Payments Leader

Three Big Drivers of the Payments Revolution: Lean In or Lose Out by Dondi Black

December 4, 2018

Dondi Black, FIS | Vice President of Payment Strategy

From global markets to Mainstreet U.S.A., the payments ecosystem transformation is happening at a quickening pace driven by a variety of factors including changes in regulations, emerging technologies, and shifts – sometimes subtle, sometimes dramatic – in consumers’ attitudes and behaviors.

In this article, I shine a light on three big, and enduring, drivers of the payments revolution.

Optimize the User Experience (UX)

What consumers expect today are user experiences communicated in their language. Modernization improves the UX by harnessing the power of contextual communications. Technologies driving modernization:

- Artificial intelligence (AI) moves beyond fraud applications to improve customer recommendations and provide real-time advice and information. For example, Clinc’s voice-powered AI platform named Finie answers consumers’ questions posed in everyday language instead of “bank speak.” Instead of saying “provide a list of my transactions,” consumers can ask “did I spend more on groceries this month than last month?”

- Geo-location services that match the location of a card transaction to the location of the consumer’s phone reduce false positives, thereby improving the UX.

- Predictive and behavioral analytics help marketers personalize communications and better tailor offers to capture favorable responses.

Sign Me Up

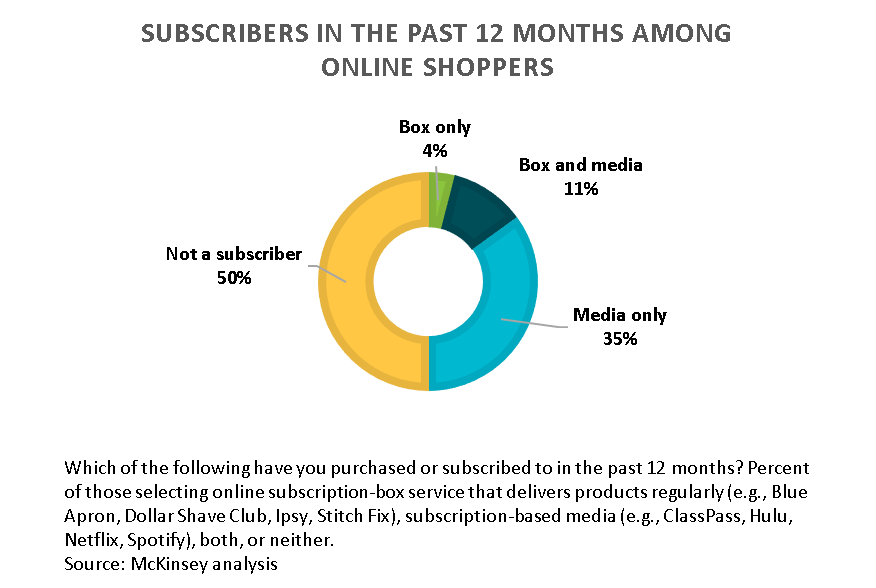

Help fueling the rise in digital commerce in the United States are subscription services – in entertainment (Netflix, Hulu), in transportation (Uber, Lyft), in consumer goods (subscription boxes from Dollar Shave Club to Stitch Fix) not to mention Amazon Prime. McKinsey reports that the subscription ecommerce market has grown by more than 100 percent over the past five years.

With this shift comes far greater urgency to be the “card on file.” Such standing provides critical advantages in terms of gaining a competitive edge and growing and predicting revenue.

As wallets shift from the physical to digital, it’s imperative to become “top of phone.” Although P2P transfers between consumers represent the current primary use for mobile money, merchant payment adoption is growing by double digits annually (14 percent) on a global basis, according to Aite. Value-added features – for example, gamification, loyalty and rewards, and mobile order ahead applications – are anticipated to play a large role in increasing usage, especially where growth has slowed.

Open Banking: When 1+1=100

By becoming a part of a network of providers, core capabilities are multiplied while investment resources are divided across the network. In several markets, regulations such as PSD2 have forced open banking. In other markets, fintech innovation is creating opportunities for retail banks to improve the customer experience. For example, Zelle, the API-enabled network of about 175 financial institutions, enables banks to compete effectively with PayPal’s Venmo in P2P.

PSD2 is said to be a harbinger of the future of banking in other countries than those in the European Union. Financial institutions’ monopoly on data required to deliver desired user experiences will be short lived. It’s time to act.

According to BCG, open banking has the potential to add to or erode retail banking revenues by 15-25 percent. BCG believes that the greatest disruption to retail banks that lag behind will stem from incumbent banks – not fintechs – that apply open banking to differentiate themselves and create growth opportunities.

A recent study of banks and non-banks in the United Kingdom provides clues about what will be the greatest challenges and opportunities in open banking. Developing a comprehensive strategy for investment is the most common current challenge – cited by 62 percent of study participants. Nearly half (47 percent) of the banks in the study are working on projects with payment providers.

APIs and software development kits (SDKs) are key to leveraging innovation without extensive investment in existing infrastructure.

Lean in Today and Look Out for Tomorrow

It’s imperative to lean into the three drivers of change – shifts in consumers’ attitudes and behaviors regarding UX, migration of transactions to digital, and moves toward open banking. Doing nothing risks future relationships and long-term revenue opportunities.

It’s also important to track potential disruptions in the market that either directly or indirectly affect financial service providers. For example, what happens if younger generations continue to treat transportation more like an on-demand service than a rite of passage? The 2-car family model, which has been gradually eroding, goes by the wayside. The effects of such a scenario reach beyond car manufacturers and dealers to gas stations, maintenance services, insurance companies and the financial service providers that enjoy significant transaction volume tied to car ownership.

Keep your eyes on the road ahead.