Thought Leadership

Banking on the Branch of the Future

Kelley B. Proctor, Vice President, Digital Product Line Manager | FIS Global Banking Solutions

January 01, 2019

THE BANK BRANCH IS DEAD, LONG LIVE THE BANK BRANCH!

Creating the Branch of the Future

Disruptive forces are challenging traditional bank business models and how banks interact with their customers. New technologies help us reimagine what’s possible and may, in time, redefine what it means to be a bank. In many global locations, new regulations promote open banking and the entry of fintech’s with a tech-first approach to banking. The majority of bank transactions are now completed online or on mobile. Does all this change signal the demise of the humble bank branch?

For many banks, branch closure programs have been high on the agenda, driven by a need to cut costs and a general fall in branch traffic. The growth of alternative payment methods and the decline of cash usage means there is little need to visit a branch to transact. But people still like to visit a bank branch, though perhaps less frequently than they used to and usually for a different purpose. Why?

In today’s digital age, people also want physical experiences and visiting a branch may be more appropriate for some customers and certain services. Customers tend to visit a branch to learn more about bank products and services – such as mortgages and retirement planning – and to receive financial advice. Although most customer journeys begin online, many are completed in the branch. For many banks, the branch remains a crucial customer touchpoint: a physical manifestation of its brand and all that it stands for.

Although branch closures have dominated the headlines, many banks – including startups – are opening branches, while others are repurposing branches as advice centers. We believe banks that dispense with their branch networks do so at their own peril. This may be a one-way street and there are salutary lessons from other industries: who could have foreseen the resurgence of vinyl records that are currently flying off the shelves?

The branch of the future can – and should - form the beating heart of a truly customer-centric banking strategy. In many cases it will be the final destination for a customer journey that began online or mobile. In practice, the branch is the crucial link between the customer’s physical and digital financial worlds and successful banks will be those who offer an integrated, personalized experience.

Here we offer a glimpse into the bank branch of the future: its nature and purpose and how banks must transform to meet emerging customer needs and rising expectations. In the age of the customer experience, we believe technology and human interaction should be complements not substitutes. In the bank of the future, the branch will be alive and well, and performing a role that’s real not retro.

Can the Bank Branch Survive?

The future of banking is digital. Although banks are at various stages of transformation, digitization is both inevitable and desirable. In the digital age, customers expect an engaging experience. They have high expectations that include transparency, proactive notification and advice on minor and major financial needs.

Customers also expect conversations to carry over multiple channels with frictionless interactions and ready access to knowledge and help. There can be little doubt that digitization represents a huge change in banking, potentially the greatest since the introduction of electronic payments. With so much change underway, it seems reasonable to speculate about the future of the bank branch. Is it moribund or can it be saved?

As is often the case, a look backwards provides a better view of the road ahead. Traditionally, bank customers visited a branch for several reasons. One of the most regular was to transact. With the decline of cash and checks, few transactions need to be completed in branch. However, bank branches serve multiple needs, particularly in areas where there is a preference for face-to face trust, customer education, or the practical exchange of documents and currency. The branch has particular relevance in the light of an aging population with a widening range of technology sophistication. This has tended to add to the range of services at the branch while digital banking has been reducing branch volumes. All things considered, branch economics are getting more difficult to manage.

Despite these dynamics, some banks are still investing in a physical presence, and for some it remains an important customer touchpoint. This takes on a variety of shapes depending on demographics, volumes and target markets. From functionality loaded ATM/Kiosks, to flagship stores for testing combinations of people and devices, banks around the world are testing ideas. In some cases, formats are for testing the exit from staffed branches and others are staffed locations with attracting specific customer segments in mind.

The truth is that success comes in many forms. Each bank should look at its customers, product strategies and markets to determine which strategies may work for them. Let’s consider some of the primary reasons to invest and the common elements in revised branch models.

Debunking the Demise of the Branch

If you believe the industry pundits, the total number of bank branches will shrink by one-third by 20251. However, for many banks, the branch is a critical component of a bank’s customer strategy. The truth is that banks are both closing and opening branches, but they are closing more than they are opening.

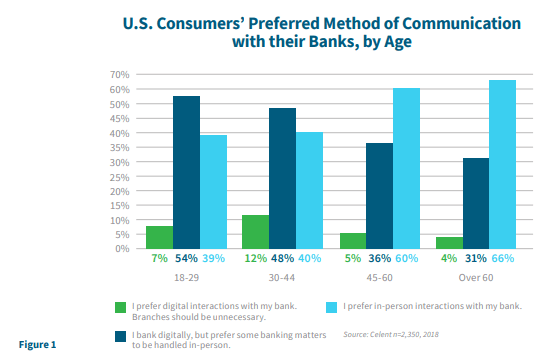

According to a recent Celent study, 50 percent of respondents, on average, across all age groups prefer in-person interactions with their bank (see Figure 1). Regardless of age, channel or need, consumers expect speed, consistency and personalization.

The importance of the branch as an advisory resource endures. Most bank customers prefer to use multiple channels and appreciate a personal touch when needed. Customers have come to expect the same high-quality experience across all their interactions, regardless of the channel. Gallup finds that customers are far more engaged with their bank when bank services are aligned closely to their preferences, digitally, physically or both.2

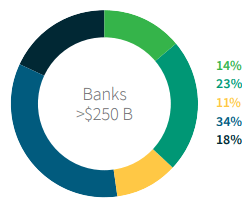

Therefore, it is not surprising that more than half of the executives in KPMG’s Banking Industry Outlook survey said they plan to increase their brick-and-mortar branches. Smaller asset-sized banks have more ambitious plans to increase branches, while their larger counterparts indicated they would either maintain or decrease their number of branches (see Figure 2).

Many banks still believe that branches are the best way to attract and retain customers. Smaller banks know community integration is a critical differentiation from more distant “digital dominators”. Today’s customer has significantly more digital alternatives but many still want to be able to talk to a person for help and hold a conversation for advice. To remain relevant, banks shouldn’t just add branches: they must reinvent their traditional branch outlet, invest in new strategies and adopt innovative technologies to make conversation the highest priority.

Figure 2. Q. In the next 12-18 months, does your bank plan to increase or decrease brick-and-mortar branches?

- Increase by more than 10%

- Increase by 6-10%

- Increase by 1-5%

- Stay the same

- Decrease

Branch of the Future: Envision, Enhance and Extend

The existing branch model has existed for almost as long as banking itself, with a traditional focus on transactional efficiency. Typical branches, as we know them, consist of a teller line and banker-defined areas with desktop computers. In most traditional bank branches, about 70 percent of the floor space is dedicated to tellers and assisted sales and service, with only 30 percent dedicated to self-service.

The branch of the future repurposes this space and, in some cases, significantly decreases and simplifies the footprint. Rather than walking in and conducting their banking needs with multiple individuals in segregated areas, customers are greeted with tablets or smart technology where universal bankers can assist them with all their banking needs. These digitally focused, or ‘smart branches’ tear down the existing silos, and make room for a more open and inviting space with minimal staffing.

Developing the right operating model for the branch will be critical to maintaining and alluring customer traffic into the branch. Although some banks have embarked on certain aspects of digital transformation, few have realized their full potential; especially as this potential just keeps getting higher. So, what should they do?

Banks need to develop a play card that rivals the success of many digital giants who have mastered the art of the customer experience.

For instance, what if Amazon ventured farther into financial services and integrated its retail network through its Pop-Up, 4-Star, Whole Foods and Books locations. The AmazonBank would be open and accessible to all – a gallery and learning center, combining virtual sales and promotion space into one.

In some locations, it would be staffed with relationship experts and remote topic experts who would guide the guest to smart decisions around financial well-being. The branch would be exciting and compelling to visit, with integrated channels for a seamless customer experience, showing how Amazon can be a ubiquitous part of a person’s daily life. In other locations customers might be assisted in using the digital devices and remote banking assistance.

AmazonBank would be compelling because it would illustrate the power of understanding the customer by using data to personalize the experience, building specific products and services to suit, willing to be open and willing to share. AmazonBank would become a conduit to facilitate interactions at the heart of all relationships. They would be always there, when and where their customers needed them. They would get the customer’s preferred interaction model right and would communicate effectively, making banking entertaining and compelling 3.

In the above scenario, Amazon makes use of its existing footprint. That’s a brand and financial reality for all existing banks. To compete with nontraditional banking providers, branches need to become smaller, more highly automated and offer a diversity of technology and physical design. Conversation space is important but transaction expectations remain without a significant rebranding exercise. Banks need to harness the power of digital tools to deliver new branch services, reduce the cost of managing branches, integrate the branch with remote assistance, while ensuring the branch remains the face of the brand. To succeed, banks must look for new ways to utilize space, adopt new technologies and provide seamless cross-channel integration. In practice, this requires simplicity of design, elimination of friction and an improved, consistent customer experience.

Key Elements in Reshaping the Branch Model

Just as Amazon uses personalization, banks must offer different solutions in dissimilar markets. A smaller town with an anchor employer might choose a co-location of high functioning kiosks. A seniors community in Arizona might have conversation centers in the mall. Both scenarios may warrant mobile advisors for premium service or large personal or community events. A recent suburban location may warrant something closer to a traditional branch. In reality, one size does not fit all.

When working through format options for bank locations, we identify five key elements that need to be considered.

Physical Space:

Physical Space:

Certainly, there are costs and limitations to altering an existing branch structure. However, simple modifications can go a long way toward improving the customer experience. Since all branches are not created equal, factors such as branch location, services and staffing levels must be considered. Reduction in costs may be achieved through redesigned or smaller branch footprints, as well as the introduction of digitally-enabled technologies. For example, breaking down barriers and creating openness, such as comfortable waiting areas and private meeting rooms, can create a more personalized environment for consultative and advisory services. Regardless of the topology, the physical branch must reflect the bank’s brand and offer the same level of quality and continuous service.

Self-Serve Devices:

Self-Serve Devices:

At locations with high transaction volumes, the use of selfservice kiosks can enhance the customer experience and reduce transaction costs. Today’s consumer is already accustomed to self-service experiences through common retailers, the airline industry, or their local grocery. Making use of these digital-servicing tools allows bankers to spend more time proactively engaged with customers while making open spaces and ‘pods’ conducive to conversations. As channels become sophisticated, the branch is the best place to use or test these new technologies. These devices can also be in “conversation rooms” where remote expert assistance can be provided in privacy after a banker introduction. In-branch kiosks can run on existing network infrastructure and are ultra-affordable compared to traditional ATMs. Ideally, where cash handling is required, it can all be handled by devices. Cash recycling at the device level is mature and reduces operational costs.

Mobile Tools:

Mobile Tools:

Utilizing self-service tools in the branch frees up more time for bankers to engage with customers and focus on revenue generating activities. Open spaces and “universal bankers’, equipped with tablets, provide a more fluid and engaging customer experience. Unlike traditional branches with dedicated tellers and bankers, universal banker models create “super” bankers, empowered to handle a multitude of banking activities - all on a single device. Tablets can be used to engage directly with the customer, inside and outside the traditional branch, facilitating collaboration and improved customer engagement. In higher volume branch locations, tablets can also be used to greet and direct traffic, as well as assist with self-service kiosk transactions and overrides.

Digital Signage:

Digital Signage:

This is an innovative way to make an immediate impact and engage customers through interactive mediums. Digital signage provides a level of flexibility and efficiency for bank branches unequaled to traditional print advertising. Digital walls or unique digital areas can serve a multitude of purposes. As branches transform, both physically and functionally, signage helps to promote bank products and services, engage in community involvement and educate customers on relevant products and services. For instance, a newlywed couple may be interested in buying their first home, whereas a retired person is more interested in cost savings and money management. When placed in intimate and private locations, digital interactive technology allows customers to access their accounts online, open accounts, pay bills or engage in personal financial management tools.

Internet of Things (IoT):

Internet of Things (IoT):

The IoT offers a plethora of options and benefits when integrated into the branch of the future. IoT beacons can recognize a customer’s smartphone and track their movement within the branch to provide key insight into customer behavior and patterns. It also provides a means of delivering personalized messages and experiences via smartphones, kiosks, and digital signage. Biometrics can be employed via tablets or self-service kiosks to recognize and authenticate customer interactions. More advanced IoT implementations provide the ability to conduct basic banking using wearables and conversational or voice banking, tying into the branch for continuous customer engagement. And, in situations where advanced advisory services are required, video and chat offer ways to leverage specialist virtually while still maintaining an intimate touch.

In practice, all of the above elements are highly complementary and bring a customer-centric banking strategy to life. The critical factor is that all bank products and services are available across all channels and are closely aligned with customers’ needs and expectations. The digital age is one of customer empowerment; therefore, banks must continually strive to increase customer engagement and build loyalty. The bank branch can also play a pivotal role in building customer trust, which is why many startups are opening new branches in key locations.

Developing a Branch Strategy Is Critical

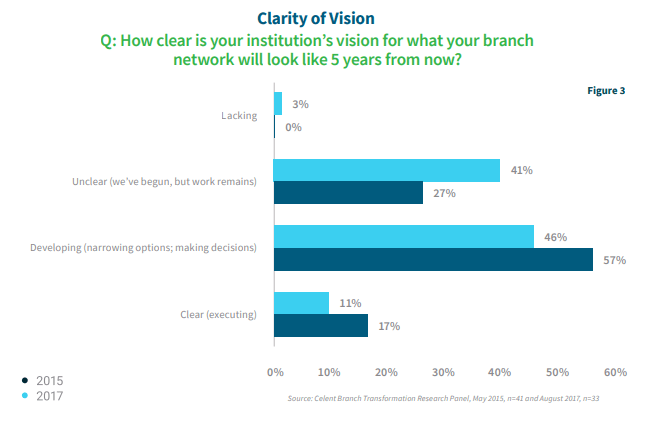

According to Celent, most banks lack a clear vision to branch transformation4. In a recent study that compared responses between 2015 and 2017 across financial institutions of all asset tiers, only 17 percent of the respondents proclaimed having a clear vision of branch transformation being executed at their institution. This includes financial institutions executing on a clear vision and strategy, even though deployments may be limited. Conversely, the percentage of those unclear or actively developing a vision is 27 percent and 57 percent, respectively (see Figure 3).

Developing a holistic plan, tailored to customer journeys and segmentation, can reap early financial benefit and ensure long-term success. Building for change and minimal infrastructure through server-less and commodity infrastructure is possible in most markets. Branch transformation does not have to be daunting; however, the strategy, planning and execution should be deliberate. Reinventing the physical space is one aspect that entails new design metaphors, coupled with digitally enabled technologies that create unique centers of customer engagement. The other, and most important aspect, is that branches of the future must be relevant and customer-centric in nature. They must be an active and critical participant in the bank’s overall customer strategy. Together, these two core values will drive enhanced and differentiating branch experiences for the future.

A Role for Technical Partners

Digital expansion into more processes and more channels will continue. For example, TD Bank just announced their goal for customers to complete 90% of their transactions digitally within the next three years. Unequivocally, your customers are changing. But, we are talking about their money and big decisions. Customers across all age ranges still like to see a physical presence and have the ability to reach out to a person for expert advice and help.

At FIS, we understand the need to transform branches that make them more cost-effective, yet tailored to the crucial needs of the customer. We provide a rich set of capabilities, built on an industry-leading platform, that ties into API-based solutions that provide plug-and-play digital enablement across your institution.

About Us

FIS is a global leader in financial services technology, with a focus on retail and institutional banking, payments, asset and wealth management, risk and compliance, consulting, and outsourcing solutions. Through the depth and breadth of our solutions portfolio, global capabilities and domain expertise, FIS serves more than 20,000 clients in over 130 countries. Headquartered in Jacksonville, Fla., FIS employs more than 55,000 people worldwide and holds leadership positions in payment processing, financial software and banking solutions. Providing software, services and outsourcing of the technology that empowers the financial world, FIS is a Fortune 500 company and is a member of Standard & Poor’s 500® Index. For more information about FIS, visit www.fisglobal.com.

1 “Say Goodbye to Your Neighborhood Bank Branch,” The Washington Post, April 2016

2 Most Banks Would Trade Personal Banking for Digital Banking. By Beth Youra, Gallup.com, April 17, 2016

3 Financial Brand: Bank of the Future, June 2014

4 “The Slow Wheels of Progress,” Branch Transformation Panel Series 7. Celent, September 2017