Payments Leader

Making Payments Pay for Your Business – by Ernie Buday

April 12, 2018

Ernie Buday, FIS | Vice President, Product Strategy

Payments are the most relationship-oriented and offer the most frequent interactions with customers of all products offered by financial institutions. This is especially true as we continue the migration to fully digital payments. Yet, many financial institutions are leaving money on the table when it comes to payments.

Here are three top tips to make sure that doesn’t happen to you.

Treat Every Payment as an Engagement Opportunity

Conservatively speaking, consumers make an average of 22 payments using their credit and debit cards every month. With fewer banking customers visiting branches, viewing these payments as interactions between your financial institution and your customers is paramount. This means that every payment is a chance to learn and an opportunity to cross-sell through exquisitely targeted and personalized offers that drive revenue.

The move toward digital payments and self-service is driving this upward because of cost efficiencies and improved customer experiences. To capitalize, financial institutions and credit unions must transform ingrained policies and practices and eliminate silos to build new approaches to payment services across all service channels.

Make Payments a Strategic ImperativeFor many financial organizations, the management of payments products is often in siloes and spread across the business. As an example, we see Remote Deposit Capture (RDC) in treasury management and Wire Transfers in operations. This results in no one managing these products holistically to make the business case to maximize their potential.

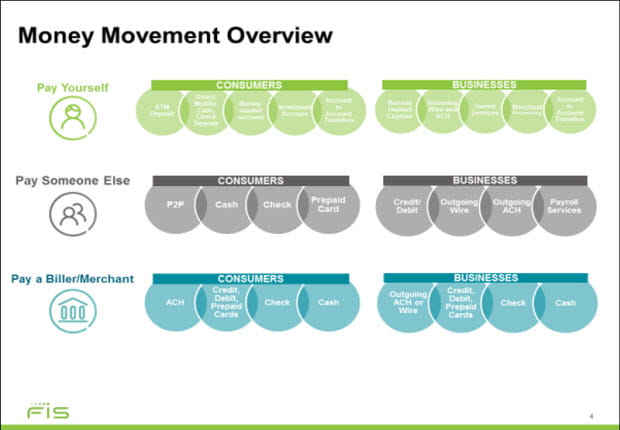

To begin to address this, it’s important to first understand what customers’ needs are relative to moving money. Simply put, there really are only three:

- Paying themselves

- Paying someone else

- Paying a biller or merchant

The graph below highlights the true list of products that need to be actively managed from a payments perspective. It is important to categorize each of these from both a consumer and business perspective.

When actively managed, payments products can be the most effective tools your business can use to grow customer relationships and acquire new ones. Make it a strategic imperative.

Maximize Revenue Potential of Money Movement

Payments are the only financial products that your customers utilize on a daily basis. The growing preference for digital and self-service will only increase this. So, rather than rely on requests from customers to buy and use them, make ongoing new customer acquisition and utilization campaigns around your products a priority.If your brand isn’t the one your customers are using for their payments needs, you could be leaving money on the table.

Consider this. In working with one of our clients recently to optimize their payments strategy, together we uncovered that payment interchange income comprised more non-interest income than their wealth management fees or mortgage banking fees, and was equal to service charges. Further, payments revenue was a significant percentage of their net interest margin. The takeaway is that there is a direct correlation between a strong payments strategy and your balance sheet growth.

As one executive at First Tennessee Bank once adeptly stated, banking is “a three-legged stool: deposits, loans, and payments. Take away payments and your stool won’t stand.”

Said another way, if you don’t have payments as a strategic component of your business, the stool that is your business can never really stand in today’s environment.