Serving small businesses beyond PPP

June 14, 2021

Financial services firms have performed admirably in helping small businesses with loans secured by the federal government in support of the Paycheck Protection Program (PPP) of the CARES Act. So how do banks capitalize on this goodwill and these relationships?

This small business market opportunity is too important to miss. According to FIS research, small businesses comprise an $850 billion global market for banking revenues. Competitive pressure from fintechs and raised expectations require that bankers consider small businesses differently than in the past.

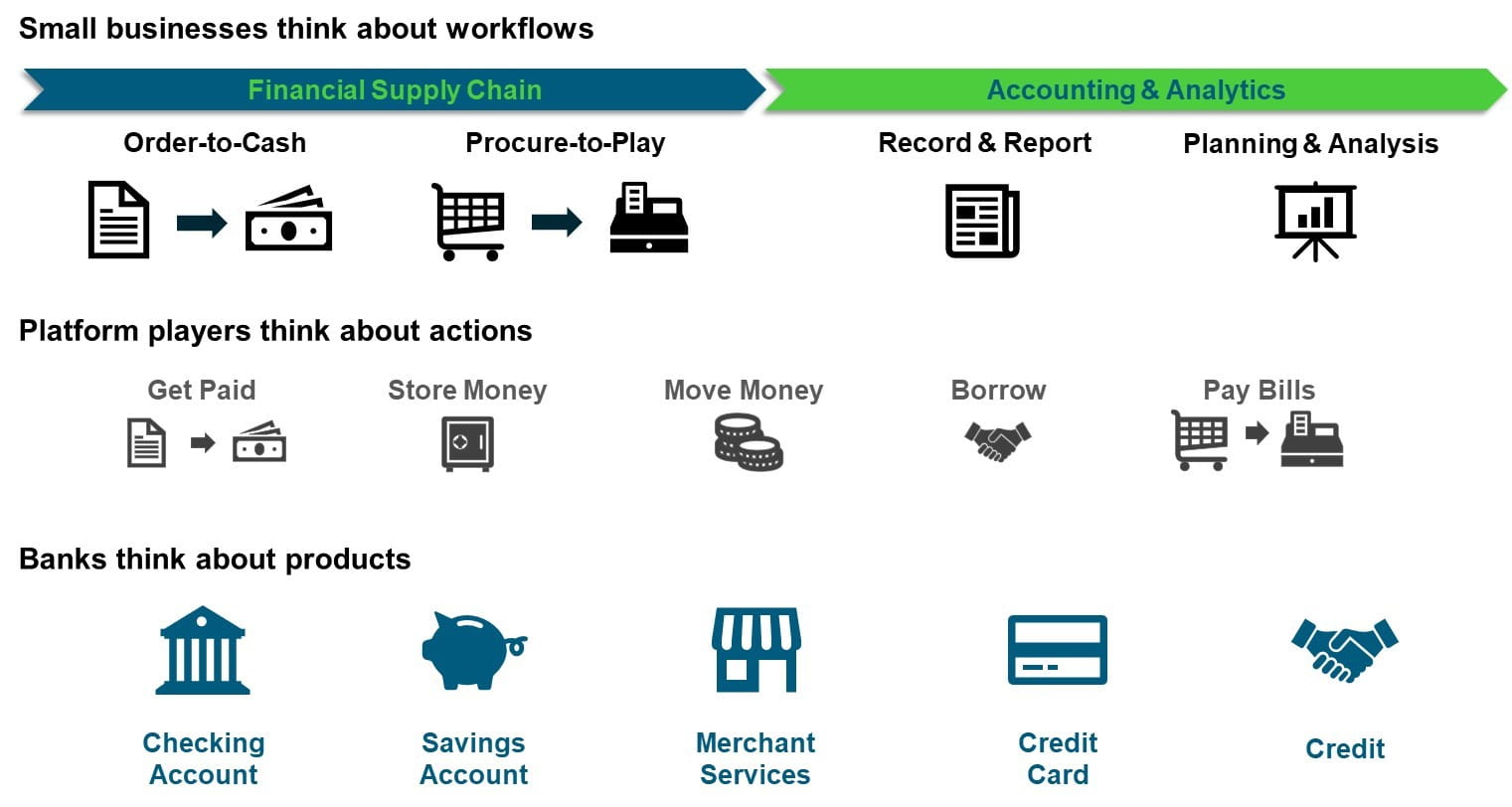

Bankers need to think like small business owners and not as product developers. According to Celent, small businesses think about workflows and banks think about products, with most still offering checking accounts. Technology platform players think about the actions small businesses want to undertake, which brings them much closer to small businesses’ needs.

How can bankers change their approach to secure small business relationships? We offer four actions for consideration.

Focus on growth niches, diving deep into markets with potential

While lending growth is down or stagnant within small businesses such as restaurants and hotels, certain industries are thriving during the Covid-19 Pandemic. Bankers that work to understand the needs of these niches can succeed in challenging times.

As an example, many community banks and their dealership customers saw rising demand for recreational loans as consumers, including many first-time buyers, looked to boats, RVs and other vehicles for an escape during the pandemic. Experts say this sector will remain strong this year and beyond. According to the Independentbanker.org,

“Chelsea State Bank now views recreational loans as an opportunity to retain and attract customers and further diversify its loan portfolio. The $395 million-asset community bank plans to step up marketing efforts to customers and also rely on existing relationships with local dealerships to increase its recreational loan volume.”

Robust marketing and analytics tools can aid bankers in uncovering and messaging to niche demographic markets.

Offer cash management and innovative accounting services

Cash management services help cement lending relationships and offer banks a steady stream of fee income in the process. Online and Mobile Banking, designed with features such as positive pay, help small businesses save time with basic banking functions.

Beyond cash management, financial institutions should look to offer services such as integrated small business accounting, invoicing, and payment solutions. Such financial products should allow small business customers to:

- Send invoices

- Get paid online

- Pay bills

- Integrate payroll

- Automate accounting

Extend financial inclusion

Financial inclusion remains a hot topic for a bank’s underbanked prospects. Financial inclusion efforts can also extend to a bank’s small business customers.

Consider Veritex Community Bank in Dallas working hard to make financial literacy and resources accessible to local Black business owners in its community. The $8 billion-asset community bank partnered with a local radio station to sponsor an episode of its “Keys to Excellence” series during Black History Month. For the community bank’s part of the series, they discussed financial literacy and how Black business owners can connect with professionals to grow their businesses.

Banks can offer their own financial literacy and education to the employees of minority-owned firms to further their financial inclusion programs.

To help in these efforts, FIS offers a free online education series on financial literacy. Interested parties can find out more by contacting FIS.LearningSolutions@fisglobal.com

Consider banking as a service for small business customers

Small business products and services should become seamless and easy for business customers to both explore and use. Bankers should enable their small business customers to launch and manage their financial operations efficiently from one portal, this type of banking-as-a-service could provide them with meaningful analytics and insights to aid efficient decision-making and running of their business.

This type of portal could help small firms manage with a focus on financial aggregation and visibility:

- Business customers can access, manage, and originate FI products such as business accounts, cards, lending, payments directly within the platform

- A customizable central dashboard provides a unified financial and operational view of each unique business

Taking comprehensive actions, like the ones summarized above, can help regional and community banks solidify small business relationships while building revenue in times of overall slow loan growth.

- Topics:

- Digital transformation