Good Bye Expedited Payments. Hello Real Time. by Mike Kresse

January 17, 2019

Real-time payments are poised to become part of financial institutions’ bill pay services and render expedited payments a thing of the past.

Financial institutions lose control over bill paying to billers

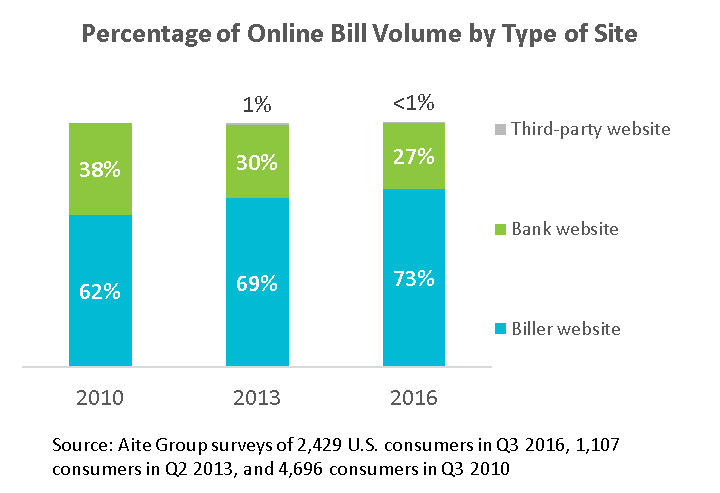

Since 2010, consumers have significantly shifted bill paying to billers’ websites from financial institutions’ bill pay services. Despite the benefits of being able to aggregate bills in one location, schedule payments in advance and make secure payments online or through mobile devices, consumers continue to abandon banks’ bill pay apps.

So why are consumers flocking to billers’ websites? First, the payments are made immediately – critical to consumers about to have their electricity or other important services shut off. With only 54 percent of consumers always paying their bills on time, according to Aite, a huge percentage of consumers need last-minute payment options. Second, most big billers offer the choice of paying bills with a credit card –an option employed by one-third of consumers.

But, perhaps the most significant reason for the migration to billers’ sites is that consumers receive immediate assurance that payment has been made, reflected in one’s balance and confirmation. Contrast that assurance with “fire and fingers crossed” – what I call the financial institution’s bill pay process. You fire off the payment and cross your fingers that it arrives in time. Or, the tardy payer can pay the financial institution to expedite the payment.

Regaining control over bill pay makes for stickier customers

Bill pay is a sticky application that creates high engagement, not only with bill pay but with other services. Less stickiness equates to lost opportunities to create deeper, more profitable relationships.

What will give consumers a compelling reason to reengage with their financial institution’s bill pay? Make bill pay as fast as biller-direct payments through real time.

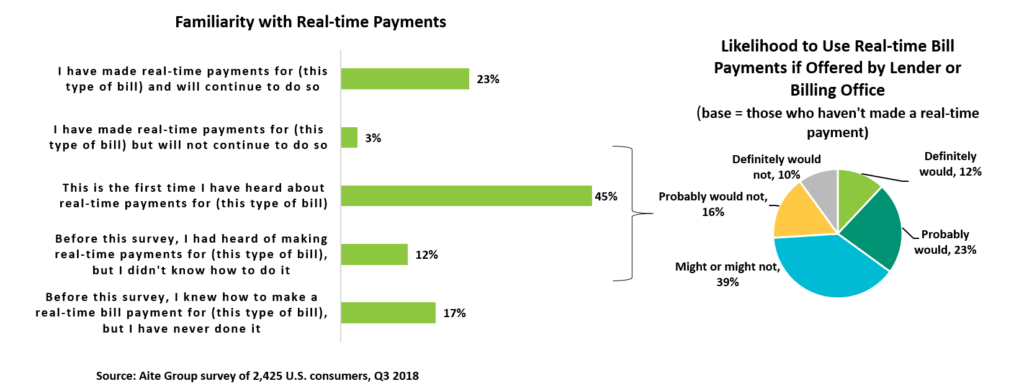

Aite’s recent report indicates that nearly one-quarter of consumers have either used real-time payments and plan to continue to do so (23 percent) and another one-quarter (26 percent) are likely to use real-time bill payments if offered by a lender or billing office. It’s no leap in logic to imagine that the ability to aggregate bills, ensure secure payments and pay billers in real time would reengage account holders in bill pay.

However, speed is not enough. What’s also needed is integration between the bill pay app and the biller to provide confirmation and reassurance that a payment has posted. This can be accomplished in either of these two ways: Use existing rails – for example, credit card rails – or create a new channel or mechanism to facilitate real-time payments – specifically, leveraging the Clearing House’s efforts to create a real-time rail across all financial institutions.

Expedited payments go the way of the dodo

As more people adopt P2P payments services such as Zelle and other real-time payment applications, consumers expectations about how fast is fast enough rise. Speed is expected – table stakes. It means that consumers don’t expect to pay a premium for fast. Otherwise, why not continue to pay the biller directly? Expedited payments, and their revenue stream, become extinct.

It’s not too soon to anticipate and plan for real-time payment ubiquity in the market and its impact. Real-time bill payments may not result in additional costs for financial institutions. Be on the lookout for ways to offer these services without creating incremental cost.

- Topics:

- Payments