Thought Leadership

The API Developer Experience Enabling Rapid Integration

Ramchandar Loganathan | IBS Solution Architect

February 13, 2018

Banks require application programming interface (API) capabilities to realize the significant benefits of rapid integration (see the FIS white paper, “The Benefits of Open APIs Enabling Rapid Integration”). A robust and intuitive developer experience creates the foundation for rapid integration. This paper describes the attributes of a comprehensive API banking solution from intuitive learning to an API Gateway – describing how they positively affect the application developer experience. The paper closes with the perspective of a traditional software developer embracing APIs for the first time.

Intuitive Discovery and Learning

A developer portal should be the first interaction a developer has with an API. The Developer Experience (DX) encompasses many aspects of the relationship between developers and the API platform, with a portal covering areas such as education, tools and platform usability.

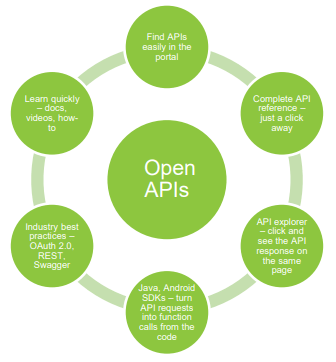

Open APIs should provide a DX with clean, well-documented and extremely easy-to-use APIs. Aided by a portal, developers can integrate quickly with pre-built APIs, integrate open standards for authorizations (OAuth) and integrate with other tools. Embedded productivity and learning aids help streamline work processes.

The developer experience is further enhanced when the APIs allow a developer to quickly learn how functionality can be applied. Other aspects of the experience should include reliability (including availability and scalability), facilitating troubleshooting (providing useful error messages), change management (API versioning) and visibility (logs and usage access).

When all these pieces fit together well, they provide a comprehensive developer experience, which improves efficiency and productivity.

Depth and Breadth of Services

Modern developers expect a fluid interaction with data platforms. To make this possible, they need APIs that access the full breadth and depth of bank systems.

Open APIs can provide access to bank functions, including:

- Complete customer inquiry

- Complete account inquiry

- Account maintenance

- Loan management

- Image integration

- Funds management

- Cards management

In addition, end-to-end use cases covering the following functionality help banks looking for a broader set of integration capabilities:

- Deposit account origination

- Funds sweep

- Customer and account maintenance

- Loan origination

Open APIs provide the right solution for a bank – whether the need is for additional data in a customer management app, or in a full-fledged onboarding experience. APIs can do the heavy lifting, so that developers can focus on the customer experience.

| Open APIs in a Connected World |

|---|

| In a not-too-distant future, consumers will expect every one of their connected devices to work together. It will take APIs to make that happen. |

An Environment that Enables Rapid Development

As web and mobile app users have high technology and efficiency expectations, APIs will become a common approach for integration efforts. Open APIs, such as IBS Open APIs, offer a banking-specific developer portal provided through FIS Code Connect. Code Connect is designed to empower financial institutions with the ability to share data quickly and securely, while growing an ecosystem of partners and customers.

The following rapid development environment features should be provided by a bank’s API partner:

| Rapid Development Features | IBS Open APIs |

|---|---|

| Easy, real-time access to core data and functionality |

|

| Simple third-party integrations |

|

| Lightweight architecture |

|

| Less bandwidth |

|

| Centralized marketplace to explore available APIs |

|

| Quick testing and sandbox capabilities |

|

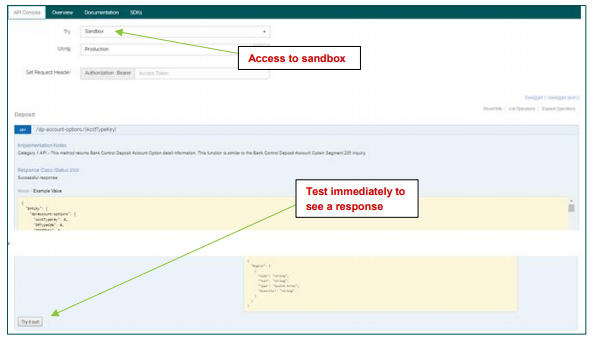

Using IBS Open APIs within the FIS Code Connect Marketplace, developers can browse through a catalog of existing IBS APIs, read documentation describing their use and experiment with them in a “sandbox” environment (i.e., an environment that allows developers to experiment freely with the APIs they create).

Testing can be performed from the Code Connect Marketplace directly to a test bank, returning live data on request. Developers can then subscribe to the APIs they want and use them in an actual integration.

Value to Speed of Integration

Banks will need enhanced architectural, technical and operational capabilities to support innovation driven by emerging open banking concepts. This will include, at a minimum, API management capabilities integrated with the bank’s existing integration tier and security architecture. Open APIs can provide immense value to banks launching a new integration initiative, collaborating with a third party or looking to innovate in a way that requires access to IBS core data and functionality. The following table summarizes capabilities banks should expect from an API partner:

| Open API Platform Capabilities | |||

|---|---|---|---|

| API Gateway | Bank APIs | Training and Documentation | Throttling and Governance |

| OAuth | Service Orchestration | API Support | Policy Enforcement |

| API Management | Publishing | Monitoring | Versioning |

| Access Control | Analytics | Auditing | Routing |

REST vs. SOAP Approach to Integration

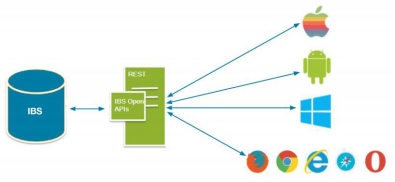

IBS Open APIs leverage the same messaging architecture used by the FIS middleware solution, Connectware, but with the added benefit of using Representational State Transfer (REST) web services. REST services are lightweight, intuitive to discover and learn, and easier to integrate.

Though Simple Object Access Protocol (SOAP) is a preferred approach for certain use cases, REST is quickly scaling and now represents over 75 percent of public APIs.

The following are some of the advantages of a REST approach:

- It is easy to understand. Every activity is a combination of noun and verb – select the object to interact with and perform an action inclusive of Create, Read, Update and Delete (CRUD) operations, so it’s simple to write and document.

- It provides a greater variety of data formats and offers better support for browser clients.

- It provides better performance (because it is faster and uses less bandwidth), particularly through caching for information that’s not modified.

- It makes it easier to integrate with existing websites, with no need to refactor site infrastructure.

Beyond Traditional Integration

IBS Open APIs can be integrated via FIS Code Connect – an API Gateway. The gateway eliminates the need for a dedicated network connection to IBS Open APIs for new client or third-party connectivity. Historically, a VPN/dedicated network set-up could take seven to 10 weeks. With IBS Open APIs, a Secure Sockets Layer (SSL) certificate must be issued and deployed, allowing IBS Open APIs to be set up in just two to four weeks. This results in time savings of more than 50 percent for the integration effort of IBS Open APIs.

In addition to time savings, IBS Open APIs provide access to capabilities that have not been previously exposed. These services include:

- APIs helping to build a next generation user experience

- APIs that serve analytics with increased speed, scale and greater functionality

- Business service APIs that fulfill broader integration needs of banks

Rapid Development with the Right Educational Tools

A robust portal should take the guesswork out of integrations by providing developers with a centralized place for discovering all the tools they need to successfully use an API. The portal should provide:

- API documentation explaining all aspects of an API

- Complete Swagger file for each API

- Code snippets for testing the API

- Software Development Kits (SDKs) in Java and Android

- Search capabilities to find the desired API

- A sandbox, with a test bank (where applicable) to interact with a live API. See the following example for entry to a developer sandbox.

An API portal should offer simple navigation (as shown above) which enables app developers to easily register apps, get keys and start consuming APIs. Developers can make calls to discover the structure and depth of APIs.

Access to these features ensures that developers can quickly understand the API and seamlessly integrate it into their app.

Generate Insight

To be competitive in today’s world, banks should use their resources carefully, making strategic decisions based on resource use and user experience. When using Open APIs, monitoring usage becomes an important tool to ensure their optimization. Open APIs should provide analytics tools to monitor, gain accurate insight and develop an understanding of API usage.

API analytics should provide:

- Dashboards for API-related statistics that are published over time, which include:

- API usage

- API response times

- Usage by resources

- An alert mechanism based on real-time analysis, which includes:

- Abnormal response times

- Abnormal request counts

By providing visibility into API metrics, Open APIs help improve overall engagement and satisfaction for developers.

A Developer’s Perspective on Open APIs

Developing integrated solutions in a traditional mainframe environment takes a great deal of planning, establishing communication environments, reviewing documentation, coding and testing.

The development approach with open APIs is vastly different – especially if your API partner provides a library that lets application developers browse and access an intuitively organized inventory of APIs

Not only should developers be able to browse through the catalog of available APIs, documentation describing their use should be readily available. Most importantly, developers should be able to experiment with and test using APIs in a sandbox environment. A development sandbox, API portal and API gateway capabilities translate into significant time savings for banking application developers.

Get Started with Open APIs

For a new development project, developers typically want to get hands-on experience with integration code as quickly as possible. One developer working with APIs for the first time found the ease of using an API marketplace (or portal) impressive. He immediately discovered an inventory of potential banking services to call upon, as shown in this partial screen shot from the FIS Code Connect Marketplace:

In addition to the available services, he found the supporting documentation was easily and immediately available through the FIS Code Connect Marketplace.

Significant Time Savings

The developer then decided to put APIs to the test based on his experience with traditional integration development methods. He knew from experience that setting up a development environment and invoking APIs typically found in a mobile banking flow took him 10-12 hours. These APIs included signing into the app, seeing balances and getting transactions.

Setting up a development environment and invoking these same APIs within the FIS Code Connect Marketplace took him under an hour – a tenfold time savings compared to a traditional approach. He quickly became a convert to open APIs

Value of a Sandbox

Within an API marketplace, developers should have an environment to experiment with the APIs they create. This sandbox environment provides real responses for the APIs invoked, but does not touch any real banking data or a live production system. A sandbox allows for testing more quickly, allowing developers to adjust “on-the-fly” to real-time feedback.

Top Reasons for Using an API Approach

While working with the Code Connect Marketplace and testing in a sandbox environment, the developer found immediate success with the new approach, generating faster integration and application development. His top reasons why other developers will embrace an API approach for faster integration are:

- Find everything you need in one place. With an API marketplace, developers can discover APIs, browse documentation and test new APIs – all within one portal.

- Leverage the accessibility and instant availability of immediate web communications as developers no longer must wait for communication links to be established.

- Use the intuitiveness of an API marketplace to replace the need to read documentation, streamlining your learning curve.

Summary

Surrounding the developer with robust experience for creating banking APIs opens the door to rapid integration. This in turn spurs the creation of innovative banking solutions for financial institutions to meet rising customer expectations for banking apps. This paper is the second in a thought leadership series on the value of the IBS Open API solution.

Contact Us

For additional information on IBS Open APIs, and the benefits banks derive from this robust tool set, contact Amit Aggarwal at Amit.Aggarwal@fisglobal.com or call 414.815.1182.