Global eCommerceADDITIONAL RESOURCES TO HELP YOU

Use your data smartly

In the midst of uncertainty, we strive for transparency and openness to guide you along and ease some stress. Payments data and analytics are critical components to understanding the health of your business, especially during these unprecedented times. To ensure you’ve got access to reporting that helps you optimize your strategy while you navigate the next couple of months, we’re offering special access to Worldpay’s reporting platform, Pazien.

Pazien gathers your transactional data daily and delivers visual, interactive analytics that you can act on. If you’re already using Pazien, you can sign in today to take advantage, or reach out to your relationship or support manager for information.

Date and data comparisons in Pazien enable you to come to solid conclusions on your performance so you can make decisions that improve the bottom line. When you compare data, you reveal things like:

- How sales and refunds increase or decrease across time, and what channels cause those shifts.

- Any imminent or persisting fires you need to address.

- Particular regions affected by spikes in declines.

- Areas where fraud tools would be most impactful.

- Countries where certain payment methods are preferred.

- Specific banks that constantly issue chargebacks.

- Which business units are the most lucrative.

There are three prominent methods of comparison in Pazien Pro:

- Pivot tables

- Date comparisons

- Change over time

- Data comparisons

These comparisons have the ability to take your analysis to a deeper level and reveal where to target your efforts, and in what order. Keep reading for tips on how to make the most out of each feature.

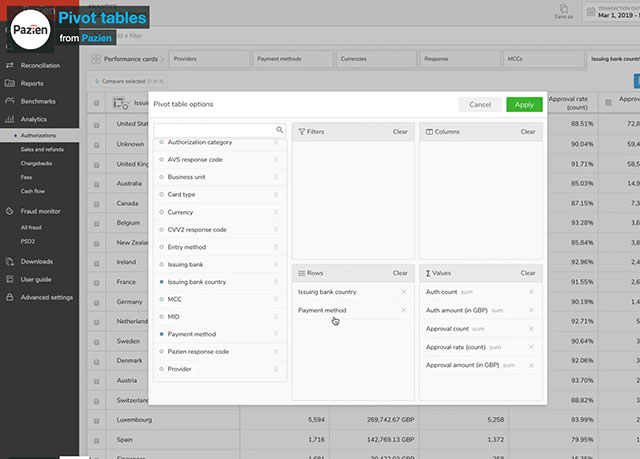

PIVOT TABLES

Pivot tables are often used in Excel to compare and analyze particular data fields. Pazien Pro performance cards have pivot table capabilities so you can quickly manipulate your data to drill in deeper.

Here are some ways to take advantage of pivot tables:

- Understand which payment methods you offer are preferred in certain regions.

- Determine which banks have the highest instance of fraud related chargebacks.

- Recognize which business lines cause the highest volume of specific decline reasons.

Create a pivot table

- Select any performance card from a page in the Analytics section.

- Click the pivot table gear icon in the first column header to open options.

- Drag and drop your desired pivots into relevant buckets.

- Tip: Anything from the rows, columns, and filters list can go into the rows, columns, or filters buckets. Anything from the values list can go into the values bucket.

- Click Apply. Your data will populate a pivot table according to your specifications.

- Scroll vertically and horizontally to view all of your data. You can also export the pivot table if you need to.

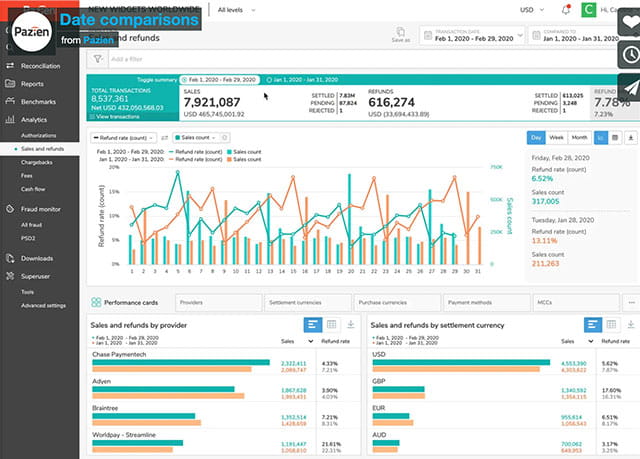

DATE COMPARISONS

When comparing date ranges, you can easily identify patterns. Recognizing patterns paves the way for effectively spotting problems, along with completing trend analyses or projections.

Here are some ways to look at date comparisons:

- Month-over-month – Track your approval rate by month. If your approval rate is lower one month, ask yourself if you implemented stricter authentication methods, or explore decline reasons to see if there was an uptick in fraud attempts.

- Quarter-over-quarter – Understand if chargebacks have fluctuated. If they’ve remained stagnant, or gone up, consider if Disputes defender could help prevent or win more chargebacks.

- Current month this year, to the same month last year1 – See how sales and refunds have changed. What factors contributed to those changes?

Create date comparisons

- Open the date picker in the top right corner of Pazien.

- The past 30 days are preselected, but you can change your base date range to any date by navigating through the calendar and clicking once on the start date, and once on the end date.

- Select Add a comparison.

- Choose the date range you’d like to compare. You can either select a date range by clicking once on the start date, and once on the end date, or you can pick from the preset options.

- Add a third date comparison if you’d like,and select Apply.

- The date comparison persists from the summary bar, to the trend graph, to performance cards.

1Pro grants you access to 13 months of data; however, you can only compare data that has been loaded in Pazien. If you were loaded on Pazien 6 months ago, you can compare data over that 6-month time period.

CHANGE OVER TIME

Different from date comparisons, change over time is a feature of performance cards which allows you to see fluctuations in particular performance over a single date range. Change over time comparisons are helpful in unearthing seemingly small problems that can have a big monetary impact, and in identifying small wins that can be replicated in the future.

Here are some ways to think about change over time:

- Daily – View which days of the month resulted in highest sales by MID, and determine if there were promotions those days that you could apply to future days to boost sales.

- Weekly – View which card types have the weakest approval rate. Contribute to weekly reconciliation by reporting your cash flow by business unit.

- Monthly – When looking at a longer date range, see how a new payment method you implemented resulted in higher approval rates over time.

Create change over time views

- Select any performance card from a page in the Analytics section.

- Click on the delta, or triangle, icon in the upper right corner of the performance card. Change over time defaults to monthly changes.

- Open the Options tab on the right.

- Choose what you’d like to track. You can also stick with the default option.

- Change the time period to daily, weekly, or stick with monthly.

- Choose if you’d like a percentage or numeric unit of change.

- Changes will apply as you select them, so click the X in the options tab when you're finished.

- Data displays the tracked item in bold, and the delta, or change from the prior period, in gray.

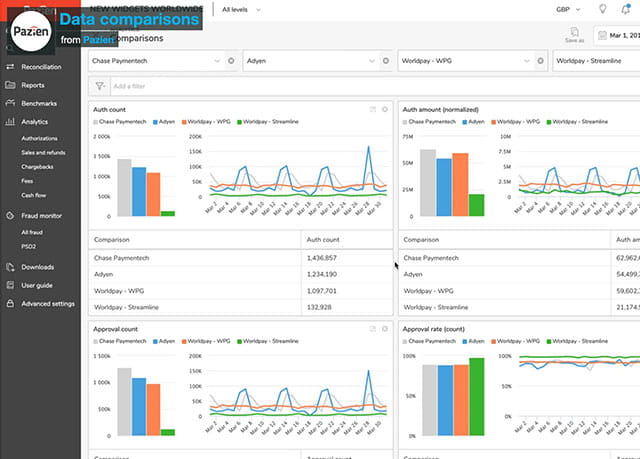

DATA COMPARISONS

It's incredibly easy to fall into focusing on one area of your payments performance. However, we want to give you the tools to consistently consider the big picture. So instead of stressing about why fraud-related declines are up, you can quantify that those declines resulted in fraud-related chargebacks going down. Data comparisons in Pazien Pro enable you to take up to four factors of your payments and compare them across authorizations, settlements, chargebacks, and more.

Here are some ways to leverage data comparisons:

- Payment methods – Understand sales vs. refunds vs. chargebacks for your top four payment methods.

- Regions – Select your top four processing countries and see how approval counts stack up to approval amounts.

- Business units – Track which lines of business cost you the most vs. which generate the most revenue.

Create data comparisons

- Select any performance card from a page in the Analytics section, for example Payment methods.

- Choose up to four items to compare by checking the boxes in the leftmost column.

- Click Compare selected at the top of the performance card.

- When the modal pops, you can add more filters, or simply click Compare to be taken to the comparison.

- The comparison shows items from the page you were on.

- Scroll to the bottom of the comparisons and click Add a comparison.

- Choose which settlement, authorization, cash flow, chargebacks, fees, and fraud2 data you’d like to add.

- Click Update metrics.

- The screen will now show all of your comparisons. Remove comparisons by clicking the X in the corner of the card.

- Drill into data by selecting any card, and explore the performance cards that live underneath it.

2Fraud data is only available for certain customers. To learn more, reach out to your relationship or support manager.

Protect your business for the long haul

As more consumers shop online during the COVID-19 pandemic, fraud attempts are increasing. New TransUnion research shows 22% of Americans have been targeted by digital fraud related to COVID-19 and there’s been a 347% increase in account takeovers.

Fraud is a typical part of doing business in today’s digital world and fighting fraud should be part of a multilayered approach. Not only do you want to increase approval rates, you want to protect your revenue and stop fraud before it happens.

FraudSight is an in-authorization fraud mitigation solution powered by artificial intelligence and machine learning. With FraudSight, we can help protect your business against fraudulent activity and provide some confidence during these uncertain times. Best of all, it can be deployed with little-to-no additional integration for our merchants.

It's more critical than ever to protect online transactions while not jeopardizing legitimate purchases. Fortunately, there are a few things you can do right now to address these concerns:

- Monitor warning signs

Payment verification is an important part of protecting your business. There are a variety of strategies to employ including implementing technology utilizing artificial intelligence and machine learning to help catch certain patterns. In addition to technology, here are a few other tips that may serve as warning signs. These are not a guarantee fraud is occurring, but they are flags to investigate.

- The shipping address and billing address differ

- Multiple orders of the same item

- Unusually large orders

- Multiple orders to the same address with different cards

- Unexpected international orders

- Require identity verification

Finding a balance between protection and ease of purchase will ultimately help you protect your customers and your business. The following tactics can make it more difficult for fraudsters to be successful:

- For customers that have a login, require a minimum of eight characters as well as the use of special characters in your customers’ passwords

- Set up Two-Factor Authentication that requires a One-time Passcode (OTP) via SMS or email

- Use biometric authentication for mobile purchases or logins

- Monitor chargebacks

Keeping good records is essential for eCommerce. If a customer initiates a dispute, your only available recourse is to provide proof that the order was fulfilled. Be prepared to provide all the supporting information about a disputed transaction. Worldpay's Disputes solutions can connect to your CRM and provide you dual-layer protection against friendly fraud, first deflecting them before they arise and then fully managing chargeback defenses on your behalf.

- Monitor declines

Credit card issuers mitigate fraud by automatically declining payments that look suspicious, based on unusual card activity such as drastic changes in spending patterns or uncommon geolocations of spending. You can check your own declined payment history to help spot a potential problem. When volumes increase, the help of a payments fraud management partner is beneficial.

It is our top priority to keep your business operational and supported. Contact us to learn more about how you can protect your business.

Take control of chargebacks

Now it’s more important than ever to take control of your chargebacks. While health professionals around the world are tirelessly fighting to save lives due to COVID-19, we want to help our merchants in any way we can. Disputes and chargebacks are typically a normal part of any business, but there are better ways of managing them when they arise.

How we’re helping

To help you manage chargebacks during this unprecedented time, we’re offering the use of our Disputes solutions suite (Disputes Deflector and Disputes Defender). Please contact your relationship manager for details.

Our solutions provide you with dual-layer protection against chargebacks, first deflecting them before they arise and then fully managing chargeback defenses on your behalf.

With Disputes Deflector you:

- Get notified earlier in the chargeback lifecycle

- Prevent a dispute from turning into a chargeback

- Reduce the overall number of chargebacks to your business

Disputes Defender will help you save time and money fighting chargebacks by:

- Providing end-to-end chargeback management

- Gain a cost-effective approach and partner to defend chargebacks on your behalf

Our Disputes solutions are success-based models, there are no upfront fees and we simply retain a percentage of the revenue we recover for you.

Further, we recognize that at this time internal resources may be tighter than ever and therefore we have integration options that involve zero technical resources.

Impacts of chargebacks

When consumers dispute a credit card transaction, there are at least six ways for you to lose:

- You lose the sale

- You lose the merchandise

- You eat the shipping costs as well as the labor to ship

- You lose the overhead of manually reviewing the transaction

- If you lose the chargeback dispute, you not only pay fines to the card networks, but your processor may label your business ‘high risk’ if you experience too many chargebacks

- You may lose some customers

Merchants in the travel, airline, and entertainment industries have already been greatly impacted. But, online merchants in just about every vertical will ultimately also feel the effects of this pandemic in some fashion due to:

- Too much consumer demand

There was a 23% increase in eCommerce transactions in the week following the World Health Organization declaring the COVID-19 outbreak a pandemic on March 11, compared with the average weekly volume in 2020.

- Supply chain issues

Although the situation is now described as “contained” in China, weeks of significant disruption have caused serious delays in supply chains. This ongoing ripple effect may affect needed deliveries via delays or cancelled orders.

- Poor customer service

An increasing number of customer service employees are being asked to stay home but customers will still need assistance. If you’re unable to help in a timely manner, many will file a chargeback.

- Delivery delay or cancel

Even if you can manage to get orders out, due to virus-related restrictions experience with shipping delays are becoming the norm. Also, certain delivery services could see a sudden surge in usership for which they are not prepared, whether you provide grocery delivery or online service delivery.

Strategies to fight chargebacks

So, what you can do? Before you do anything, first, you need to determine the true cause of chargebacks: criminal fraud, merchant oversight, or friendly fraud.

Criminal fraud

Detecting criminal fraud requires additional solutions. Worldpay's FraudSight is an in-authorization fraud mitigation solution powered by machine learning technology that helps identify criminal fraud. Once the possibility of criminal fraud has been removed from the equation, you can start investigating merchant oversight and friendly fraud as potential causes.

Merchant oversight

Simple oversights can end up being costly. We know you have a lot on your plate so we’ve provided a few simple tips to help prevent any accidental oversight.

- Make your contact information easily visible to customers

You want your customers to be able to easily contact you before calling the bank to raise a dispute. Make your customer service information easy to find and navigate. Your phone number, email address, and social media information should appear prominently on your website.

- Ramp up customer service

During this critical time, customers are anxious and want to get their goods/services as soon as possible. Be sure to remove any communication barriers and provide excellent customer service, such as fast (less than one hour) responses to all email, social media, and SMS queries, and answering all phone calls ideally in less than five seconds.

- Make cancellations/refunds easy

If the customer asks to discontinue a service or refund a purchase, you should grant the refund or cancelation quickly. Make it a simple, no-strings-attached process. Also, be sure to inform the customer once you make the cancelation or issue credit back to their bank account.

Notify customers of delays in a timely manner. If an item is backordered, let the customer know as soon as possible. Give the customer the opportunity to cancel, versus waiting for a delayed arrival. Likewise, if you discontinue an item, notify the customer immediately. You can offer suggestions for similar items, but don’t make the substitution without the customer’s approval.

- Stick to payment networks best practices

Always follow the rules and regulations set forth by payment networks. In addition, it’s best to abide by certain key best practices. For instance, you should submit copy requests in a timely manner, ensure sales receipts are legible, settle payment batches promptly, and never attempt multiple authorizations after receiving a decline.

Friendly fraud

Friendly fraud occurs when a customer legitimately uses their card to make a purchase but submits a chargeback after receiving the product. There are a couple of strategies you can use to help mitigate this type of fraud.

- Deploy VMPI for chargeback prevention

The Visa Merchant Purchase Inquiry (VMPI) is a plugin provided by Visa. VMPI allows banks to automatically recall transaction information in the event of a customer dispute, potentially resolving many issues before they ever progress to the chargeback stage.

By working with Worldpay, you can deploy VMPI and prevent many chargebacks from happening. Worldpay's Disputes Deflector helps you to address and resolve cardholder issues earlier in the dispute lifecycle. By leveraging new scheme services, VMPI and Mastercard’s Eliminator, you can respond to cardholder inquiries (such as unrecognized transactions) before a chargeback or dispute is raised. We’ve partnered with industry leader Chargebacks911 to give you direct insight to the card brands and issuers.

- Deploy a chargeback management solution

Disputes Deflecter works in tandem with Disputes Defender to help dramatically reduce your chargebacks from start to finish. Even if you’re not processing your chargebacks with Worldpay today, we can still support you and handle all your multi-acquired transactions.

It's critical that you react as quickly as possible to protect your business and prevent losses. However, we understand managing chargebacks is not easy. With fear and anxiety about the coronavirus outbreak running high, it’s more critical than ever that you have the help you need to take the right steps to avoid and fight disputes. We’re committed to helping you meet these challenges.

At Worldpay, we are thinking about our merchants around the world. We’re in this together and it’s our top priority to keep your business operational and supported. We are available to help you and your business in any way we can.

How digital content is evolving with COVID-19

By James Tiltman

The COVID-19 global pandemic has forced digital adoption upon the world, changing our way of life. The question I ask myself is how much of our new behaviours will remain once things go back to normal, and what will that new “normal” look like. One common trend we’ve seen globally is that many of us have turned to digital content as a means of entertainment and education. As a result, online brands, particularly those offering subscription models, have seen a surge in demand. The ease of access, cost of entry, personalised service and the overall convenience offered by subscriptions is appealing, but once children return to school and the economic impact of COVID-19 becomes evident, how many of us will question the value of our subscriptions?

Research conducted by Zuora, leading subscription management platform provider indicates that of those brands running a subscription model, 85% are still experiencing growth;

- 47% have seen no meaningful change to their growth rates during the pandemic

- 20% experiencing accelerated growth beyond pre-COVID-19 forecasting

- 17% seeing lower growth rates than previously forecast

- 15% experiencing negative growth in their subscriber basei

Netflix claims to have more than doubled their number of expected new subscribers in the past 3 months; with the media streaming giant announcing that it added 15.77 million new paid subscribers globally, as people have sought ways to entertain themselves during the lockdown.ii

All forms of online entertainment have seen an explosion of interest and most are gated by a subscription. Worldwide, video game play increased 36% during the week of the 16th March compared to previous weeks; with Spain showing largest growth rate of 48%.iii US consumer spend on video game products reached the highest total in U.S. history in Q1 at $10.86bn. So it’s no surprise that the two largest console producers both report increases in their subscription products, with Sony indicating at the end of March that they now have 2.2m subscriptions for their video game streaming service, PlayStation Now, and boasting 41.5m subscribers to their premium access and discount service, PlayStation Plus.iv

Of all online media and entertainment verticals, one has surprised me. Pre-lockdown, my normal commute routine involved plugging into my preferred music streaming service on my tube journey until I reached the office. As such, my expectation was that with most of us working from home, our “listening” time would reduce and many brands in this space would experience increased churn and reduced customer acquisition. On the contrary, Spotify, publishing their Q1 2020 results at the end of April, report reaching 130m Premium subscribers globally at the end of the quarter (March 31), up 6m subscribers vs. the prior quarter. v Globally, time spent listening to audio streaming services was up 35% during the week of 16th March compared to previous weeksvi, proving that it’s not just the lure of “The Tiger King” on Netflix or creating your idyllic world on “Animal Crossing: New Horizons” on your Nintendo Switch, but that the ambient chill out playlist is still getting airtime whilst some are working from our backyards.

As we start to adapt to the ‘new normal’ and return to offices and schools, will the online habits we have adopted during lockdown recede with the virus, or will they become a permanent part of our lives? Brands offering a subscription model need to pivot quickly from focusing on customer acquisition to subscriber retention. It’s now more than ever where the relationship between brand and customer really counts. How brands maximise loyalty, increase retention and minimise churn will no doubt be the deciding factor.

A well-timed announcement by Netflix recently said that they will proactively ask inactive users if they wish to continue to subscribe, offering them an easy way to cancel and later re-enable their subscriptionvii. It’s exactly this type of capability that helps subscribers build confidence in brands, which will bode well when users start to review their budgets and consider which subscriptions to keep. Along the same theme, there has been a 4x increase in pro-active subscription suspensions by brandsviii; coupled with smart messaging this will also help to minimise voluntary churn.

Whilst some smart PR and marketing can significantly help strengthen the consumer/brand relationship, voluntary churn is still a subscriber decision. Where brands can make a significant difference is by focusing on minimising their involuntary churn - the loss of subscriptions due to payment failures. Many of these failures can be mitigated using the appropriate tools and best practices associated with maintaining users’ payment credentials. For example, by using the “Account Updater” capability, brands can have the most up to date payment card information on file without relying on the card holder to update. With the industry indicating that 30% of cards held on file are obsolete within the first twelve months, our own data suggests that 15% of card on file authorisation attempts fail for reasons that could easily be avoided using Account Updater. After implementing the service, some brands report an increase in overall acceptance rates of between 200bps and 700bps. Coupled with an intelligent retry strategy, an optimised payer journey, and offering a well-tailored suite of payment options, brands can minimise involuntary churn automatically allowing them to focus on mitigating this voluntary churn and maximising overall retention.

Retention rates will be critical. As lockdown restrictions begin to lift, brands operating in the subscriptions space need to move quickly. It’s going to be interesting to see how things pan out in this space. Pre-pandemic, there was a lot of talk about subscription fatigue and consolidation. Has COVID-19 saved some brands or prolonged the inevitable? Time will tell.

- Zuora Subscription Impact Report: COVID-19 Edition

- https://www.theguardian.com/media/2020/apr/21/netflix-new-subscribers-covid-19-lockdown

- https://www.statista.com/statistics/1106498/home-media-consumption-coronavirus-worldwide-by-country/

- https://www.theverge.com/2020/5/19/21263492/sony-playstation-subscribers-active-users-ps4subscription

- https://www.musicbusinessworldwide.com/despite-covid-19-spotifys-premium-subscriber-base-grew-by-6m-to-130m-in-q1-2020/

- https://www.statista.com/statistics/1106498/home-media-consumption-coronavirus-worldwide-by-country/

- https://media.netflix.com/en/company-blog/helping-members-who-havent-been-watching-cancel

- Zuora Subscription Impact report: Covid-19 Edition

MERCHANT SERVICES SCAM ALERT

We have received reports of businesses being contacted by callers claiming to be representatives of a merchant services provider. These callers are telling merchants that their current provider is shutting down due to the COVID-19 situation. They proceed to tell the merchant they need to switch processors to continue accepting electronic payments.

If your business is targeted, please know that this is part of a scam and not legitimate. Worldpay will continue to be your trusted partner and support your payment processing needs.