True partners take ownership

April 20, 2020

In large transformative initiatives, a lack of clear ownership often impedes real progress. True partners may make mistakes, but they also take ownership and accountability. In significant initiatives, technology leaders should become a true partner, not just serve as a vendor. This type of collaboration achieves results, drives progress forward and inspires continuous improvement.

High-performing financial institutions should challenge their technology partners to take ownership of the initiative of which they are an integral element. Sole ownership of an effort limits the number of interactions the bank must manage, an important consideration for their current resource-constrained time.

The ownership model may also extend to components the partner itself may not own, but which contribute to a comprehensive solution critical to the bank.

Transformative initiatives succeed with one hand to shake

Following completion of a challenging technology project, instead of seeking one vendor to blame for failure, the bank should gladly seek one hand to shake (or one complimentary email to send). Programs such as a core banking transformation are particularly complex, requiring subject expertise beyond what is required to keep the financial institution operating day-to-day.

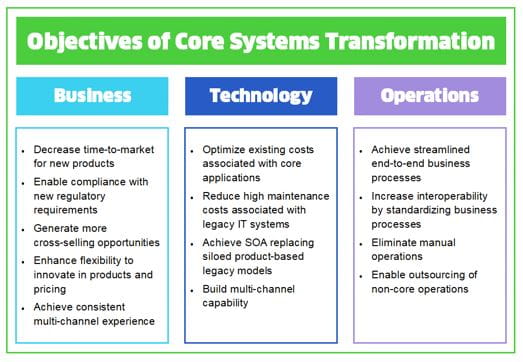

Using Capgemini’s objectives for core systems transformation as a guidepost (as illustrated below), bankers should adhere to the triad of successful core modernization rationales: business, technology, and operations:

When the transformation is done right, the efforts are well worth it because the benefits are so broad.

The absence of true ownership of a transformative initiative often produces less than desired results. Financial institutions that fully engage in transformational change realize meaningful results. This transformational change usually encompasses a significant upgrade in technology, a radical re-engineering of their business processes, and/or a major strategic shift (changing to a sales culture as opposed to an operational one).

To ensure success, a bank’s technology partner taking ownership of the transformational changes must devote significant attention and resources to following a change management methodology and developing a communication plan to support that methodology. Leadership runs smoothly with informed participants who have fully bought-in to the program.

The components to own

A strong partner in a core transformation will take ownership of the program with support from a robust methodology that mitigates the risk in such initiatives.

One challenge that an organization faces in this type of program is the need for expert internal resources to contribute throughout the process, even though they are expected to participate in many of the projects simultaneously. These resources often have business-as-usual roles to fulfill as well as the project’s demands, so it’s important to plan the use of key resources effectively to avoid conflicts that could introduce delays to the program delivery.

Strong program communication and governance will help the partner manage and own the change they are driving. Elements of the transformation itself include:

- Business Process Improvement: re-engineering or creating tasks that align with new technology to deliver optimized efficiency

- Training and education: learning systems and content that help bank staff become comfortable and familiar with new solutions, along with any necessary cultural change

- Planning for, and implementation of, the actual conversion: FIS provides deep expertise in mapping data and migration of banking systems, supported by a proven methodology

- Managing third-party providers: governance and experience to lead key partners and help ensure they complete deliverables needed for the overall program success

- Dedicated resources who provide solution-level support: governance, solution design, and quality experts familiar with the newly delivered solution – who then provide continual support and meaningful enhancements for the life of the partnership

Ownership and the art of escalation

A program manager spends the vast majority of his/her time communicating – reporting progress to stakeholders, conducting meetings, and sharing metrics can take much of the day.

Certain communication requires careful consideration due to its volatile impact and visibility. Escalating issues requires the insight and deft touch that only a veteran program manager can apply. The technology partner taking ownership of a bank’s core transformation must govern with senior, experienced leaders who understand when and how to escalate issues.

As bankers seek to improve their institutions with transformative programs, they must review the performance of their technology partners. They must also assess who can lead complex efforts by taking ownership of the technology, people, and processes involved.

- Topics:

- Digital transformation