Payments Leader

ISVs Integrate Payments to Achieve a Holistic View by Sri Kothur

January 15, 2019

Sri Kothur, FIS | Payments Leader

Today’s independent software vendor (ISV) market resembles the Wild, Wild West. With so many players operating, so many integrations happening, and so many disruptive technologies emerging, it’s difficult for companies to navigate through the complexities of choosing the most appropriate solutions for their businesses.

The Imperative to Streamline

Regardless of business size, companies want to be able to easily view the impact of payments data and inventory throughput and integrate it with other parts of their businesses. Large companies are able to build or acquire software that delivers a holistic view of their businesses, enabling them to streamline their businesses, speed up decision-making and enhance profitability. But, until recently, everyone else has been tasked with piecemealing critical information together. This slows down critical business decisions, which puts smaller companies at a competitive disadvantage.

Large companies are able to build or acquire software that delivers a holistic view of their businesses, enabling them to streamline their businesses, speed up decision-making and enhance profitability. But, until recently, everyone else has been tasked with piecemealing critical information together. This slows down critical business decisions, which puts smaller companies at a competitive disadvantage.

Also hindering optimal business performance is not tying payment data into ISV software. For example, marketing optimization software enables businesses to measure response to marketing efforts. However, not integrating key payment information decreases insight about individuals who purchase in response to marketing efforts and their choice of payment methods.

The Holistic View

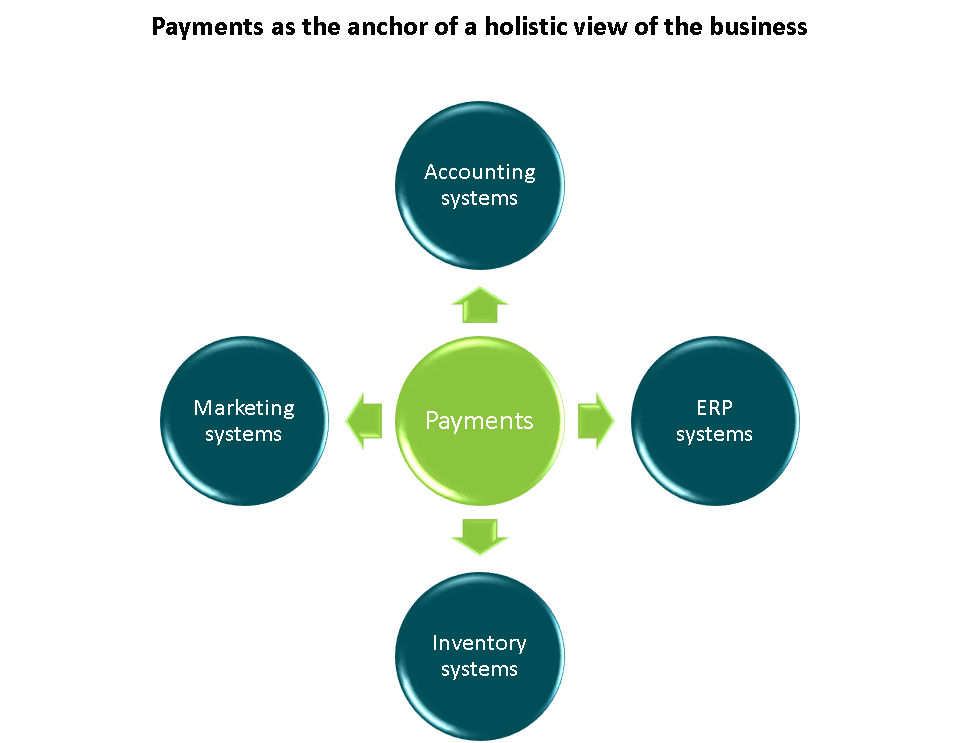

What does a holistic view look like? Payments is the anchor that flows into inventory and the ERP system that tracks how many units are sold. It also flows into the general ledger to compute margin. Integrating marketing systems into the holistic view allows for quick feedback on profitability of promotions.

In response to challenges by disruptive ISVs equipped with solutions that integrate payments, some big ISVs are introducing software to provide clients with a more holistic view of performance. For example, dominant players such as Micros (Oracle) and Aloha (NCR) initially focused on organizing ordering and inventory systems but are now adding payment capabilities to maintain their share against emerging contenders. Others are following suit.

Many types of business in various verticals currently struggle with inefficiencies and associated expense of trying to integrate payments with other systems. In the insurance industry, policy presentment is separate from policy premiums, for example.

Each vertical has specific needs. Retailers want to integrate payments with inventory. Ticket sellers want to integrate payments with seat assignments.

Large players have sufficient scale to design their own systems or acquire a software firm to fill the gap but small businesses that operate on thin margins are at a particular disadvantage. For example, a restauranteur running a happy hour promotion cannot assess the impact of payment method on profits unless payments are integrated with other systems.

No Easy Button

Software services from ISVs can represent an equalizer for smaller businesses by saving them time and helping them operate more profitably. However, there is no “easy button” to gain a holistic view. Some businesses will be able to add on to existing software, but others will need to go through a “rip and replace” process. Your payment processor should help you sort through options to find an optimal solution in your line of trade or business vertical.