How AI will change organizational design for the 21st century

December 19, 2023

In 1855, the New York and Erie Railroad Company had an organization problem. While new technologies were changing businesses broadly, the size and scale of the railroads meant they needed breakthroughs in organization design and strategy. Railroads were the biggest and most complex organizations on the planet at the time.

In the 1840s, Daniel McCallum, a Scottish-born American civil and railroad engineer, developed and patented a new type of bridge that could withstand much greater loads than those of the time. He embarked on a multiyear program of restructuring to make the railroad more efficient and safer. He pioneered a range of new management techniques, particularly around communication strategies utilizing a brand-new technology, the telegraph. By Feb. 2, 1857, Daniel had introduced the first modern-day organizational chart to help understand the structure and workings of the railroad, along with introducing new management techniques and leadership that became a benchmark for American corporations at the time.

Since that time, we've essentially maintained a hierarchical view of management structures, and the organization chart itself hasn't really changed. With the advent of better computing, communication and reporting mechanisms, some alternative structural approaches have emerged. As corporations became multinational and required different geographical approaches, perhaps even different brands and products at a local level, attempts at networked organizations, matrix management styles and, most recently, decentralized organizations have also resulted. Figure 1 - Plan of Organization, New York and Erie Railroad, 1855 (Source: Geography and Map Division, Library of Congress)

Figure 1 - Plan of Organization, New York and Erie Railroad, 1855 (Source: Geography and Map Division, Library of Congress)

From blue chip to silicon chips

Today, seven out of the 10 largest companies in the world are technology companies. This has required a very different level of management competency when it comes to technology itself and is starting to significantly impact organizational structure. These tech-based firms operate much more efficiently with comparatively greater productivity, better return on equity and lower staff numbers than traditional 20th–century corporate leaders.

Figure 2 - The largest companies in the world by Market Cap, August 2023 (Source: Economic Times (India), "Apple's market cap bigger than most countries' GDP"; By Rajesh Mascarenhas, July 2023)

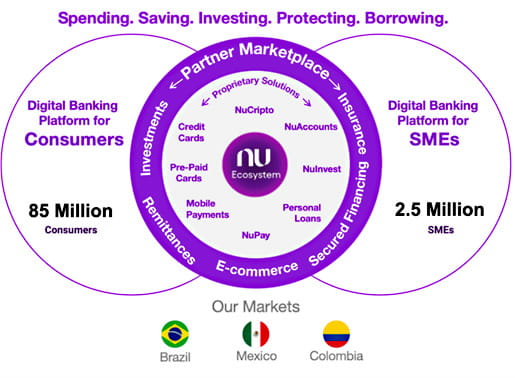

Likewise, the organizational charts of modern financial services players, like Alipay, WeBank, Nubank and others, generally look nothing like those of traditional banks who have led the world in financial services over the last five decades. These new companies boast executive leadership teams with deep technology capabilities. Rather than having legacy product teams around mortgages, credit cards and so forth, their organizational charts tend to be more execution-focused on partnerships, savings, lending, payments or insurance. With the exception of corporate finance and compliance competencies, most executives at these companies have extensive technology experience.

Figure 3 - NuBank Structure (Source: NuBank, SeekingAlpha)

Emerging drivers of 21st century organizations

As artificial intelligence (AI) pervades our markets and industries, we will have to create organizational structures that cater to large-scale autonomous operation. This will force us to abandon many of the corporate structures that pervade boardrooms today and to create very different organizational metrics.

Harvard Business Review (HBR) looked at emerging organizational structures required in the age of AI-powered organizations and found four key arenas of these future-proof plays.

- Hub - Central executive function that aligns strategy with analytics and execution

- Spoke - The strategic business unit, function or geography where the AI functionally operates, managed by a human team

- Gray area - Work that is shared between various units

- Execution teams - Typically project teams that work to collect the data, train models and work to launch an AI-powered capability at the spoke level

In the future, banks will likely be decentralized autonomous organizations with very similar structures to what HBR proposes.

There are two other areas that will also impact organizational design and mission in the 2030s and beyond. The first is sustainability: how to reduce the impact of the corporation on the environment and planet. The second is community: how corporations contribute to the broader social good.

We most likely will develop broad metrics beyond the share price, using them to measure the effectiveness of corporations in new ways, such as net-new resources used in production, carbon output, human versus AI-labor patterns and so forth. Profitability, while remaining important, won't be a sustainable strategy without addressing broader concerns over the mission and policies of corporations. It may not be possible to be a highly profitable company without a broader community mission and alignment.

In an AI-based organization, execution around the technology is the everyday operational function of the business, regardless of product or service. The mission of the algorithms, smart contracts, digital assets and people in these types of businesses becomes aligned with the policy or strategy that defines the parameters of the AI operation. The AI runs the business day to day, with people supporting and cross-checking its accuracy and efficiency. AI is like the operations team in the current business in many respects - the difference being that once in place, human operators are minimal. In the transition to highly autonomous corporations and societies, we will increasingly employ technology for greater productivity, improved access and growth.

The internal risk, compliance and governance functions will no doubt also be greatly impacted by AI-powered business platforms and architecture. We'll require humans to train and manage these models and algorithms, but the further we seek to benefit from AI operationally, the less humans will be involved in day-to-day business operations.

The message is simple. If you want to thrive in the next 10 years as we transition to smart companies, contracts and economies, the ability to understand where technology is transforming your industry and how to integrate it in delivery is about the only thing that will keep you relevant.