The M&A landscape and outlook for community banks

June 07, 2021

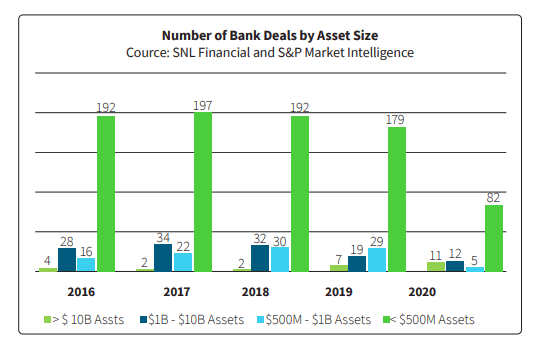

Echoing similar recent industry articles and papers, the American Banker’s article, “What will drive bank M&A in 2021”1 postulates that the pre-pandemic trilogy of low interest rates, a need to cut costs, and the need to invest in technology remain drivers in today’s improving economy. With the stabilization of the economy, bank deals have accelerated. In fact, three of the five largest bank deals in the last decade have come in the last five months and investors have responded with enthusiasm.2 Multiple community and mid-tier deals have also been announced. For the fifth consecutive year, the vast majority of 2020 banking M&A transactions occurred at the small-bank level, with banks holding $1 billion or less in assets making up approximately 80% of the acquisition targets.3

Several themes have emerged from recent acquisitions:

- An outlook of low interest rates continuing to cut into interest income and fee income nearing its apex may result in more banks seeking out bank acquisitions, fee-based business acquisitions, or even a buyer.

- Reducing the high cost of doing business remains a very important factor for banks seriously considering acquisitions.

- Many banks, including community banks, see an acquisition or merger as an opportunity to expand their reach or to scale up operations more rapidly.

- The struggle to keep pace with the expansive technology spending of larger banks across their technology infrastructure, digital/mobile platforms, and emerging technologies (such as AI) is a real one for most banks. For smaller banks, this is creating a need to combine with peers or larger regionals.

- The uncertainty around credit quality is reflected in the form of lower prices offered for banks that agreed to be sold – at the lowest average premium in seven years4.

M&A Integration

Compared to organic growth, merger and acquisition offers the ability to create larger footprints and deeper market share, and to gain access to new technology, products, markets, and distribution channels in a far shorter period. It is an important strategic option that community banks can leverage to make quantum leaps in a competitive marketplace and become more profitable and productive.

Yet despite the best of merger agreements and projections, many such efforts fall short in integrating people, process, and technology, while failing to maximize the return to their shareholders. Unsuccessful integration efforts can take too long, and squander valuable time, personnel, money, and other resources that do not support the intended M&A objectives. As a result, business disruption increases and opportunities to create value are lost.

There’s much that goes into the execution of a successful integration — one that achieves its stated benefits, where goals are met and value is delivered. The answer lies in a disciplined approach to tactical planning and execution.

It is very important to have a detailed framework for M&A’s to provide the following foundation to success:

- Keeps your bank focused on the integration objectives

- Supplies a disciplined approach and methodology for capturing the benefits

- Offers a plan for clear communication to all constituencies

- Provides a quick return to business as usual

Without a detailed framework, banks increase the risk of their acquisition or merger failing to align to their strategic objectives, possibly losing valuable staff and customers as efforts to combine the two companies fail to meet stated objectives.

FIS can help

The HORIZON core platform provides the scalability needed for successful bank consolidation initiatives. Growth-oriented organizations have found the HORIZON applications easy to board and train new bank staff on.

A proven and seasoned implementations team ensures a smooth transition of new entities to the HORIZON platform. FIS Implementations is built upon an exceptional history of successful client conversions, working with a range of financial services partners.

In addition, the FIS Consulting and Professional services team can drive value from a core banking transformation initiative beyond a standard conversion effort, with expertise in program leadership, solution design, staff augmentation, and process improvement.

1 American Banker, January 24, 2021

2 S&P Global Market Intelligence “Research & Analysis: Larger bank acquirers coming back to the negotiating table” March 3, 2021

3 Deloitte 2021 Banking and capital markets M&A outlook, February 2021

4 American Banker, January 24, 2021

- Topics: