Payments Leader

Customer-centric Bill Pay by Mike Kresse

November 2, 2018

Mike Kresse, FIS

Consumers shouldn’t bear the burden of figuring out complicated banking applications and jargon to pay their bills. This includes navigating through multiple screens to move their money. It’s time to reinvent bill paying and, according to a recent report from Javelin, financial institutions are in the best position to do just that. Consumers need banking applications to provide better oversight of all bills, easier transacting and more control over accounts, including how fast money moves.

Bank-centric User Experiences (UX)

Currently, financial institutions expect consumers to adjust to their processes and language. For example, suppose a customer goes to their bank and asks how much they need to save in a rainy-day fund? The financial institution’s manager tells the customer to total up their expenses and income to determine what they need. But, the bank already has that information. Why not show it to them and provide a recommendation?

Consumers using banking apps currently must navigate to one place to pay bills, another place to transfer money and a third place to make a peer-to-peer (P2P) payment. Why shouldn’t a consumer be able to choose where or to whom they want their money sent and count on their financial institution to invoke bill pay, transfer or P2P automatically?

Customer-centric UX for Bill Payment

Javelin reports that what consumers value in bill paying includes: saving time, simple recordkeeping and assurance that payments are made and recorded properly. What this implies is that consumers want easy access to all their billing information, the ability to organize bills according to priority and status – pay now, upcoming, paid, for example – and assurance that the money is there to pay the bill and they can transfer it quickly.

Bill paying can become as easy as other digital experiences that consumers have embraced, such as shopping from Amazon. New bill pay services will make this happen. They will reflect how consumers want to make payments and build in features that greatly improve the user experience – few clicks vs many and behind-the-scenes use of artificial intelligence (AI) such as autofill, for example. Availability of real-time payments around bill pay will reassure consumers that their payment will be made on time.

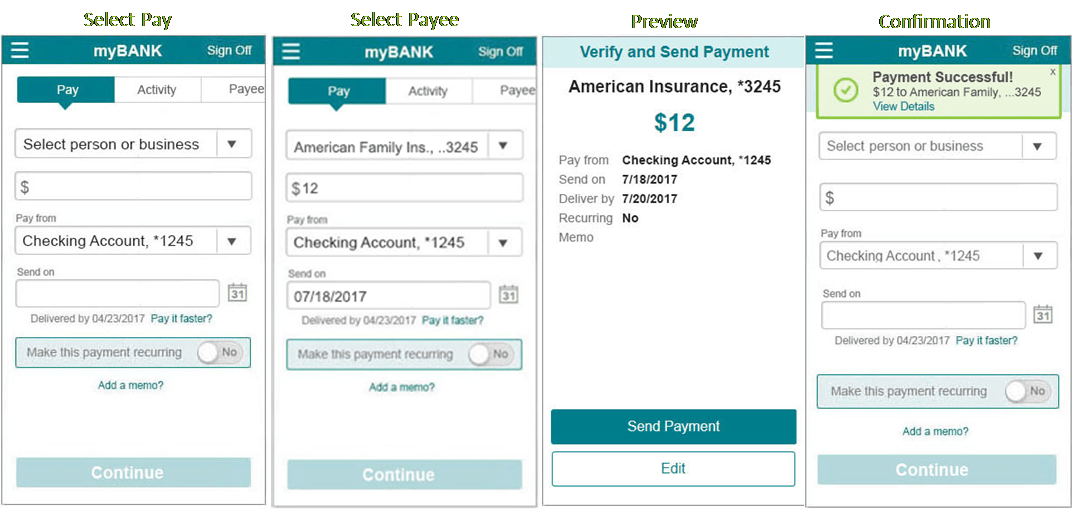

Example of Customer-Centric Bill Pay Flow

In moving toward a customer-centric UX, it’s critical to choose a vendor that not only creates technologies that significantly improve the customer journey but also provides API capability so that the UX becomes part of the financial institution’s brand, not the vendor’s.

Future Possibilities

The customer-centric UX mindset also sets the stage for further simplifying banking activities such as voice/AI banking. The current consumer script for voice banking might go something like this: “Alexa, I want you to go to my XYZ banking application. Click on Payments & Transfers. Click on QuickPay Send Money. Send to John Doe. Pay from my checking account. Enter $50.00. Send today.”

The future alternative could be: “Alexa, pay John Doe $50 from my checking account today.”