Need to Grow Deposits Organically? A Direct Bank Levels the Playing Field.

April 08, 2020

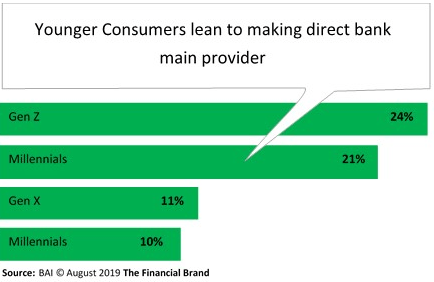

Many bankers still look at direct banks with a degree of scepticism and, in some cases, outright fear. After all, they have always grown deposits through one-time promotions or new product offers that create core funding upticks to fuel lending needs. Those strategies don’t always apply anymore – as younger consumers are leaning toward direct or digital banks as their main provider of depository services. A recent article in The Financial Brand describes the increasing appeal of digital only financial institutions with Gen Z, Gen X and millennial consumers.

M&A not the only option to acquire deposits

Non-traditional options dictate that bankers at smaller institutions take a different approach to growing core deposits. Of course, banks have been acquiring each other for years, and if a CEO wants to hang a “For Sale” sign, that’s always an option. A different strategy involves a “fight-fire-with-fire” approach. This entails taking on the large banks with a direct bank offering that levels the deposit-gathering playing field.

In recent years, FIS has seen a trend of large institutions beginning to stand up separate brands and infrastructure for digital/direct banking. The banking sector is starting to push harder into this area with standalone digital brands/platforms. Witness the press that surrounds Marcus from Goldman Sachs, Citizens Access, Ally Bank and others.

Direct banks acceptance

Findings from recent research such as the FIS Performance Against Consumer Expectations (PACE) survey indicate direct banks draw interest across demographic segments based on a variety of motives. Overall, consumer satisfaction with direct banks reached a score of 3.85 (out of a four-point scale) in 2020, beating other traditional financial institutions, including credit unions for the first time.

The market driver for establishing a direct bank is primarily core deposit growth; however, financial institutions should also consider their advantages in avoiding disruptions within their existing channels and serving as a “test bed” for innovative new fintech deposit products.

Regional and community banks need to overcome barrier perceptions

Community bankers could be operating under false impressions and dated information regarding taking a direct bank approach. Perceptions of high costs and long development lead times do not necessarily apply anymore. When one compares the relative costs and risk of acquiring another bank, growing organically by standing up a direct bank makes simple economic sense.

Another traditional direct bank barrier, complex integration efforts, is fading away with many components offered as banking as a service (e.g., banking in a box). And many integration needs are addressed by application programming interfaces (APIs) that make open banking a reality. Support services can be managed by existing call center and operations staff of a traditional bank or outsourced to back office providers deeply familiar with the technology platform offered by the direct bank.

A way forward

In an article in the ABA Banking Journal, Rob Lee, EVP of digital and banking solutions at FIS, states “Starting a digital bank is far more than simply standing up a new technology solution. In fact, technology is often ‘the least complex and probably the least expensive’ part of the process. Instead, it’s about answering the strategic questions first. It’s things like: how do you position a separate brand? Will [your] customers expect to drive into the branch if they have a question? How do you market – what is the investment required?”As community bankers explore the direct bank option, they must invest their time on marketing strategies and planning, while taking advantage of a technology solution that runs on a different platform than their existing core processing solution. They need an on-demand core solution with turnkey software options enabling the rapid deployment and launch of direct banking on a lightweight, flexible platform.

Core on Demand allows for rapid implementation and launch of a direct bank with a different approach to more methodical step-by-step programs, encouraging agility and rapid delivery of banking services. This speed and flexibility enable the capture of core deposits with less risk than acquiring another bank rich in deposits. The benefits of the Core on Demand approach include:

- Cost economies - Real-time processing capabilities that deliver true market advantage without the high cost, and without compromising functionality.

- Increased efficiencies - As a separate core solution, integration and interaction with a bank’s existing core is not a complicating factor.

- Speed to market - Innovation is not hampered by the limitations of existing legacy systems.

- Uninterrupted growth - 24/7 capabilities reduce operational risk and create an always-on solution for a community institution and its direct banking customers.

- Rapid deployment - The core’s cloud-native architecture allows fast deployment of a direct bank – as soon as 90 days.

A Core on Demand approach addresses the traditional reservations community bankers have had toward direct banks, while providing a path for organic growth that levels the playing field with large, global institutions – without having to be acquired by one.

- Topics:

- Fintech