Payments Leader

Market Segmentation: The First Step in Achieving Product Profitability by Sandra Blair

July 31, 2018

Sandra Blair | Vice President Product Strategy

Market segmentation is based on the premise that companies don’t have sufficient resources to be everything to everyone. It lays out a logical process for defining core customers – those for whom resources are used to attract and retain – so you can best focus on them.

However, it’s easy to become sidetracked when defining a comprehensive market strategy for new products. Cool, new technologies and overly vocal stakeholders can shift attention away from real opportunities.

That’s why the first step in delivering profitable products is ensuring that new products are aligned with the needs and wants of your most promising and potentially promising customers.

Analyze Before Adopting New Products

Market segmentation analysis helps companies determine what populations to target within their trading areas, thereby laying a foundation for successful product launches.

Product portfolios are specific to an institution. Just because a product has shown success at another institution is no guarantee that it will be a star performer in your product portfolio, especially when customer composition and trade area characteristics differ significantly. That’s why it’s critical to analyze your market before committing resources.

The Process in Action

Markets can be segmented on a wide range of factors ranging from demographics to attitudes and behaviors. Before engaging in developing a complex segmentation, however, think about what data you can easily obtain about current and potential customers. And, think about what data is linked to product usage and profitability.

Useful consumer segmentation schemes can be as simple as dividing consumer data into income groups within age segments. Business customer segmentations employ firmographics such as business size and company age – factors that historically have had a large impact on product adoption and usage.

The following example represents a cost-effective approach to consumer market segmentation.

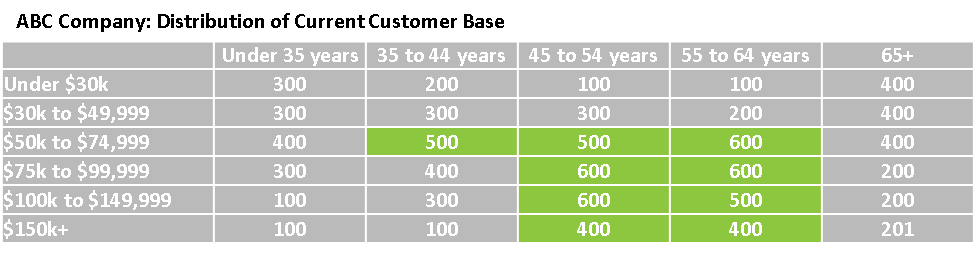

- Using standard Census categories to facilitate trade area analysis, ABC Company plots the distribution of its current customer base of 10,000 consumers across the age-income matrix. Comparing the past distribution of its customer base to the current one highlights ABC’s fastest-growing segments.

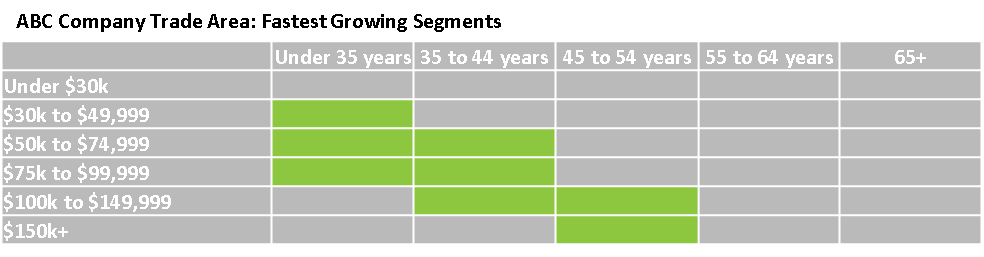

- Analysis of ABC’s trade area reveals the trading area’s fastest growing segments. Results suggest that ABC is falling short of attracting its fair share of some high-potential segments – consumers under 35 years old, for example.

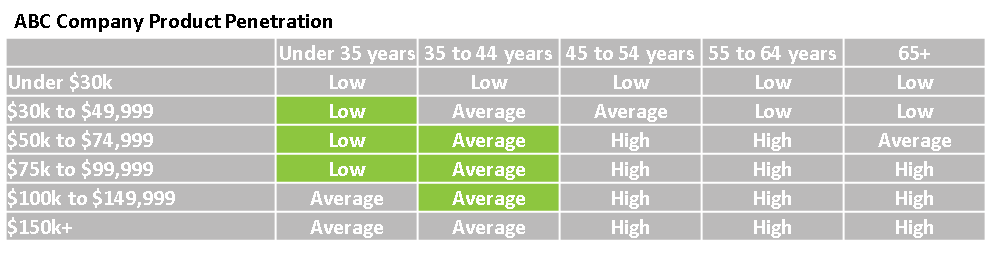

- Looking at product penetration across the demographic matrix adds insight into where gaps in the product portfolio may need to be filled to capitalize on growth opportunities within ABC’s customer base as well as its trading area.

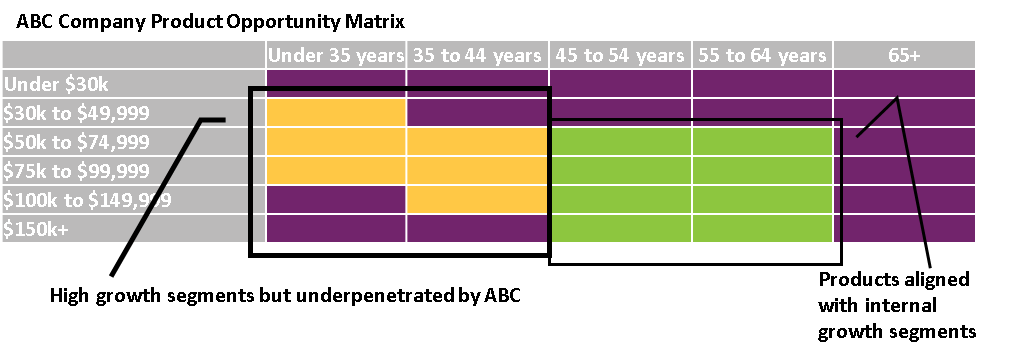

- The summary helps ABC focus resources logically. For example: Purple indicates low growth (at ABC and in the trade area), low opportunity segments; yellow indicates high growth segments but currently underpenetrated, which suggests product shortfalls in meeting needs; green indicates high growth segments in sync with the current product portfolio.

Employing this approach also can be valuable when assessing potential mergers and acquisitions. It helps answer questions, such as:

- How will the current product and service portfolio fit the needs of retail and business customers in the new trading area?

- What products should be added to maximize the potential of a merger or acquisition?

Before moving forward, companies should be confident that proposed additions to product portfolios fit with overall product strategies and represent the best vehicles for optimizing resources across the organization.