Conversational Banking - Is your future banker a voice-activated device or a messaging platform?

January 24, 2019

Synopsis

As digital devices become an everyday banking channel for our customers, financial institutions have been challenged to provide mass personalization that the big technology (Big Tech) companies like Amazon, Facebook, Apple provide to their customers. Until banks can provide this personalized experience, customers will continue to go to the costly branches and cost centers or worse yet, leave their primary banking institutions for the services provided by the FinTech and Big Tech companies. The current digital experience that banks provide to their customers is very prescriptive and limited to one-way conversations. Banks are yet to engage their customers in an intelligent, interactive, two-way conversation that traditionally a human banker can do in a banking or contact center. By using a chatbot or an interactive assistant to interact with their customers, banks can engage in a relevant two-way conversation and recapture the leading position that they used to enjoy in their customers’ financial lives.

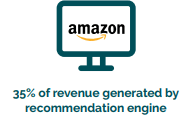

Digital devices are mainstream today. Seventy-five percent of all customer interactions with a bank are done digitally via online or mobile.1 However, the financial institutions of today face a paradox. Forty-seven percent of customers choose a bank because of the proximity of a branch to their home, yet, banks will see less than 50 percent of their customers for the first time in 2018.2 This means that banks must really get their customers’ attention when they do visit the branch or call the contact center plus serve up compelling personalized experiences on their customers’ digital devices. A true multichannel digital and personalized experience is necessary to fulfil the customers’ needs and gain their trust. Furthermore, leading brands have set very high expectations when it comes to personalization. Figure 1 shows how leading brands have mastered the art of mass personalization. Amazon generates 35 percent of its revenue from its recommendation engine.3 Netflix saved $1 billion in customer retention using its recommendation engine.3 Customers expect this level of personalization from their financial institutions as well.

Today, customers’ interaction with their bank is mostly one way on their digital devices. When customers access their banks’ online banking or mobile banking application, they are provided a finite set of transactional choices. These transactions, including checking balances, transferring funds, making bill payments, obtaining transaction history, etc., are mostly one-way in that customers are provided a standard set of responses for their queries. If the customer has any additional questions that are outside of the given set, they often do not find the answer within the banks’ digital properties and are asked to call a help desk or a contact center. Often, the contact center uses legacy, outdated tools and processes, hence will tell the customer that they will have to get back to them in a few days. This leaves the customer with an unpleasant experience. Contrast that with the highly personalized interaction that customers can have with the Big Tech companies, banks are facing a serious risk of losing these customers to these alternate service providers.

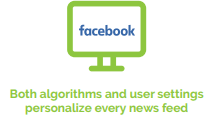

With the proliferation of mobile applications today, a phenomenon called “app fatigue” is starting to set in. While the average customer has 60-70 apps on their mobile device, they only access 5-6 apps on an average daily.4 Gartner predicts that by 2019, 20 percent of the brands will abandon their mobile apps, by 2020, 30 percent of browsing will be done without a screen, i.e., customers will just stay on their messaging platform or voice platform without accessing the brands’ website or app, and by 2021, “Conversation AI-first design” will be adopted by 70 percent of all organizations. Figure 2 illustrates the app fatigue phenomenon and the shift from digital apps to conversational assistants.

Figure 1: Leading brands have mastered the art of mass personalization

Figure 2: App fatigue will cause the shift from digital apps to conversational assistants

What is conversational banking?

It is defined as banking where lightweight, Artificial Intelligence (AI)-powered chat software, commonly called as chatbots, communicate with bank customers through familiar text- and voice-based interfaces to enable a two-way digital customer experience.

There are three concepts that must be highlighted in this definition. The first one is that the chat software or the chatbot must be lightweight and AI-powered. It is not a standalone app but is usually bolted on to another commonly used chat or messaging application. It could also be a lightweight skill or a capability on a commonly used voice-activated device. The software is AI-powered in that it not only responds to commands but is also able to infer, learn and make decisions like a human would. Without this inference capability, the bot will not be able to carry an intelligent conversation and will be no better than the legacy Voice Response Unit (VRU) that quickly transfers the conversation to a human. The second concept is that the bot should support both text- and voice-based interfaces as customers are familiar with both now and like the ability to seamlessly transfer between the two interfaces at their location and surroundings. The third concept is that it should promote an intelligent two-way conversation, otherwise the customer will be frustrated and either will request a transfer to a live banker, or worse yet, will go elsewhere to satisfy their needs. Hence, conversational banking, if done correctly, can improve the customer experience due to intelligent two-way interactions; provide unique data insights to the bank about the customer as the conversation helps capture nuanced customer data, like their needs and desires; and help improve operational efficiency by finishing more of the interactions without needing human intervention.

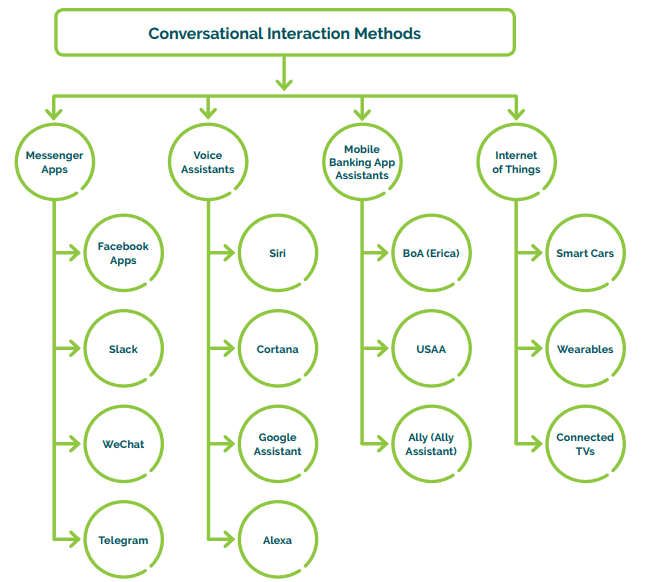

So, what are the methods of conversational interactions that are available today? We have seen four broad categories of conversational assistants, as shown in Figure 3.

1. Messenger Apps – These are financial assistants available on messaging platforms. The most common and widely used app is Facebook Messenger. Facebook Messenger has a robust bot development framework that is used by several organizations. Another common app is Slack that is used by teams for collaboration and has a robust bot framework as well. WeChat and Telegram are apps that are more common in Asia, Europe and the Middle East and can be used to create chatbots as well.

Figure 3: Conversational Interaction Methods available today

2. Voice Assistants – These are general purpose assistants that are activated by voice and are available on mobile and voice-activated devices. Alexa by Amazon is the most popular voice-activated device, though Google Assistant by Google is also popular and gaining market share. Siri by Apple and Cortana by Microsoft are voice assistants used on mobile devices.

3. Mobile Banking App Assistants – These are usually text- or voice-based and deployed as an add-on or an extension to the bank’s mobile app. Some examples are Erica by Bank of America, Ally Assist by Ally Bank, USAA voice assistant that has been built in partnership with Clinc and TD Bank voice assistant that has been built in partnership with Kasisto.

4. Internet of Things – These are assistants within connected devices. Examples are smart cars, wearables and connected televisions. They enable a limited set of use cases in the context of the device and do not have the widespread adoption that the other interaction methods have.So, using one or more methods will improve the customer experience as they will enable intelligent two-way conversations on platforms that the customers are accustomed to, provide unique data insights from the conversation to the bank and help improve operational efficiency by answering and solving more of the customers’ desires through the conversational channel.

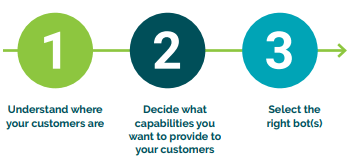

So how can a financial institution build a conversational banking strategy? Figure 4 outlines the three steps that a bank must undertake:

Figure 4: Three steps to build a conversational banking strategy

There are three broad steps that a bank must undertake to build a conversation banking strategy:

1. Understand where your customers are – It is important for financial institutions to understand what their customer touchpoints are and how customers move from one touchpoint to another. Banks do this by plotting out user journey maps. These maps help outline how the bank’s customer interacts with the bank. It is a good way of exposing friction points in the user journey and provides an opportunity for the bank to eliminate or mitigate these as it works to improve these user journeys and make them suitable for conversational banking.

2. Determine what capabilities to offer – Once the financial institution has plotted out the user journeys, it is important to strategize and prioritize what capabilities should be offered to its users through a chatbot. These could be existing capabilities or even net new capabilities that are conducive for conversational banking. It is important that the bank employs a crawl, walk, run approach and introduces capabilities in a phased manner with lessons learned in each phase incorporated into the subsequent phases. The capabilities that a bank wants to offer are usually classified into three broad categories as shown in Figure 5. The “Awareness” category includes capabilities that provide financial awareness to the customer, such as providing account balances, enabling simple transactions like payments, providing alerts, etc. These are interactions that customers can already accomplish today using their digital device. The “Optimize” category goes beyond financial awareness to financial coaching and includes capabilities like setting up a budget, optimizing expenditure, etc. The “Intelligent” category goes beyond optimization to now help customers achieve their life goals. Examples include planning and executing a home purchase, a car, planning for a wedding, planning for college, etc. Today, we find that banks have started with interactions mostly in the Awareness category and have employed a few

Figure 5: Conversational banking use case categories and examples

Awareness

- Check Account Balances

- Verify Bill Payment Due Dates

- Set up P2P Payment

- Set up Payment

- Set up Recurring Payment

- Receive alerts for Low Balances or Payment Due

- Notification of Expense Crossing Budget Threshold

- Receive Alerts for Large Transactions over Threshold

- Understand Expense on budget

this week

Optimize

- Help me set up a budget

- Help me set up savings goals

- Recommend best investment product for saving goals

- Help me improve my credit score

- Recommend where to cut spending to stay within budget

Intelligence

- Help formulate a goal

- Buy a house

- Buy a car

- Save for a life event (e.g., wedding, college, child birth)

- Open recommended account(s)

interactions in the Optimize category as well. We also find that some banks start with a small number of interactions in the Awareness category that does not involve user authentication. These could be interactions like providing product descriptions, product catalog related queries, providing ATM locations, etc. This enables them to gain valuable experience in conversational banking before they tackle the problem of user authentication, authorization and multi-factor authentication.

3. Select the right bot(s) – It is very important to understand the benefits and constraints of the different bot types before one or more bots are selected. If multiple bots are selected, it is very important to ensure that the customer can seamlessly navigate from one bot to another. When banks introduced the online channel 20 years ago and the mobile channel 10 years ago, they were introduced as silos where one channel did not know about the actions performed by the customer in the other. It is important that we do not repeat the same mistake as we introduce bots into the banking ecosystem. Figure 6 provides the benefits and constraints of each bot type.

The benefit of a messenger app is that the user is familiar with this technology, and they have widespread adoption as well. However, the user security and authentication for this bot type is not mature and introduces a certain level of friction in the user experience. Voice assistants are also commonplace now and provide the benefit of gathering additional information from a two-way conversation with the user. However, this bot type also suffers from the same user security problem as the messenger app. Furthermore, today’s common devices – like Amazon Echo, Google Home, etc. – do not pass the actual voice signature for authentication. Instead, they pass on a unique identifier for a given user’s voice, which does not allow for authentication using voice signatures. However, we believe that these device manufacturers will eventually provide the actual voice recordings or authenticate voice signatures. This will improve the security of such devices. Mobile Banking Application assistants are also very familiar to users; but, they create a cumbersome user experience as the user must toggle to an assistant for help and toggle back to the mobile application to finish out their interaction. Intelligent devices have the benefit of anticipating user needs and completing a task; however, they are not commonplace today and the problem of user security is still a concern on these devices. A financial institution that chooses one or more of these bots must ensure that they are an extension of its digital strategy, i.e., that they consume the same services and APIs as your existing consumer and banker-facing channels.

Figure 6: Benefits and constraints of bots

| Bot Type | Benefits | Constraints |

|---|---|---|

| Messenger Apps | User familiarity and widespread adoption | User security for transactions like money movement not mature and bank-grade |

| Voice Assistants | User familiarity and adoption as well as gathering additional information during a conversation | Very cumbersome user security. Voice signature not passed to application for more robust voice authentication methods |

| Mobile Banking App Assistants | User familiarity with mobile app they use today | Cumbersome toggling between mobile addistant and assistant |

| Internet of Things | Intelligent devices anticipate need and fulfill | Do not have widespread adoption, user security is a concern |

FIS Response to Conversational Banking

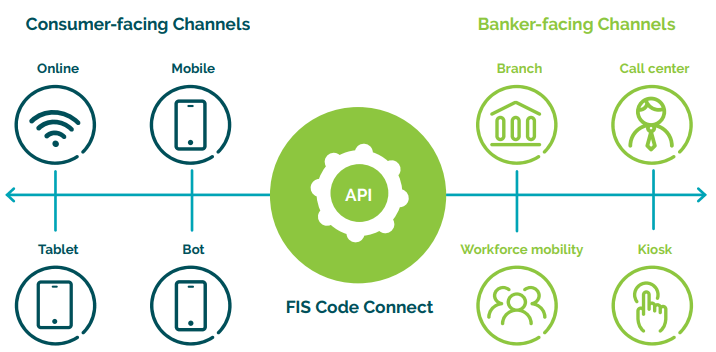

FIS is well-positioned to respond to the conversational banking phenomenon. FIS Code Connect platform and API marketplace provides a common digital API that can be used by any channel to construct differentiated user experiences and offerings. FIS sees the chatbot as another conversational touchpoint that utilizes the same APIs as used by other digital channels. Figure 7 shows an overview of this strategy.

Figure 7: The Bot is a natural extension of the FIS Code Connect Strategy

For FIS, the conversational banking channel uses the same Code Connect APIs as the other channels

Conclusion

As bank executives begin to develop their conversational banking strategy, they should ensure the following:

- Keep in mind the crawl, walk, run adage. Start small and implement in phases with lessons from each phase feeding into the planning and execution of the subsequent phase. Classify the user journeys into the Awareness, Optimize and Intelligent buckets. Start with the simple use cases in the Awareness category.

- Select the right bot(s) and ensure seamless journeys between them. Do not repeat the same mistakes that were made during the introduction of online and mobile banking channels.

- Carefully work with your legal, compliance and security teams to design the security mechanism for the bots. This must strike the right balance between robust security and user friction.

- Understand that the bot is not just to improve personalization and customer engagement, it can lead to operational efficiencies as well.

- We believe that conversational banking is going to create disruption in the financial space like mobile banking did 10 years ago. It is extremely important for financial institutions to embrace this trend to personalize their customer experience and continue to preserve their customers’ trust that they have worked so hard to gain.

About FIS

FIS is a global leader in financial services technology, with a focus on retail and institutional banking, payments, asset and wealth management, risk and compliance, consulting and outsourcing solutions. Through the depth and breadth of our solutions portfolio, global capabilities and domain expertise, FIS serves more than 20,000 clients in over 130 countries. Headquartered in Jacksonville, Florida, FIS employs more than 53,000 people worldwide and holds leadership positions in payment processing, financial software and banking solutions. Providing software, services and outsourcing of the technology that empowers the financial world, FIS is a Fortune 500 company and is a member of Standard & Poor’s 500® Index. For more information about FIS, visit www.fisglobal.com

1 FIS Performance Against Customer Expectations (PACE) Survey 2017 for USA.

2 Jim Marous, Chatbots and Interactive Banking, The Financial Brand, February 2018.

3 Ganesh Ramakrishnan And Uday Akkaraju, 151 – Conversational Banking, FIS Connect 2018.

4 Heather Pemberton Levy, Gartner Predicts a Virtual World of Exponential Change, Gartner, 2017