind. New doesn’t always mean better but such intentional modern architecture design incurs lower deployment capital requirements and operating costs (e.g., components launched within cloud containers); it also enables future-proofing the solution set against the constant and rapid velocity of change due to the components' flexibility and nimbleness. For example, FTE resource talent availability and costs are maximized in comparison to older programming languages and database administration and by deploying fully exposed API service repository, microservice strategies are enabled, thus increasing time to market, agile development practices and more seamless integration. Further, the overall modern architectural design can introduce dramatic improvements to operational performance tuning, infrastructure hygiene and DevOps. The ability to leverage technologies such as application containerization and container management, particularly with cloud auto-scaling capability, smartly – and more importantly, automatically – scales not just the solution but precisely the specific microservice application. This would allow the most optimal cost management of production efficiencies to address month-end processing spikes and/or payday cash out transactional monsoons as examples.

Additionally, infrastructure hygiene benefits, such as better availability, better fault tolerance, along with cloud provider maintenance, patches, upgrades and security focus, can transform a major share of the IT budget from being used to simply keeping the lights on, toward innovative initiatives. Many – if not all – of these areas of enrichment are significantly constrained or become non-starters with legacy monolithic systems.

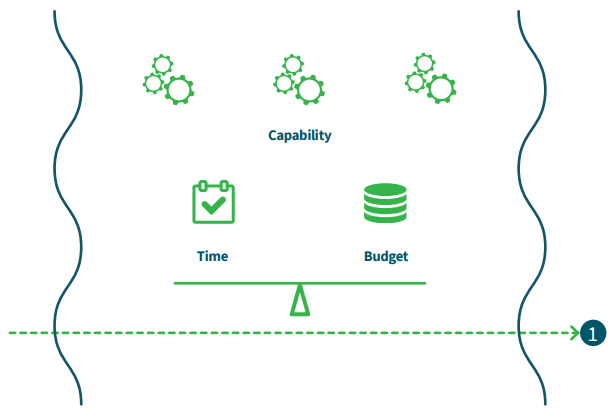

So, let us re-evaluate our river crossing puzzle analogy taking into consideration a mindset of componentization that leverages the advantages of modern architecture design, enriched capability and enterprise-wide applicability. For example, what if the farmer were to acquire several rabbits at the market rather than the cow? They are, after all, less costly to acquire, generally faster and nimbler in comparison and are more ready-set for expansion (recall the centralized preference management example above). As a result, the quantity of cabbage required is dramatically reduced in relative size of the number of rabbits compared to the single large cow’s consumption requirements. Further, the farmer is better able to determine how many rabbits he needs at present and as such can leverage the cost savings toward additional investments – say of small baskets or balloons (ample creative freedom, I know). So, when the farmer approaches the river, he is better equipped to cross the divide by launching the rabbits within their individual baskets, further enriched by the floatation of the balloons, and as such, the cabbage and wolf may all travel together safely and securely in one single direction – forward. By prioritizing component capability acquisition and leveraging their modern architecture and technologies (i.e., deploying with the cloud via containerization methods), all three paradigms – capability, budget and time – have been right-sized and maximized.

In conclusion, core modernization through componentization can be a much more efficient and beneficial transformation strategy that produces impactful and measured short-term wins, aligned with long-term visions. Recognizing that, “User experiences … must be enhanced to better meet customers’ new needs. This requires that products and strategies be evolved, technologies be modernized and partnerships with the right technology providers be formed.”6

1 CELENT – Core Banking Systems for Large Banks N.A. Version December 22,

2016 James M. O’Neill and Stephen Greer.

2 CoreEY – Surgically replacing core banking platforms: A perspective on alternate

approaches 2016 Wim Geurden, Matthias Loh, Jan Muralitharan and Bob Reveal.

3 Gartner – Critical Capabilities for Global Retail Core Banking October 9, 2017 Vittorio D’Orazio and Don Free

4 The Platformification of Banking – July 19, 2016 by Ron Shevlin posted on The Financial Brand.

5 BCG, How to Reap a Pricing Windfall in Retail Banking Febrauary 18, 2016 Sumitra Karthikeyan, Santiago Mazón,

Ian Wachters, Marcin Kotlarek, and Martin Van den Heuve.

6 AITE – NeoBanks: Banking on the Digital Experience November 2017

David Albertazzi and Ron van Wezel