Thought Leadership

Excel when opportunity knocks – Obtaining the expertise needed to consolidate acquisitions successfully

Jim Gorski | FIS Consulting Services

February 06, 2019

Drivers of the Current M&A Environment

The banking industry struggles with top-line growth as sources of new revenue remain elusive. With organic deposit growth challenges failing to support lending activities, financial institutions must seek ways to expand. Favorable regulatory changes have eased the way for banks to acquire without regulatory barriers. Efficiency expectations have increased as digital banking takes further hold.

This paper explores these market drivers and suggests the skills and talent needed for successful merger activity. The key to realizing the intended benefits of a bank consolidation.

Favorable Regulatory Environment

In 2018, Congress passed a bill raising the threshold at which regulators classify a bank as a Systemically Important Financial Institution (SIFI) to $250 billion in assets. The legislation is often referred to as the Crapo bill after Sen. Mike Crapo, R-Idaho, who led the effort. The new bill raises the ceiling for a designation that carries costly regulatory requirements; which now apply only to a small number of very large banks. This opens the door for mid-tier institutions to pursue merger and acquisition plans without adding significant regulatory burden.

At the recent Bank Director's “Acquire-or-Be-Acquired” conference in Phoenix, advisers said, “The increased asset threshold for being deemed a systemically important financial institution, or SIFI, is enabling more large-deal activity. And some believe that more scale will help banks compete with JPMorgan Chase & Co. and other mega-banks, that are spending billions of dollars per year on technology.”1 This sentiment is shared by other industry observers, such as Yahoo Finance’s Brian Chueng, who states, “Prior to the regulatory change, banks near the $50 billion threshold were hesitant to make deals because growing in asset size would subject them to a slew of added regulatory requirements. But with that line no longer there, the floodgates could open for larger banks to make big deals.”2

Need for Core Deposits

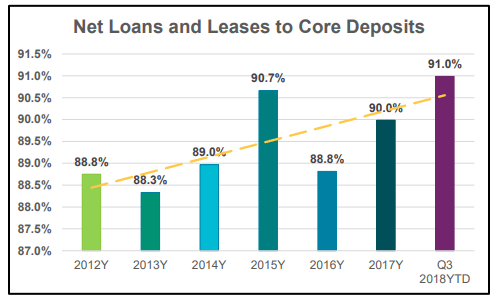

A challenging environment for deposit acquisitions contributes to an increase in the overall loan-to-deposit ratios at domestic banks as indicated in the following graphic.3 The net loans- and leases-to-core deposits ratio is used to assess a bank's liquidity, by comparing a bank's total loans to its total deposits for the same period. This number is expressed as a percentage. If the ratio is too high, it means the bank may not have enough liquidity to cover any unforeseen funding requirements. The rising ratio reflects the pressure the industry faces to collect sustainable core deposits.

Acquisitions can be a ready source of core deposits and a tactic that bankers are ready and willing to pull the trigger on as indicated in the following sample headlines:

- “Credit unions, community banks chasing deposits as cost of funds rises” — Standard & Poor’s, December 20, 2018 —

- “Banks Paying up for Deposit Rich Sellers” — American Banker, January 9, 2019 —

Increased Efficiency Imperative

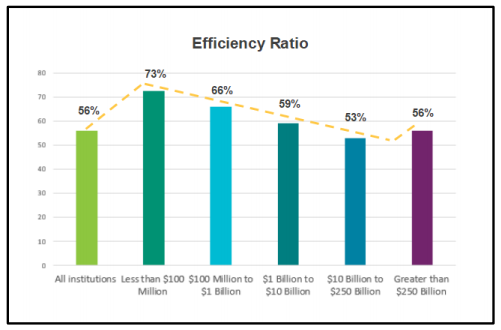

The banking industry maintains an ever-increasing need to cut costs and invest in new technologies and new ways to attract and keep core deposits without investing in physical infrastructure. While improvement has occurred in recent years, according to FDIC data, the overall industry efficiency ratio still lags 2009 levels. The rapid adoption of digital client-facing products causes industry analysts to anticipate better efficiency ratios. Banks must continue to seek performance improvement in this area. Adding scale and then wringing cost from operations through merger and acquisitions is one proven way to improve efficiency.

A comparison of recent efficiency ratios by asset size range of banks indicates that size does matter in achieving scale and operating efficiency.4

Why Banks need M&A Execution Assistance

Acquisition execution within a financial institution creates excitement, yet it’s also a resource-challenging time. Finding both the technical and banking expertise needed with a tight labor market creates a quandary for the senior management team of the newly combined entities. The U.S. Department of Labor cites the following employment statistics:

“Unemployment rates were lower in December than a year earlier in 250 of the 388 metropolitan areas, higher in 116 areas, and unchanged in 22 areas, the U.S. Bureau of Labor Statistics reported today. The national unemployment rate in December was 3.7 percent, not seasonally adjusted, down from 3.9 percent a year earlier.” 5

In a time of both M&A opportunity and low unemployment, financial institutions’ needs for skilled human resources can become acute. Banks, like the system integrators they partner with, need skilled subject matter experts for interim bursts of intense work. These supplemental resources mitigate the strain and drain on existing staff. Acquisitive banks should consider taking advantage of the many applicable skill sets available from third parties who execute bank consolidations on a regular basis.

Staff augmentation allows organizations to acquire consolidation process, product, technology and project management expertise to support conversion and merger activities – while allowing permanent staff to continue performing their daily “business-as-usual” activities. The following section of this paper describes the important human resources and skill sets critical to successful bank consolidation initiatives.

Expertise Critical to Merger Success

Project and Program and Portfolio Leadership

Beyond the “nuts and bolts” of a conversion, most banks seek to enable a transformation of their people, process, and technology. These initiatives demand skilled leaders to provide firm governance to ensure bank and partner resources meet key commitments and provide the expected deliverables. These senior Program and Project Managers should comprehend and adhere to a bank’s established governance methodology while being seasoned enough to provide sound judgement and executive communications.

The skills and attributes bankers must consider when looking for Program and Project Managers to lead various aspects of a merger initiative include:

- Leadership and Accountability. Program and Project Leaders must eagerly provide a single point of contact for the initiative they lead. These individuals take ownership for success while providing clear, concise and consistent communication to all program/project stakeholders.

- Business Focus. Program and Project Leaders must focus on the value of a bank’s technology for the end users and assess how fintech enables the bank’s strategic objectives.

- Governance. Program and Project Leaders mitigate risks within the initiatives they lead while ensuring stated quality expectations are met.

- Proven Change Management and Control. These leaders ensure all stakeholders are on the same page and work to eliminate any surprises during the lifespan of a merger/consolidation effort.

The following graphic summarizes the role of a Program Leader in driving a bank consolidation:

Quality Management

Quality Management within merger and consolidation activities requires skilled Quality Assurance resources with experience conducting crucial tasks such as:

- Defining testing requirements of the new integrated solutions

- Defining and establishing necessary test environments and data

- Managing test execution and reporting

Experienced quality managers bridge the communication between the bank’s executive leaders and the numerous siloed development organizations contributing point solutions to the newly merged organization. These quality experts can ensure the integration testing between the various application development efforts is identified, planned for, executed, and reported on. Filling the following roles becomes vital to ensuring a high-quality bank conversion:

- Test Manager

- Test Analyst

- Tester

- Defect Manager

While many stakeholders affect the quality of the outcome in a bank merger and consolidation, experienced and senior quality experts can provide the structure and communication needed in complex solution development. Sound quality management should consist of the inputs identified in the following diagram:

Solution Design

Replacing a core system due to a merger should not become a simple swap-over effort. To deliver substantial efficiency gains available in advanced technology platforms, innovative business processes must accompany new systems. Best practices and finely tuned staffing models can be applied to ensure the realization of maximum value, starting even before the actual conversion event.

Solution Architect resources should collaborate with the business stakeholders in a bank to establish the business scope and requirements and then design a blueprint to realize the vision. A proven design process allows the architect to solve for the business needs according to the timeline and agreed-to budget. A good Solution Architect understands the business and the challenges developers must address to construct a solution. The Solution Architect also understands the resources third parties can bring to bear in the conversion and transformation. They know when to deploy and the talent required to exact maximum value from the initiative.

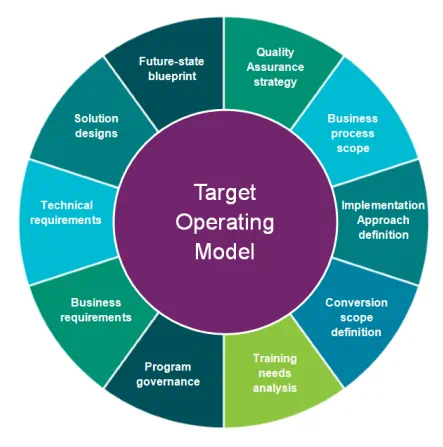

Supporting a transition to new core banking technology, architects should develop a Target Operating Model (TOM).

A TOM helps define how a bank will use the new applications and identifies proposed changes to the business processes using the new solutions. The overriding goal is to maximize the utility of new technology features and functions and help ensure the bank achieves the greatest efficiency and highest return on their investment.

Key inputs for a successful TOM effort include:

A Target Operating Model takes input from many sources to understand both the current banks’ environments and the future state of the combined institutions.

Business Process Improvement

Core conversion initiatives are comprehensive projects that involve all areas of the financial institution. Subject Matter Experts (SMEs) from the functional areas provide the impetus for Action Teams that identify, develop, and implement the new business processes coupled with the new technology.

Subject experts attached to the Action Teams recommend best practices and offer guidance on the feasibility of proposed solutions. These subject experts help financial institutions positively impact efficiency and service levels through streamlined, repeatable business processes within the newly combined institutions.

Finding resources who can identify, and capture process improvements typically includes an initial in-depth evaluation of the FI’s business processes and their alignment with core processing technologies.

Subsequently, the FIS SMEs collaborate with the bankers to formulate recommendations for ensuing quantifiable improvements for all lines of business and support areas that cover the following:

- Retail/Consumer Banking

- Lending and Loan Operations

- Deposit and Operational Back Offices

- Administrative and Support

Banking Product Expertise

Bank mergers require effective product consolidation to realize the many operational benefits of the transaction. Deep banking product expertise becomes an invaluable asset both in pre- and post-merger activities.

In planning for the consolidation, bank executives must make many application decisions – from product analysis through product definition. Once those decisions are made, detailed mapping helps ensure a successful data conversion effort occurs. Subject experts, with deep knowledge of how banking products impact the merger perform become invaluable. They can also help ensure findings from the Business Process Improvement effort and solution design create actionable results.

Immediately following the merger, these product experts can directly support staff unfamiliar with new banking products – allowing them to develop the knowledge and confidence needed to operate efficiently. Ideally, these experts will have performed similar tasks with the same banking products in a financial institution like that of the newly combined organization.

Specific activities these product experts can perform include:

- Product analysis and data mapping

- Facilitation of bank decisions during product planning for a pending merger

- Providing verification of test results and/or test reports

- Performing post-conversion product optimization and process support

Training and Education

System conversions and organizational consolidations dramatically increase the need to educate bank employees. Training becomes critical to ensure a smooth transition. Tight timelines increase the pressure on employees and managers who must make every effort to ensure staff is prepared on conversion day. Many banks have reduced their training staff, and/or they cannot scale to meet the peak training demands a merger creates.

Knowledgeable training resources who understand the technology within the newly created institution are a must. These resources should be able to deliver in-person courses, provide webinar learning sessions, or be able to develop online courses that meet a bank’s unique requirements. The training can vary from general banking guidelines for new hires, to specific processes and procedures for back-office deposit operations employees. The following video provides an example of just one type of general, online training: Banking 101.

Summary

As bankers look for expertise to help realize the gains of a pending merger or acquisition, they should consider a partner with extensive experience in Program Leadership, Quality Management, Solution Design, Business Process Improvement and Training.

Contact Us

For information about FIS Consulting and merger transformations, call 800.822.6758, or visit www.fisglobal.com.

1 S&P Global Research, Chances for a mega deal are rising, January 31, 2019

2 Yahoo Finance, why 2019 could be the year of the big bank merger, December 14, 2018

3 FDIC, January 2019

4 FDIC, Quarterly Banking Profile, Third Quarter 2018

5 U.S. Department of Labor, Metropolitan Area Employment and Unemployment Summary, January 30, 2019