The potential of generative AI is huge. What’s standing in the way for financial services?

May 04, 2024

Artificial intelligence (AI) is becoming ubiquitous in people’s lives, especially with the introduction of generative AI tools such as ChatGPT. Generative AI offers many opportunities for both companies and consumers, from content creation to personalized recommendations. Our research, “Trust in Generative AI,” finds that despite the transformative potential, consumers’ understanding and trust of generative AI is mixed – and that’s preventing generative AI from maximizing its potential.

This confusion is no surprise given recent headlines and a lack of regulatory clarity. But if financial services firms can cut through the noise, they may find that consumers are more receptive than they think.

Who is utilizing generative AI today?

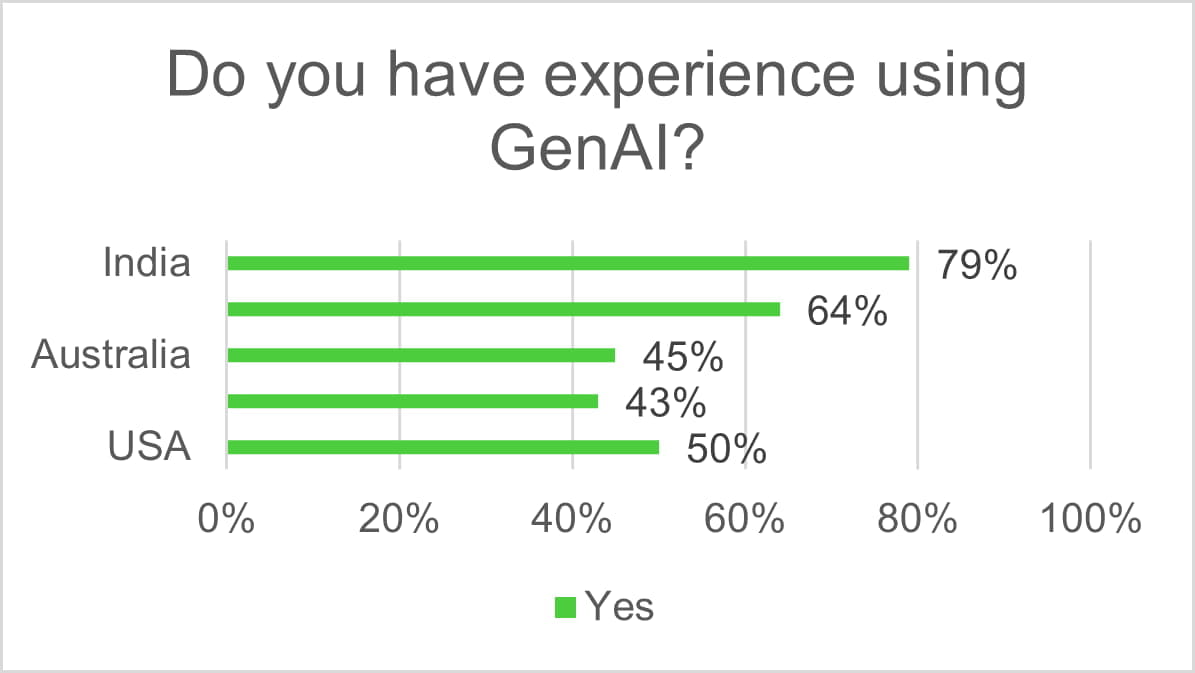

According to our research, India is far ahead in terms of familiarity and usage: 88% of Indian consumers said they are familiar with generative AI, and 79% have experience with it. Why? India has a dynamic technology ecosystem, and generative AI is not merely a buzzword. Major banks are using it to develop responsive and intuitive user experiences.

Of the countries we surveyed, Singapore has the most similar AI outlook to India, with 64% of Singaporeans saying they have experience with generative AI. Consumers in Australia, the U.K. and the U.S. are less likely to use generative AI.

What’s blocking greater adoption?

In the case of generative AI, familiarity may breed trust. Indian and Singaporean consumers who are more likely to have experience with generative AI also have more trust in it. Only 3% in India and 8% in Singapore do not trust generative AI at all, versus 33% in Australia and 30% in the U.K. and U.S.

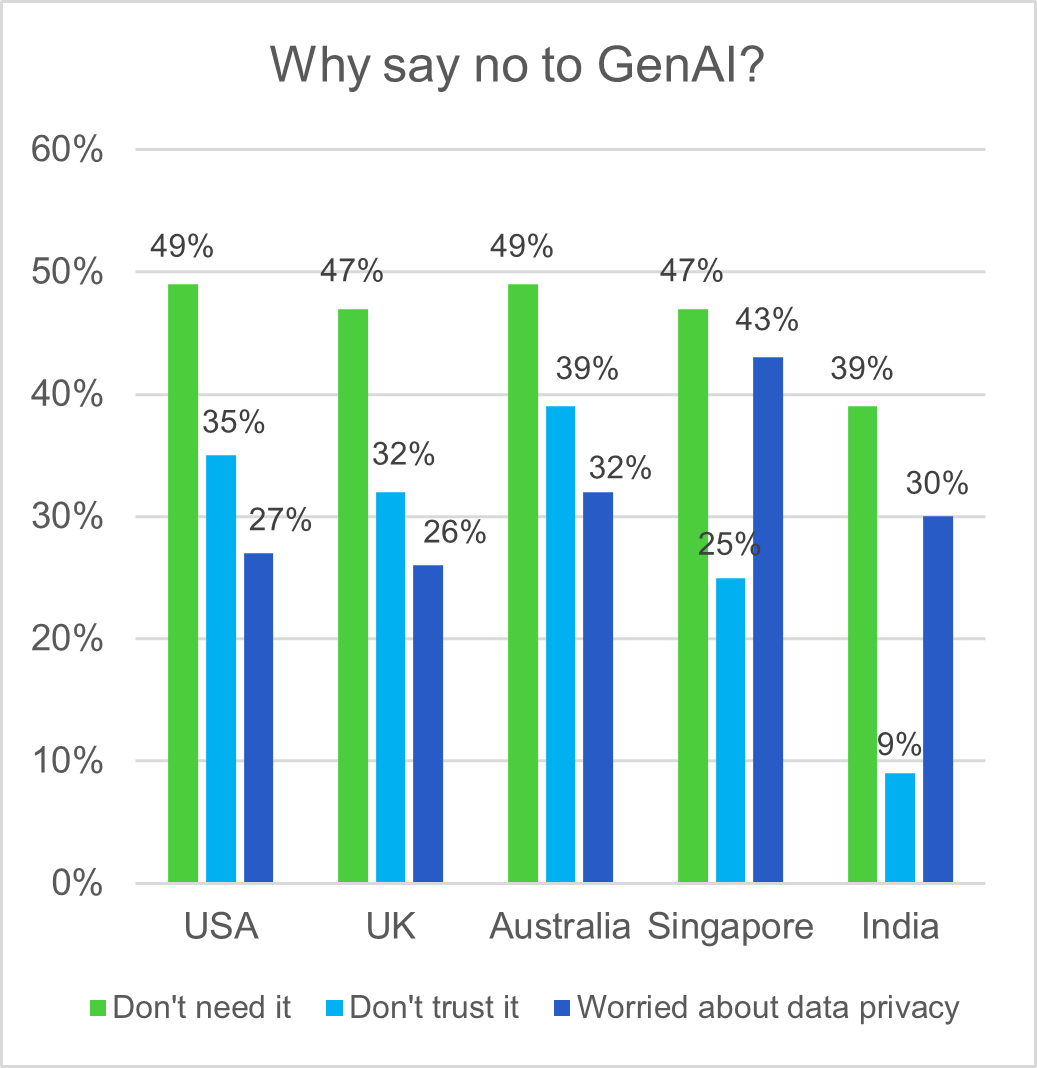

But resistance to generative AI goes beyond trust. Consumers don’t see a need for it, plus they’re worried about data privacy.

Would you bank using generative AI?

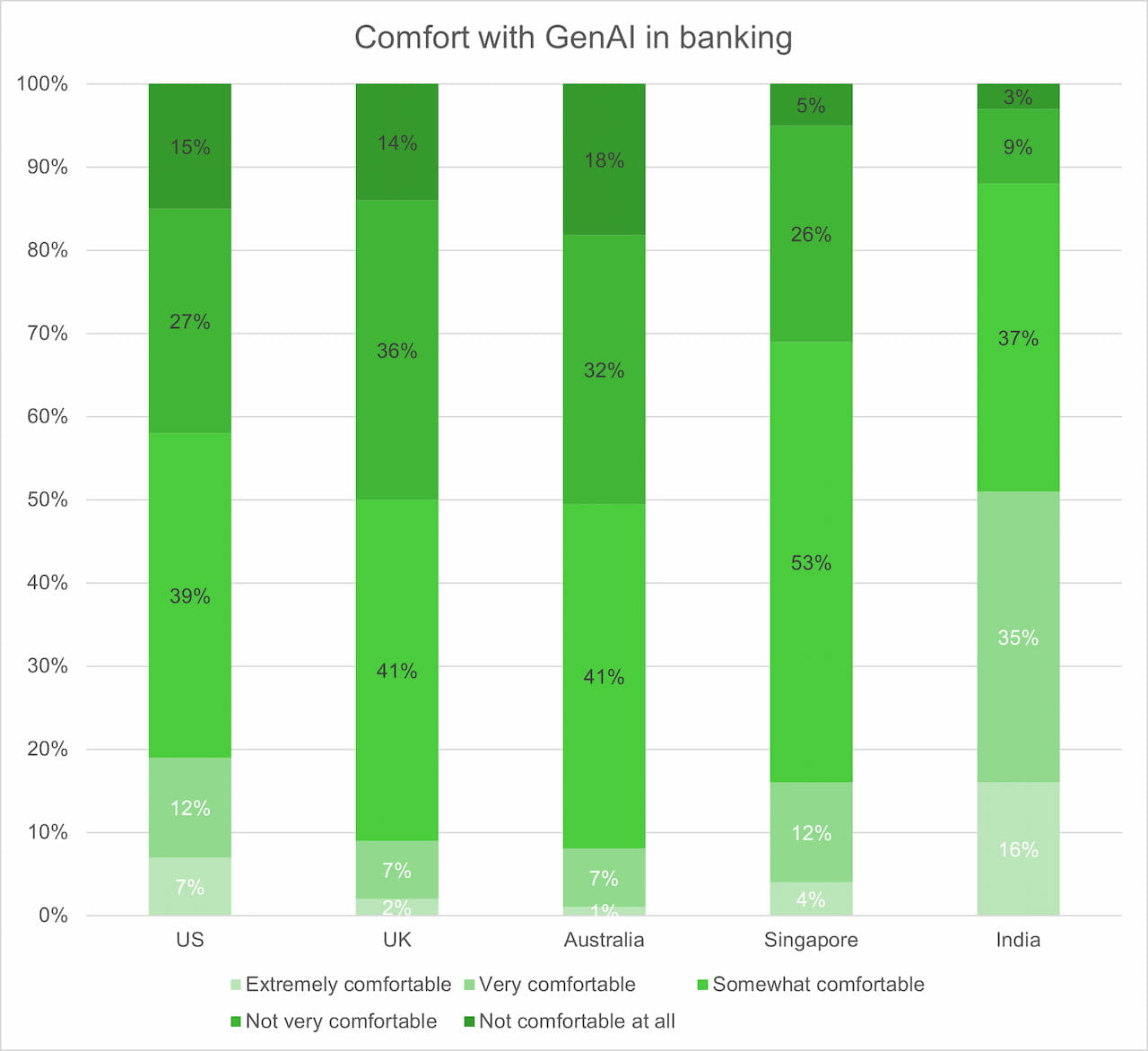

Not surprisingly, consumers from the U.S., U.K. and Australia are also more likely to be uncomfortable with their banks deploying generative AI, while only 3% of Indians and 5% of Singaporeans say the same. However, there is some hope for generative AI proponents: 41% of respondents in all five countries say they are at least somewhat comfortable with their banks utilizing generative AI.

Over 40% of respondents in the U.S., U.K. and Australia are interested in exploring a generative AI-powered financial application, and an overwhelming 91% in India and 74% in Singapore say the same. Most often, consumers believe that generative AI would save them time, though Indian consumers say they also simply like utilizing new technology.

Of course, many financial services providers are already deploying generative AI. From deeper insights into customer behavior, preferences and risk profiles to more effective marketing campaigns and more insightful research reports, generative AI offers intriguing opportunities for businesses. News organizations have reported on JP Morgan’s plans to develop a ChatGPT-like AI service that gives investment advice, while Bloomberg has announced BloombergGPT, a new large-scale generative AI model. The opportunities for consumers go well beyond that, with the chance to boost financial literacy, tailor services to individuals and improve portfolio performance.

But key consumer concerns need to be addressed before the industry can deliver the full value of generative AI.

Closing the trust gap

The flipside of that interest in generative AI is the fact that most consumers in Australia, the U.K. and the U.S. aren’t interested in generative AI-powered financial applications. Will that change in the future?

We asked respondents if they would be more comfortable with generative AI in five years’ time. Indian and Singaporean consumers remain more enthusiastic, with 80% and 58%, respectively, saying they would be more comfortable. Australia, the U.K. and the U.S. continue to lag, with just 48% of those consumers agreeing that they would be more comfortable.

There are some promising signs though. Sixty-five percent of consumers would stick with their primary bank even if they were utilizing generative AI, and another 12% said they’d be more likely to continue using them. So, despite the hesitation among many consumers, our research should reassure providers that they can continue to adopt generative AI without weakening customer relationships.

Regulatory clarity is another key piece to the puzzle, and that seems to be on the horizon – even if it’s a far horizon. The EU was among the first to take action, but U.S. legislators and the Indian government are among those also considering rules. And although governments are taking different approaches, everyone will welcome greater certainty and oversight when it comes to generative AI.

The road ahead

In the meantime, providers and the industry as a whole can start addressing consumers’ concerns.

1. Adopt strong data governance and be transparent with consumers

Thirty percent of consumers say they don’t use generative AI because of data privacy concerns. Research from the Data Protection Excellence Centre found that many generative AI desktop applications have fallen short of GDPR and AI transparency standards. Firms must find ways to credibly reassure consumers that they will be protected, including providing details on their governance frameworks, incorporating human oversight and supporting relevant regulations.

2. Educate consumers about how and why to use generative AI

Many consumers simply don’t see the need for generative AI, or a reason to use it. But this technology offers tremendous benefits to consumers, from recommendations on how to improve their spending habits to making customer service interactions faster and more effective. The industry has a role to explain the value of generative AI to consumers.

With this two-pronged approach, financial services firms will be well-positioned to capitalize on the potential of generative AI while building greater trust with their customers and consumers at large.