Thought Leadership

Collaborating for Success in the Age of Disruption - Why Servicing and CRM Belong Together

Steven Folkerts, Kellye B. Proctor, Ganesh Ramakrishnan | FIS Global Banking Solutions

April 01, 2019

Servicing and CRM Belong Together

This is the age of the customer experience. Expectations are high, increasing, and often established beyond financial services. Corporate giants such as Facebook, Amazon and Google continually raise the bar in terms of what people expect from a quality digital experience.

Disruptive technologies are redefining industries, and boundaries are blurring. Traditional banks face new competition from fintechs and digital-first banks that are unburdened by legacy infrastructures and processes. While competition is ostensibly fierce, many banks have partnered with fintechs to increase their agility and to acquire new technologies and skills.

As the world embraces open banking, partnership becomes essential. The API economy is booming and redefining what’s possible throughout financial services. Although instigated by competition, these new dynamics also drive collaboration and co-dependency.

The overwhelming message is clear: The age of competition is also one of cooperation. So what does this mean? Disruptive technologies, disintermediation and open banking have delivered synergies that were unimaginable just a few years ago. And for businesses to thrive, everything must work together seamlessly.

Ultimately, although competition will create winners and losers, the undisputed champion is the customer.

The Strategic Significance of CRM

In a customer-centric age, Customer Relationship Management (CRM) is a strategic determiner of business success. Retail bankers acknowledge that the closer any banking initiative is to the customer contact points, the greater its value. In practice, CRM is the holistic process of acquiring, retaining, and growing customers.

Typically, CRM focuses on practices, strategies and the technologies necessary to manage and analyze customer interactions and data throughout the customer life cycle. But many CRM solutions are closed-loop and focus solely on the customer. To deliver on the vision of true customer centricity, a CRM system must extend further into industry verticals, such as retail, commercial banking and/or insurance. Is this feasible?

Here we consider the synergy benefits of an advanced CRM platform and an omnichannel banking solution. We believe the combined value is significant and far greater than the sum of its parts. Market feedback suggests the time is right for such a solution.

Banking Evolution and Trends

Over the last two centuries, banks have evolved into a complex labyrinth of products and services, bundled together and marketed under a single brand. Over time, banks expanded by adding more products, and distributed these through an increasing range of channels: branch, phone, ATM, internet and mobile.

This strategy has worked well – banks offered a one-stop-shop for financial products and won the loyalty and trust of customers. But a proud heritage does not ensure a successful future.

The Rise of Omnichannel

In the digital age, customers don’t think in terms of banking products or channels. Instead they look for engaging experiences. Over time, many banking products have become available through multiple channels to deliver an omnichannel banking experience.

This progression signaled the birth of the customer journey – banks can offer products where and when customers need them, increasing convenience and building loyalty. Although omnichannel banking is quickly becoming a hygiene factor, many banks struggle to offer a true omnichannel experience where customer journeys can begin on one channel and be completed on another at a different time.

Digital Banking – Where Banking Meets Life

Customer journeys are real-life experiences and banks must make their products and services available not just when people need or want them, but when they begin to have a potential interest in them. For example, people may be interested in financing when they begin the process of looking for a house or new car.

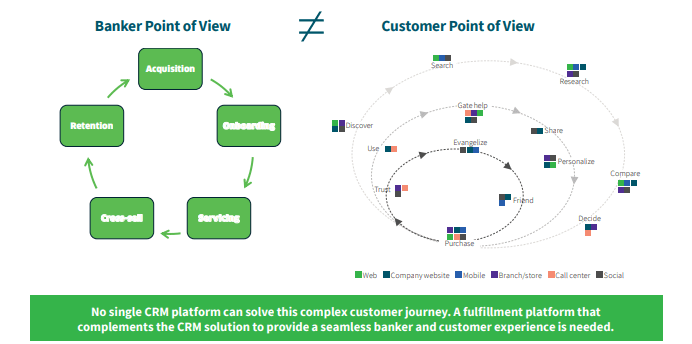

In this new order, banks should provide a real-time choreography of products and services available at all stages of the customer journey. FISTM is currently engaged across the banking spectrum, helping banks transform, compete and offer exciting customer journeys. In the age of the customer experience, we recognize that customer journeys are becoming more complex and harder to fulfill with a single CRM or banking solution.

Figure 1. The Customer Journey is Increasingly More Complex

FIS One – A Strategy for Collaboration

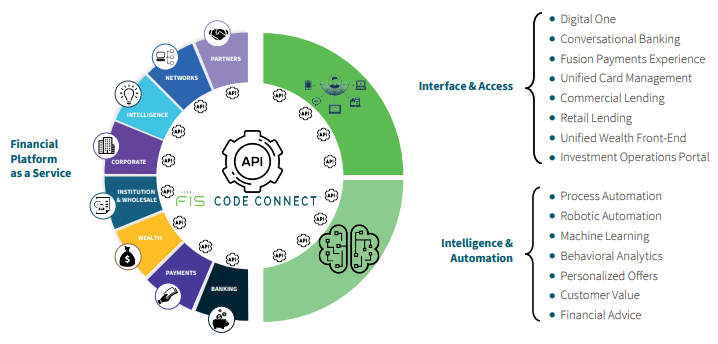

For many years FIS has delivered practical solutions for digital and open banking. Our strategy is to provide API-driven components that accelerate bank transformation and make banks fit-for-purpose in the digital age. This strategy is called FIS One.

Figure 2. FIS ONE - Unlocking value with a full ecosystem of components

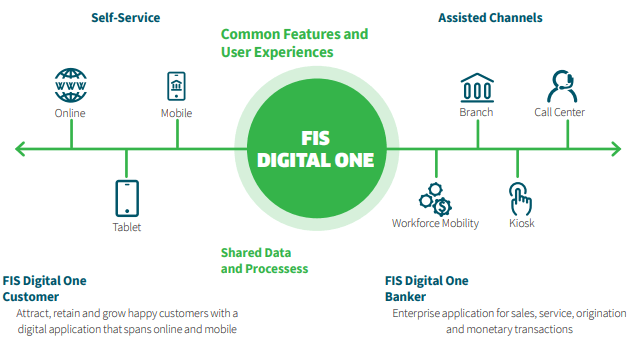

Figure 3. Potential future support for multiple ODS implementations with a single set of warehouse views

Digital One – Our Response to Change

A central plank of the FIS One strategy, Digital One® is a modern platform for omnichannel banking. It is based on an open architecture that enables banks to embrace disruption, innovate faster and connect every channel. Code Connect is our centralized fintech hub that gives developers access to the entire FIS product catalog in one central marketplace, simplifying development and easing collaboration.

Our approach is proven to give banks unlimited flexibility. The potential to create unique customer journeys is only limited by the imagination. The guiding principle of our open architecture philosophy is to establish standards for third-party developers to integrate products and components of their own choosing to offer customers a unified banking experience. This “banking as a platform” strategy facilitates the integration of CRM products and components.

Customer Relationship Management and Omnichannel Banking

As banks move their focus from transactions to a more advisory role, advanced customer relationship management becomes critical. With omnichannel bank engagement, the customer management component is the principal repository of customer data, the “universal currency” of the digital age. In our experience, traditional CRM solutions are not usually a system of engagement, because they lack the foundation and functionality to manage the customer journey across channels.

Great customer experiences must offer consistency across all channels, which include customer self-service, branch, call center and back office. Omnichannel engagement is all about the customer journey – the customer must be able to begin a task in one channel, then pick up and complete in another.

Digital One and CRM – A Case for Collaboration?

FIS has invested heavily in omnichannel engagement to offer a consistent user experience and to ensure that every customer interaction is captured throughout the customer life cycle. But our solutions cannot offer the functional richness of a specialist CRM platform, so our customers need both.

We perceive strong synergies between Digital One and a CRM solution, and this translates into a highly compelling business case. In this digital age, banks need a strategic banking solution and modern customer relationship management capabilities – in other words, a world-class integrated solution that is managed as a package.

Both platforms have very different origins and, while there may be convergence, they will never be substitutes. The benefits of the combined proposition greatly exceed the sum of its parts.

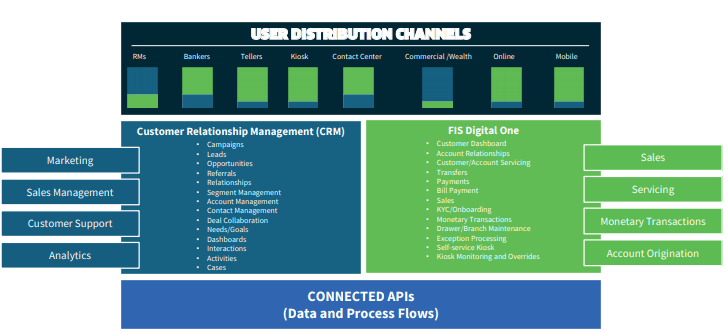

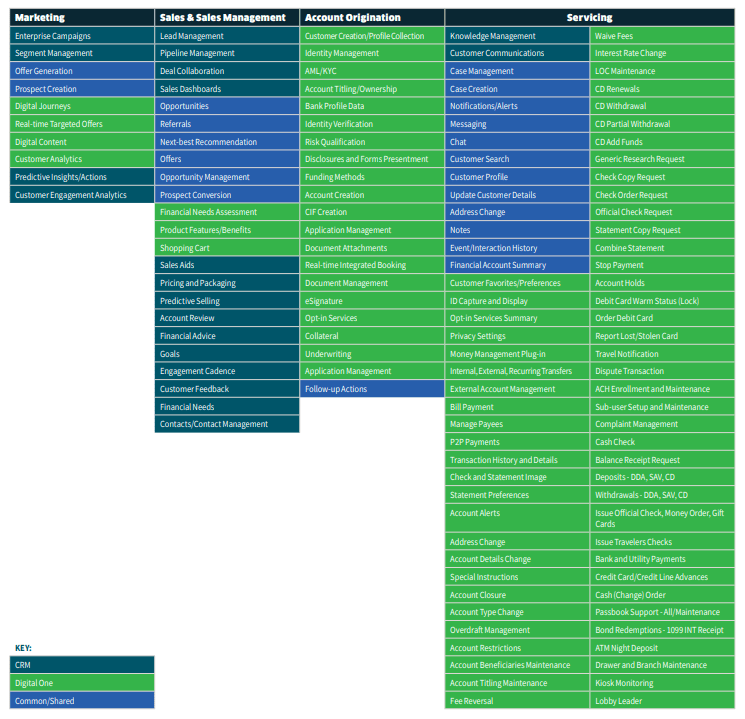

When analyzing a full digital solution, the functional overlap between a servicing platform and a CRM solution can often lead to a gray areas around sales, targeted marketing and opportunity management. Figure 4 shows the functional overlap between a servicing and CRM platform.

Figure 4. Digital One and CRM

Building Success – The Best of Both Worlds

Having delineated and confirmed the technical and functional synergies between the two systems, we arrive at the business synergies, and there is clear demarcation between the two. The following diagram shows how the partnership can manage the customer experience throughout the life cycle and across all channels.

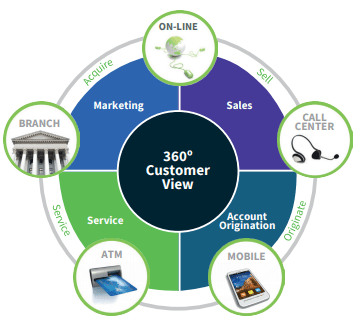

Figure 5. 360º Customer View

In this scenario, servicing, sales and lead management are handled by the Digital One omnichannel banking experience. In this way, the customer truly benefits from the best of both worlds.

Clear demarcation of roles is fundamental to the success of working together to deliver each bank’s vision. FIS’ clients greatly value our banking expertise and practical know-how. We believe the same is true for institutions using a sales/CRM solution, so clear lines of responsibility and accountability must be established at the outset. The chart below shows the functionality required to fully embrace a digital approach to customer interaction:

As can be seen in the chart, sales and servicing are intimately linked and FIS’ experience in the field is that virtually all customer-initiated interactions are a result of a service request, which creates the opportunity for a sales interaction. This “service first” approach to digital interaction is why Digital One is designed to be a common landing area for customer interaction, which at every step allows for proactive sales.

FIS – Our Track Record of Success

FIS has managed many successful partnerships. All our leading solutions adopt an “API first” architecture to encourage collaboration, integration and innovation.

We recently partnered successfully with PayPal to increase customer engagement and drive digital revenue growth among FIS’ banking partners. This partnership allows financial institution customers to set their default funding source in PayPal to increase convenience and deepen the relationship.

Similarly, most CRM systems have advanced analytics and artificial intelligence (AI) functionality to boost efficiency, intelligence, and collaboration. We believe this proposed collaboration between FIS Digital One and a CRM solution represents a unique opportunity to deliver a step-change improvement in customer relationship management for FIS banking clients, and in turn, the banks’ own customers.

As collaborative business models become mainstream, clients expect best-of-breed solutions, delivered by multiple partners. There are many reasons to pursue this partnership and few not to.

Guiding Principles of a Combined Solution

We have an opportunity to deliver a world-class solution that

transforms customer relationship management in the banking

sector. Although discussions are at an early stage, we believe the

following guiding principles should drive progress:

- Provide an exceptional and consistent banker and customer experience across the combined solution.

- No double-entry of data across the applications. Seamless interoperability allows data to be shared without banker intervention

- Understand the strengths of each application across the value chain, and use each application aligned to its strengths

- Provide the opportunity to turn every service interaction into a sales opportunity.

We believe this collaboration can create a world-class combined CRM/banking solution that will have great appeal in the marketplace and offer benefits to all parties.

1 The Financial Brand, Banking Trends 2018 report (www.thefinancialbrand.com)

2 Foest, Marvin W. FIS™ white paper. Targeted Core Banking Modernization: Digitally-enabling banks with tailored

transformation journeys. September 2018.

3 Aite Group, Retail Banking and Payments Trends, 2018 Acceleration Evolution, January 2018 (www.aitegroup.com)

4 Ovum, Online and Mobile Banking in the Context of Multichannel Delivery and Social Media, January 20, 2017 (www.ovum.informa.com)

5 Aite Group, Retail Banking and Payments Trends, 2018 Acceleration Evolution, January 2018 ( www.aitegroup.com)

6 Ovum, Online and Mobile Banking in the Context of Multichannel Delivery and Social Media, January 20, 2017

(www.ovum.informa.com)