Clients help guide AI initiatives at FIS

March 23, 2020

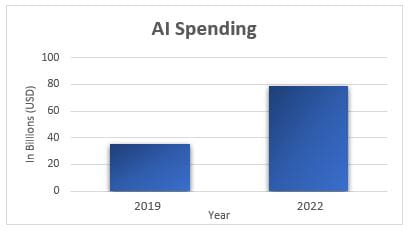

Artificial intelligence (AI) within the financial services industry has evolved from a philosophical research topic into a collection of powerful enabling technologies with the promise to reduce operating expense and raise productivity. A Deloitte global AI study found that, in organizations adopting AI, more than eight in 10 leaders see AI as “very” or “critically” important to their business success in the next two years. AI adoption and spending are surging globally with global spending on AI to top $35 billion in 2019 and expected to more than double to US$79.2 billion by 2022.

Banks, with many labour-intensive back office processes combined with needs to improve customer experiences, must consider AI for all facets of their business. At FIS, we understand the performance pressures our financial institution partners operate under. To help them jump start their AI involvement, we have been actively listening and working with clients to help them gain maximum benefit from their AI investment.

FIS is using AI to provide additional self-service capabilities to our clients. There are numerous technologies available to enable self-service capabilities. Virtual assistants or chatbots provide bite size information while simulating conversation with human users. Robotic process automation (RPA) takes mundane tasks and handles them for banks. FIS uses data scientists and machine learning engineers to dive deep into data to discover support patterns, assist with staffing models and find additional opportunities to minimize the time client’s spend on support.

The Client Services Opportunity

The FIS Client Services team is driving AI to help banks improve interactions with our support staff, while in turn helping them better resolve their customer support issues. The cognitive analytics aspect of AI can bring value to banking call centers by helping to assist customers in a more personal way. With the ability to recognize natural language queries and process unstructured data (e.g. an online text as a source), cognitive systems can provide guidance to service agents during customer communication.

Since cognitive systems “understand” the problem, they can provide effective solutions without redirecting calls to multiple departments and therefore saving customers’ time.

The Bank Back Office Opportunity

Within the North America Banking Solutions business unit, responsible for many of FIS core processing platforms, efforts are underway to identify opportunities for RPA within the repetitive tasks performed within the Operations areas of bank clients. The FIS approach towards RPA and digital transformation considers:

- Economies of scale

- Re-usability

- API-based interactions

- Use of an RPA platform for other use cases

The foundation of both AI initiatives within FIS is close collaboration with clients to develop solutions that address real and pressing needs. The steps involved include:

-

Solicit a variety of input

Serving a broad range of community and regional banks, FIS initially leveraged user groups and strategic advisory boards to both present AI concepts while carefully listening to the feedback of bank executives and thought leaders. These open and honest dialogs were led by subject experts on AI and RPA and helped set bankers on the same page, while setting expectations for what was possible in the short term. Besides active listening, multiple surveys were used to validate assumptions and solicit additional feedback.

-

Meet in working groups to filter and prioritize

Once interest was gained within user group meetings and webinars with clients, banks with interest in furthering AI were placed in the appropriate working groups to begin the roll-up-your-sleeve tasks of figuring out where to start, priorities for AI and how specific automated tasks could work within their unique environments. Throughout this process, FIS invested in program leadership, communication and documentation to ensure feedback was both wide-spread and organized. Early use cases were identified in areas such as submitting support tickets and updating index interest rates. A summary of that latter use case is shown in the example below.

-

Look for early adopters and low hanging fruit

As discussions evolved from working sessions to implementation planning, early adopter banks for AI projects surfaced to the top of the list. With any new technology initiatives, proving out the ROI becomes of paramont importance. The early client partners will record impacts within their organization and look for validation of use cases for other banks to consider in their broader AI adoptions.

-

Partnership to mitigate risk, accelerate implementation

Rapid implementation of AI becomes possible with the appropriate partner that encourages agility and provides the delivery of the right solution set. An AI partnership should offer:

- Cost economies – Automation capabilities that deliver true market advantage without the high cost, and without compromising functionality

- Increased efficiencies – Complimenting the bank’s core solution and client services interaction, integration a bank’s existing technology should not be a complicating factor

- Speed to market – Innovation is not hampered by the limitations of existing systems

A collaborative approach to any AI initiative addresses the traditional reservations bankers may have toward new technology, while providing a path for productivity growth that helps level the playing field with large, global institution.

- Topics:

- AI and machine learning