Thought Leadership

Cloud-Enabled Core Banking-Why Now is the Right Time to Act

Jason B. Williams | Product Consultant Senior FIS Global Banking Solutions

October 02, 2018

Cloud-Enabled Core Banking

The time is now for banks to capitalize on the many benefits that can be achieved by running Core banking solutions in the cloud. This white paper explains why. Topics include recent increased confidence in cloud strategies; a definition of what cloud-based core banking means; reasons/use cases for moving to cloud-native core banking and migrating to a cloudenabled core; and a discussion of how banks can make the move to a cloud-based core

This white paper is part of a series of FIS™ white paper publications regarding core banking modernization trends and topics.

Putting Your Core in the Cloud – Why Now?

Timing is everything when designing solutions for banks. While the quality of a solution greatly determines its strategic success, timing can be at least as important. Here we consider whether the time is right for a bank to migrate its core system to the cloud – and if so, why.

This year, Amazon Web Services (AWS) celebrates its twelfth birthday, while Microsoft Azure turns eight. In this relatively short timeframe these two companies have become the universal gold standard for cloud-based solutions. Major companies, including Netflix, Adobe, Apple, Samsung, BMW, and Facebook have all adopted cloud in a big way. However, even five years ago, the mere mention of a cloud-based core solution in the boardroom of a major bank would probably end a meeting early.

For many years banks have used the cloud for non-critical systems, such as email, customer relationship management, and application development. But they just weren’t ready to discuss moving their core systems to the cloud. Instead, they relied on the trusted strategy of building out their bank IT on bank-owned hardware in bank-owned data centers. So what’s changed?

Recent developments impacting three vital areas are the catalyst for banks rethinking cloud strategies:

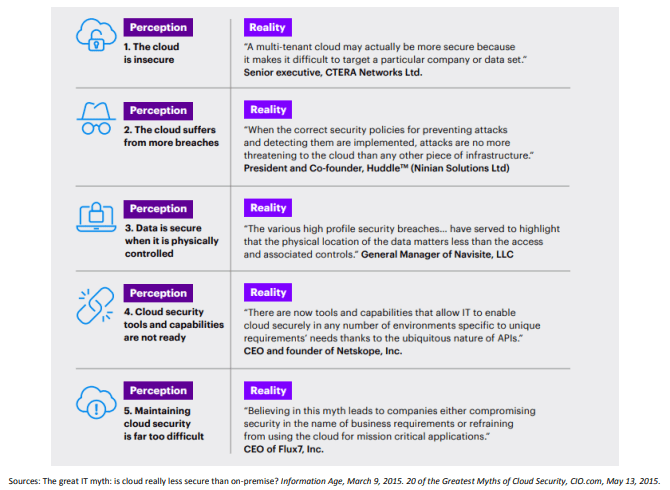

Security. Data security was the most often cited reason for banks not adopting ambitious cloud strategies. But recently, the level of security available in the cloud is at least as good as that within bank data centers. Cloud providers take data security very seriously, and security standards are amongst the highest available.

Regulation. In the past, regulators have shown concerns about banks using the cloud for customer data, due

to perceived security risks. They also worried about the implications of the concentration of so

much data residing with the big three cloud providers. However, regulators now acknowledge the

benefits of cloud availability to banks, and they are starting to adapt their thinking. Moreover,

cloud providers are engaging with the regulatory bodies to educate them about cloud technology

and what it actually means. Regulators acknowledge that a modern infrastructure environment

offers sustainable benefits to all parties. Banks can leverage the massive investments of

Microsoft, Amazon and Google, so cloud can make banking more democratic and competitive.

Regulators also recognize that cloud technology can provide a very secure environment, which is

better than most banks could achieve themselves. In return, banks are starting to get more

guidance from regulators regarding the outsourcing of core offerings, and how they can leverage

cloud providers to enable them to focus on banking rather than IT.

Regulators (especially in Europe) are also discovering that cloud banking is a powerful way of

opening markets up to more competition. New entrants can utilize cloud environments to launch

services into the market; cloud computing means that technology is no longer a barrier to entry.

Customers. In the age of the great customer experience, customers have high expectations – and the expectations keep increasing. Banks are under tremendous pressure to deliver innovative digital solutions to a consumer base that expects to transact instantly, anywhere, and at any time. These new dynamics are causing banks to rethink how best to build and deliver banking solutions.

Many banks are looking to the cloud for application development and deployment of new banking solutions. Cloud offers scope and scale to develop and deliver real-time services across any device without a significant investment in IT infrastructure. Cloud technology also offers a foundation on which to develop customer insights using big data and analytics, and simplifies the task of maintaining data transparency in multiple jurisdictions. In many banks, cloud computing has become top of the agenda.

Security and Regulatory Compliance Perceptions Associated with the Cloud

What is a Cloud-Based Core Banking System?

Gartner defines a core banking system as “a back-end system that processes daily banking transactions and posts updates to accounts and other financial records. Core banking systems typically include deposit, loan and credit processing capabilities, with interfaces to general ledger systems and reporting tools.” In simple terms, a bank’s core refers to the mission-critical systems that facilitate virtually every transaction for a bank.

Cloud-based core banking means migrating the bank’s core to a cloud provider, to exploit the provider’s computing, tooling, and operations power. In practice, the cloud offers virtually infinite computing capabilities and resources (servers, storage, networks, applications and services) that are delivered as a service to the bank.

Banks can leverage the power of the cloud by developing cloud-native applications. These are developed and deployed as a set of flexible microservices using Platform-as-a Service (PaaS) tools — which can further reduce costs, boost performance, and increase a bank’s business velocity.

The cloud platform serves as the foundation for developing and running core applications, which are designed to be flexible and scalable. The bank has the ability to run the technologies they choose and scale as necessary – paying only for what they consume.

Why Move Toward Cloud-Native Core Banking?

Beyond the obvious benefits of cost reduction, scalability, and speed of deployment, a cloud native architecture offers greater agility – it enables a bank to do things that were previously impossible.

Many banks carry the burden of legacy systems and are working with third parties to meet customer needs and accelerate progress. Core banking in the cloud allows banks to move away from a model where all technology is in one place (the bank’s data center) to one where APIs effect data movement instantaneously between multiple parties. Banks can mix and match “best of breed” solutions from their fintech partners and replace solutions when something better comes along, rather than being locked-in to a specific technology.

With this approach, banks can become innovators, build new products and scale the business. They can achieve a business agility that is impossible for a bank with a monolithic core. New services can be delivered quickly and cost effectively, facilitating a better customer experience.

Use Cases for Migrating to a Cloud-Enabled Core

Become Nimble

Typically, bank cores are monolithic and often mainframe-based applications that can hinder innovation. Seemingly simple updates can take a month, while a major enhancement can take upwards of a year to introduce. In today’s world, where the focus is on enhanced customer experiences and innovative products being brought to market fast, a core that can’t support these requirements is an impediment to progress. An API-enabled cloud-based core can use microservices to develop and integrate new solutions quickly and efficiently.

Add Agility to IT and Operations

Although many banks view cloud computing as a way to save money and convert capital expenditure to operating expenditure, in practice it does much more. The cloud can also reduce waste in a bank’s IT and operations. For most banks, running a data center operation is a major overhead and not a key value proposition. A cloud-enabled core frees a bank from this burden and offers a path to digitalize IT operations. Valuable resources can be redeployed from commodity work, such as running the core, to work that adds real customer value.

Faster Solutions Delivery via APIs

Banking has gone digital and more than 90% of customer interactions occur via a mobile app or website. Banks are jostling to deliver unique differentiating digital experiences that attract and retain new customers. They are often ranked by the quality, depth, and richness of their customer experience, which is powered by the core system. If that core is cloud-enabled via microservices and APIs then the bank is well positioned to open new channels, using API-based services to connect with partners, regulators, and different parts of the bank itself.

How to Move to a Cloud-Based Core

With banks under pressure to transform and innovate quickly, delivering innovation on a legacy IT infrastructure is unsustainable. Implementing a cloud-native approach to core applications is the right approach, but making a start is never easy. So how should banks move to an agile, efficient cloud-native approach? It begins with a detailed migration plan, which should cover everything from strategy to roles and responsibilities, technology selection and business requirements analysis.

All banks must ask two fundamental questions:

- Which existing bank applications could be moved to the cloud to reduce costs and increase agility?

- Which applications could be replaced with something cloud native or re-architected for a cloud environment?

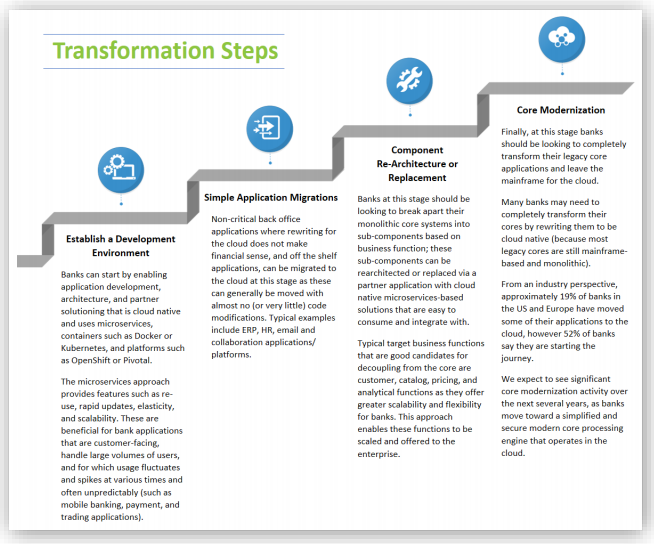

Normally, when banks start moving systems into the cloud they should avoid a wholesale migration. A gradual movement of core components, development and support strategies will ease the transition and build a firm foundation for a cloud-native applications suite. This can be done in four stages, as shown in the following image.

Transformation Steps for Core Banking Cloud Enablement

Position for Success with Cloud-Enabled Core Banking

With a cloud-enabled core, a bank is in the position to drive innovation and shape the future of technology. In recent years fintechs or “neo bank” competitors have dominated this space. Many of these new arrivals have built differentiating customer experiences that have lured customers away from traditional banks.

With cloud-enabled core banking, banks can offer unique and exciting product offerings to existing and new customers by leveraging the benefits of the cloud in three key areas:

Cloud Native

Cloud is becoming the “new normal” in many industries. By moving its core to the cloud and adopting a cloudnative architecture, a bank can reduce time to market, and become more nimble and competitive. Over time, a cloud-native architecture will offer a lower total cost of ownership than a traditional in-house, mainframe core.

Platform Banking

With a cloud-enabled core, a bank can leverage the cloud’s “API first” approach to integration. This enables the addition of new features and functions to the existing core, and the development of a bespoke banking ecosystem. Over time, a bank can become a platform on which to add best-of-breed in-house or third-party fintech solutions that augment the core platform. A platform approach to core banking empowers a bank to become more responsive to change and to seize new market opportunities.

Open Banking

The global financial services market is moving toward open banking, with initiatives in Europe, Asia Pacific and Australia. Most recently, Brazil and Japan have announced open banking regulations. Although the North American banking markets do not have any open banking regulations, several regulators have issued principles and guidance pertaining to open banking. Some US banks, including Citi and Capital One, have published APIs that allow for access of their data.

The cloud will play an integral role in the future of open banking as banks, regulators, and governments prioritize cloud computing in financial institutions. In January 2018, the European Commission encouraged innovation through open banking and cloud computing.

It is this move toward openness that will provide new opportunities to make use of bank solutions, data, and information in real-time. This will open up financial services to new competitors and create new opportunities for banks that capitalize on the opportunity.

Putting Your Core in the Cloud – The Time is Right

The business case for a cloud-enabled core is clear. Now is the time for banks to start thinking about and planning for going cloud native. Cloud has created extraordinary opportunities for banks to transform how they conceptualize, develop, manage and sell their products and services. When used to its fullest advantage, the cloud has the potential to redefine what it means to be a financial services company.

Banks that migrate to the cloud today will enjoy sustainable benefits tomorrow through increased security, ondemand elasticity, scale, and reduced total cost of ownership. The cloud heralds a new epoch in computing and how banks deploy and consume computing services.

By acting now, banks can protect and expand their market share via the cloud. In the age of heightened consumer expectations around digital, increasing regulatory pressure, and the fintech and neo banks threat, the time is right to act.

FIS – Leading the Way with Next Generation Cloud-Enabled Core Banking

FIS is a global leader in core banking platforms and we have worked with cloud technologies since their inception. The FIS next generation core banking technology is cloud agnostic, so it can be used with the FIS private cloud, Microsoft Azure, or Amazon Web Services (AWS), without needing to change the deployment process. We deliver an API-first, component-based, cloud-native core banking platform that enables banks to integrate and modify their core and supports any bank type, from digital to direct. Our platform can be deployed in a range of environments: FIS cloud, bank data center, public, private, or hybrid cloud.