Press Release

FIS Announces the Early Tender Results and Amendment to Tender Caps with respect to Cash Tender Offers for certain Senior Notes

July 11, 2017

Key facts

- $2 billion of Senior Notes at a weighted average coupon of approximately 4% expected to be purchased

- Interest expense savings of approximately $25 million in 2017 and $60 million in 2018

- Total interest expense savings of approximately $400 million over the next eight years

JACKSONVILLE, Fla. —(BUSINESS WIRE)— July 11, 2017— Fidelity National Information Services, FIS™, (NYSE:FIS) (the “Company” or “FIS”) today announced that, pursuant to its previously-announced cash tender offers (the “Offers”) for the debt securities identified in the table below (collectively, the “Notes”), more than $3.6 billion in aggregate principal amount of Notes were validly tendered and not validly withdrawn on or prior to 5:00 p.m., New York City time, July 10, 2017 (the “Early Tender Deadline”). The Company also announced that it is increasing certain of the Tender Caps as set forth in the table below. The terms and conditions of the Offers are described in the Offer to Purchase dated June 26, 2017 (the “Offer to Purchase”), and remain unchanged (including the $2 billion Maximum Tender Amount) except as amended hereby.

The Company expects to fund the tender with proceeds from its inaugural European bond issuance, completed yesterday, together with borrowings under its revolving credit facility. The Company was able optimize its capital structure by utilizing its assets and cash flows in Europe to issue debt in favorable market conditions; the new Eurobonds consist of €500 million of 0.400% Senior Notes due 2021, £300 million of 1.700% Senior Notes due 2022 and €500 million of 1.100% Senior Notes due 2024. The weighted average coupon of the new debt is less than 1%. Assuming the satisfaction or waiver of the conditions to the Tender Offers and the acceptance for purchase of Notes in accordance with the revised Tender Caps shown below, the combination of the Tender Offers and the new debt issuance will result in total interest expense savings of approximately $400 million over the next eight years, including approximately $25 million in 2017 and $60 million in 2018. The Company expects to incur approximately $150 million in tender premiums to par applicable to the Notes expected to be accepted for purchase in the Offers.

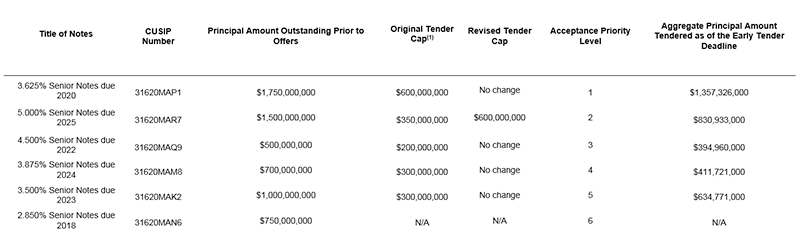

The following table sets forth certain information regarding the Notes and the Offers, including the aggregate principal amount of each series of Notes that was validly tendered and not validly withdrawn on or prior to the Early Tender Deadline:

(1) The Tender Cap for each series represents the maximum aggregate principal amount of the applicable series of Notes that will be accepted for purchase. Because the total amount tendered exceeds the Tender Caps for the Notes in priority levels 1 through 5 above, it is not currently anticipated that any Notes in priority level 6 will be accepted for purchase.

The principal amount of each series of Notes listed in the table above ultimately accepted for purchase will be determined in accordance with the Maximum Tender Amount, the applicable Tender Caps and the Acceptance Priority Levels set forth in the table above, in each case as described in the Offer to Purchase or as amended hereby. As a result, a holder who validly tenders Notes pursuant to the Offers may have all or a portion of its Notes returned to it, and the amount of Notes returned will depend on the overall level of participation of holders in the Offers and on the satisfaction or waiver of the conditions of the Offers, including, without limitation, the Financing Condition.

Holders of Notes validly tendered and not validly withdrawn on or prior to the Early Tender Deadline, if accepted for purchase, will be eligible to receive the Total Consideration, which includes an early tender premium of $30 per $1,000 principal amount of Notes validly tendered by such holders and accepted for purchase by the Company. Accrued interest up to, but not including, the Settlement Date (as defined below) will be paid in cash on all validly tendered Notes accepted for purchase by the Company in the Offers. The Company reserves the right, subject to applicable law, to increase or decrease the Maximum Tender Amount or any applicable Tender Cap.

The Offers are scheduled to expire at 11:59 p.m., New York City time, on July 24, 2017, unless extended (the “Expiration Time”), or earlier terminated by FIS. The settlement date for Notes that are validly tendered at or prior to the Expiration Time is expected to be July 25, 2017, the first business day after the Expiration Time (the “Settlement Date”).

FIS has retained Barclays Capital Inc., J.P. Morgan Securities LLC and BofA Merrill Lynch as Dealer Managers. D.F. King & Co, Inc. is the Tender and Information Agent. For additional information regarding the terms of the Tender Offers, please contact: Barclays Capital Inc. at (800) 438-3242 (toll free) or (212) 528-7581 (collect), J.P. Morgan Securities LLC at (866) 834-4666 (toll free) or (212) 834-3424 (collect) or BofA Merrill Lynch at (888) 292-0070 (toll free) or (980) 387-3907 (collect). Requests for documents and questions regarding the tendering of securities may be directed to D.F. King & Co., Inc. by telephone at (212) 269-5550 (for banks and brokers only) or (800) 791-3320 (for all others toll-free), by email at fis@dfking.com or to the Dealer Managers at their respective telephone numbers.

This press release shall not constitute an offer to sell, a solicitation to buy or an offer to purchase or sell any securities. The Tender Offers are being made only pursuant to the Offer to Purchase and only in such jurisdictions as is permitted under applicable law.

About FIS

FIS is a global leader in financial services technology, with a focus on retail and institutional banking, payments, asset and wealth management, risk and compliance, and outsourcing solutions. Through the depth and breadth of our solutions portfolio, global capabilities and domain expertise, FIS serves more than 20,000 clients in over 130 countries. Headquartered in Jacksonville, Fla., FIS employs more than 53,000 people worldwide and holds leadership positions in payment processing, financial software and banking solutions. Providing software, services and outsourcing of the technology that empowers the financial world, FIS is a Fortune 500 company and is a member of Standard & Poor’s 500® Index. For more information about FIS, visit www.fisglobal.com.

Follow FIS on Facebook (facebook.com/FIStoday) and Twitter (@FISGlobal).

Forward-looking Statements

This press release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations, forecasts and assumptions that involve risks and uncertainties and on information available us as of the date hereof. FIS’ actual results could differ materially from those stated or implied, due to risks and uncertainties associated with its business, which include, but are not limited to, the risks related to the acceptance of any tendered Notes, the expiration and settlement of the Tender Offers, the satisfaction of conditions to the Tender Offers, whether the Tender Offers will be consummated in accordance with the terms set forth in the Offer to Purchase or at all and the timing of any of the foregoing, whether amounts borrowed under FIS’s revolving credit facility to fund the Tender Offers will be repaid on the timetable assumed by FIS in estimating its savings, and other risks detailed in our filings with the Securities and Exchange Commission (SEC), including the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2016, and subsequent SEC filings. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. FIS undertakes no obligation to publicly update or revise any forward-looking statements.

Source: Fidelity National Information Services

For More Information