Payments Leader

Helping Your Customers Save by Rounding Up

May 23, 2017

Maria Schuld

Where do you think rounding up could make the most impact?

Forty-seven percent of Americans report that it would be difficult for them to come up with $400 to cover an emergency expense, according to the Federal Reserve. The FDIC says some of the problem is that consumers struggle in the face of growing financial complexity and thus can’t make more sound financial decisions.

Consumers need and want education about how to solve their financial problems and make smarter financial life decisions. And banks and credit unions are best positioned to deliver it through mobile payment apps.

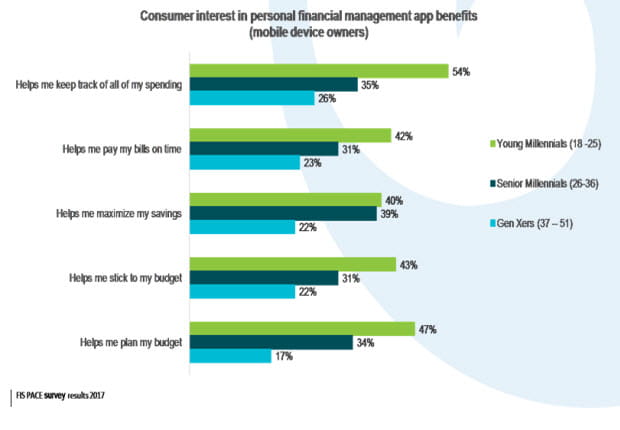

FIS’ recent PACE survey underscores high demand among mobile device owners – especially millennials – for personal financial management (PFM) tools that help them become more fiscally responsible. Maximizing savings is the third-most-desirable benefit for millennials overall but is at the top of the list for senior millennials – the cohort that’s starting to advance in careers and whose members are building their first nests.

What’s the payoff for financial institutions? Potentially high in terms of improving perceptions among consumers, not to mention that a better financial outlook can make customers stickier and more profitable.

Traditional financial institutions have great visibility into their customers’ spending habits. Using a bank’s credit or debit card, or paying bills through a bank’s bill pay site and mobile payment systems, gives the institutions deep customer knowledge, and presents the opportunity to develop a personalized relationship.

Rounding up to save and give

New tools are launching that roundup payments to the next dollar to support saving and giving:when a payment is made, these tools take the money between the actual cost of the bill and the next dollar and deposit the difference in a savings account.

Depending on the tool, they can work with debit, checks and credit cards. Some even include an option for gamification that offers credits or points to further incent savings among consumers.

Meanwhile, some charitable giving tools will track how much consumers give to their favorite charities, which facilitates itemization of contributions at tax time. But the main advantage of how a charitable giving tool works vs. how traditional charitable rounding-up schemes have worked is that consumers can choose where their funds go.

This benefits financial institutions strengthen their brands through the support of charitable giving. In fact, 91 percent of consumers globally are likely to switch brands to ones associated with a good cause, according to the 2015 Cone Communications Social Impact study.

Rounding it all up

Tools that address consumers’ financial needs and can improve brand perceptions of banks are on the near horizon.

Rounding-up tools could help solve the “millennial conundrum,” which says that millennials are late to launch, and are less trusting and less profitable among bank customers. As they soon will represent a large part of banks’ profitable customers, however, it’s vitally important to forge relationships with them now. What do millennials need? Financial education, an easy way to save built into their daily routine, rewards (FIS’ PACE research indicates they feel less rewarded by their banks) and positive attitudes towards the institutions they do business with.

I think rounding up can support both consumers’ and financial institutions’ objectives.