A suite of solutions designed to modernize the office of the CFO

Adaptable | Scalable | Comprehensive

From cost center to strategic advantage

Those supporting the office of the chief financial officer know the frustrations of manual, error-prone processes, limited visibility, high-stakes security, cumbersome implementations, complex integrations and so on. As a CFO, finance manager or head of finance at a large corporation, FIS® Automated Finance can help you transform your department from a cost center to a true strategic advantage.

Shaping payment solutions through market trends

Reveal the role of artificial intelligence (AI) and other market drivers behind our technology solutions with Seamus Smith, EVP and group president of Automated Finance at FIS.

Solutions designed to take the friction out of finance

Automated Finance offers a comprehensive suite of tools for receivables, payables and revenue optimization. Choose from our solutions that help reduce friction, unlock revenue potential and give you the confidence and capabilities to grow.

See detailsYour partner for growth

To help our clients take finance to the next level, we’re dedicated to continually improving our solutions. This includes expanded AI and machine learning capabilities, enhanced API integrations, advanced cash application automation and innovative payment options.

See what's new

Clients trust us, and so do the experts

Our exceptional track record of awards and recognition demonstrates our ability to deliver world-class technology and products.

Let’s keep our conversation going

Learn more about how FIS can help turn your finance department from a cost center into a growth partner.

Connect with an expert to get all your questions answered.

Explore the benefits Automated Finance can bring to your business.

Reach out for pricing details that align with your needs.

View detailed specifications for our Automated Finance solution.

Specs

Automated Finance

Modern interfaces offer enhanced visibility and control for more effective data-driven decisions

Automation solutions designed to decrease expenses and resources by modernizing manual workflows

Streamlined operations

Enhance productivity with dynamic self-service solutions that support businesses of all sizes.

Risk management

Predict future risk and optimize cash flow management with artificial intelligence (AI) and machine learning.

Elevated growth

Apply real-time insights to drive revenue growth and build stronger relationships with your customers.

Seamless connectivity

Integrate comprehensive solutions and compatible APIs across your entire tech stack for enhanced functionality.

Automated Finance suite

From modernized order-to-cash processes for faster, more efficient receivables management to payment offerings that cover the procure-to-pay process, our suite of solutions serves the entire business-to-business payments ecosystem.

Payables automation

Promote cost savings and revenue growth with leading-edge payables automation solutions that increase efficiency and transparency, reduce fraud and enhance the customer experience.

Integrated Payables

Enterprise Disbursements

Integrated Invoice-to-Pay

Converts payments from traditional to virtual cards and open doors to revenue

Converts traditional payment methods to digital payments

Greater transparency into cash positions

Payment card security standard v2.0 (PCI DSS) compliant

No sharing of financial data and biometric authentication with payee validation

Reduces invoicing errors by automating invoice capture

Minimizes resources associated with paper-based payments and manual processes

Reduces costs associated with check printing

Automated and cloud-based solutions reduce invoice processing costs

Executes all business payments through a single process with centralized visibility

Simplified B2C disbursements with no online account setup

Connects and captures invoice data electronically

Dedicated vendor enrollment team and vendor portal

Faster digital settlement for consumers

Open e-invoice network with access to over 2.5 million suppliers

Integrated Payables

Transform accounts payable disbursements from check to electronic payment

Integrated Payables is an advanced business payment solution that accepts a single, all-inclusive payment file from your ERP system to simplify and streamline the payment process. In addition, its vendor enrollment service takes the burden off your accounts payable staff by handling the tedious process of registering vendors for electronic payments.

Enterprise Disbursements

Optimize enterprise consumer disbursements with direct bank payouts

Enterprise Disbursements provides businesses a simpler, more secure way to pay customers directly into their bank accounts through the Pay-By-Bank experience. With this system, customers bypass manual entry of card or bank details. Customers simply connect to their bank and use biometric authentication for payments to be directly credited to their account.

Integrated Invoice-to-Pay

Automate invoice receipt, routing, approval and payment execution

Integrated Invoice-to-Pay, an end-to-end accounts payable and payment automation solution, delivers supplier connectivity and invoice data capture to remove paper processes and drive automation. With touchless accounts payable processing, it helps maintain control and visibility on invoicing and payments in a globally compliant manner – ensuring efficient and future-proof receivables processes.

Receivables automation

Experience faster cash flow and efficient receivables management with modernized order-to-cash solutions designed to remove friction and reduce expense and time to revenue.

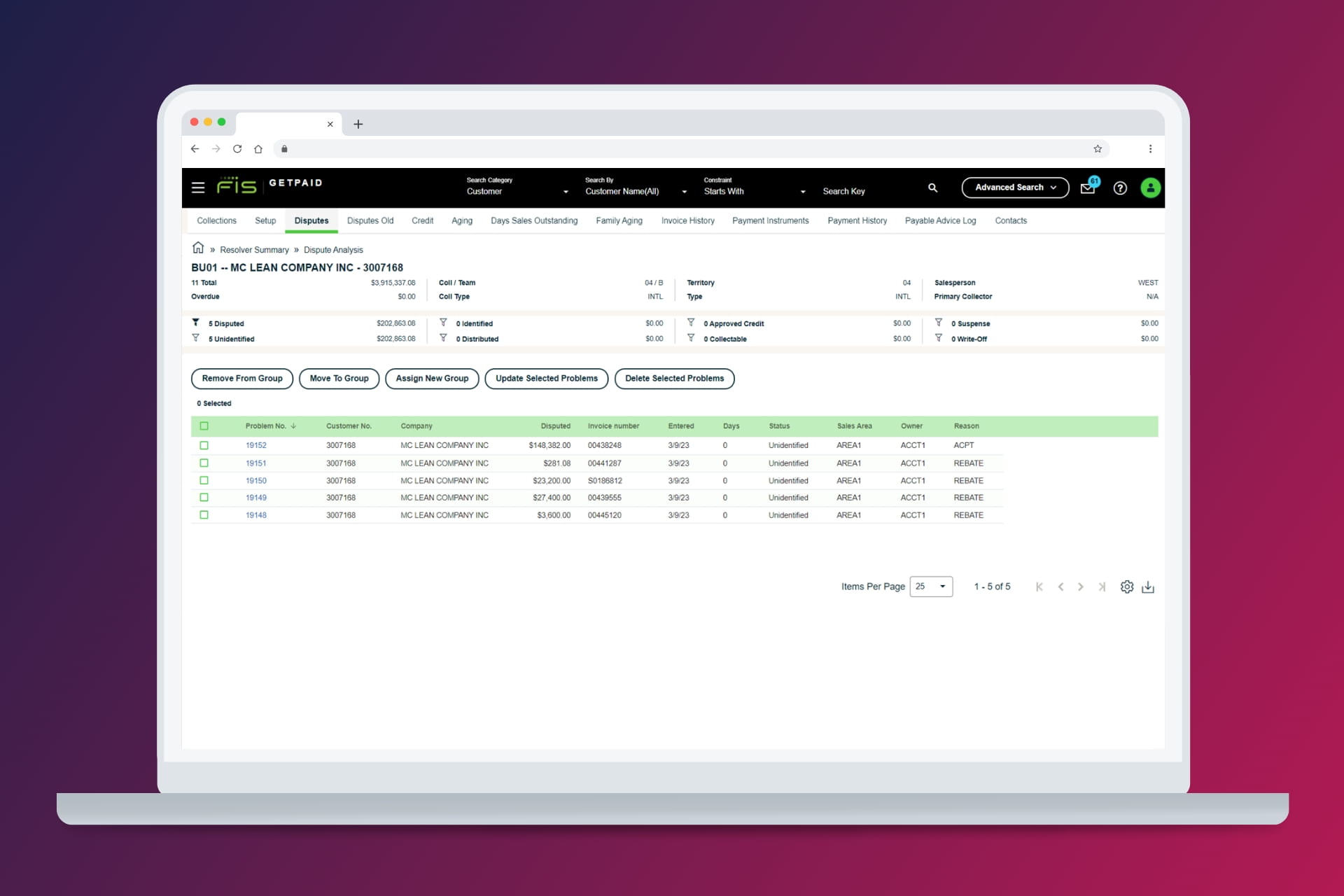

GETPAID/Integrated Receivables

BillerIQ

Reduces DSO and accurately forecasts incoming cash flow

Reduces collection and outstanding invoices while accelerating payments

AI-driven and risk-based credit and collections

Secure and compliant

User-configurable dashboards and one single user interface

Manage bills and payments in a single place

Reduces manual processes and allocates resources to higher-valued tasks

Allows customers to self-serve and reduces paper-based processes

Reduces dispute and deduction cycle time

Real-time billing and payment data reporting

Automated cash application and credit reviews with advanced workflows and auto-approval

Built-in remittance and payment data enables STP and automated reconciliation

GETPAID

Accounts receivable software that automates the credit-to-cash cycle

GETPAID is a fully integrated, web-based accounts receivable software solution that increases cash flow, mitigates risk and drives operational efficiencies. Its embedded machine learning and AI engine delivers the functionality corporates need to manage credit-to-cash processes effectively and efficiently.

Integrated Receivables

Improve cash flow for your commercial clients

Designed for the commercial clients of financial institutions, Integrated Receivables is the white-label version of our GETPAID solution that removes the resource-intensive cash application process and accelerates the payments cycle. Automation clears your commercial clients’ backlog of overdue invoices, enabling straight-through processing and improved cash flow.

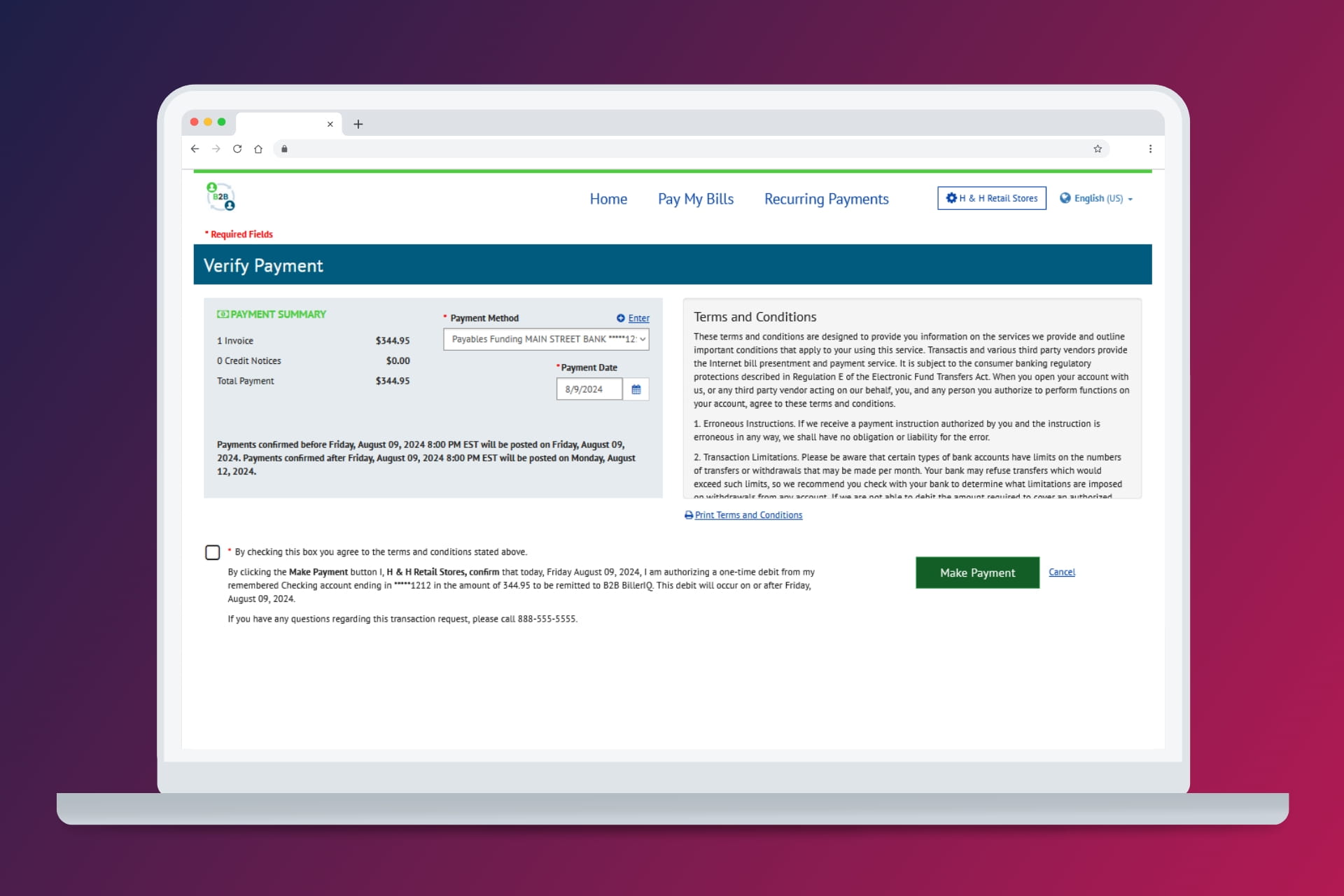

BillerIQ

Electronic bill presentment and payment to reduce costs and accelerate revenue

BillerIQ is a white-labeled industry agnostic SaaS biller direct solution that enables you to deliver bills and accept payments through a variety of digital channels, such as web, mobile, automatic recurring payments, interactive voice response, calls to a customer service representative, text and point of sale. It also includes real-time notifications, personalized bill design and targeting messaging to improve customer communications and increase overall engagement.

Revenue optimization

Maximize revenue generation through data-driven solutions that automate processes and provide valuable insights to improve accuracy, proactively identify risk and minimize revenue leakage.

Extended Account Analysis

Revenue Insight

Detects lost revenue opportunities and identifies most profitable clients, product families and services

Reduces collection costs and DSO

Minimizes leakage based on manual billing processes

Accurately identifies accounts that pose a high risk of delinquency

Flexible pricing calculations and settlement options

Differentiates between accounts that need frequent reminders and those that can self-cure

Direct integrations for faster, efficient implementations

Provides real-time collections data

Automatic reanalysis capabilities result in fewer errors

Reduces time spent on manual collection activities

Automated data collection from all billing sources

Proprietary AI and machine learning offer actionable insights into cash at risk

Extended Account Analysis

Optimize revenue through personalized offers and transparent billing

Extended Account Analysis is a premium, data-driven corporate treasury solution that helps financial institutions optimize revenue by providing visibility throughout the client relationship. Its full array of pricing strategies and fee calculations facilitate personalized offers while API technology drives automation and workflow, providing accurate and clear billing.

Revenue Insight

AI and machine learning insights that accelerate revenue

Revenue Insight (formerly Predictive Metrics) is designed to not only optimize collection efforts, but also enhance overall customer relationships. Harnessing the power of predictive analytics, driven by leading-edge AI and machine learning, finance leaders are equipped with actionable insights to make informed decisions and drive business growth.

What's new

GETPAID

This new feature optimizes cash application automation by introducing optical character recognition that supports global outreach, multiple languages and better data extraction.

BillerIQ

This recent enhancement introduces expanded payment options, such as Apple Pay and real-time payments, designed to enhance payment volume.

Receivables automation

Bringing enhanced AI and machine learning, this upcoming feature includes improved email natural language processing and new AI use cases.

GETPAID and BillerIQ

This upcoming update integrates GETPAID and BillerIQ with enhanced client portal capabilities within GETPAID.

Receivables automation

Strengthening API integration with a rearchitected integrator for all bureaus and insurance providers, this upcoming update brings cost savings and faster market readiness.

Enhance your experience with the latest features

Stay connected and in control with the FIS® Client Portal. Manage and monitor your products, stay current on important alerts, contact client services and upgrade to the newest software – all in one convenient location.

Resources

Automated Finance product sheet

A suite of receivables, payables and revenue optimization solutions designed to streamline all B2B payment processes.

Integrated Payables product sheet

A digital payment solution that simplifies, automates and enhances the profitability of your customers’ accounts payable processes.

Integrated Invoice-to-Pay product sheet

A fully scalable, secure, end-to-end accounts payable and payment automation solution for midsize businesses.

Enterprise Disbursements product sheet

The business-to-consumer solution that enhances enterprise disbursements through direct bank payouts.

GETPAID product sheet

An accounts receivable software solution that helps corporates effectively and efficiently manage credit-to-cash processes.

Integrated Receivables product sheet

A platform for financial institutions that removes the resource-intensive cash application process and accelerates the payments cycle.

BillerIQ product sheet

An electronic bill presentment and payment solution that enables businesses to deliver bills and accept payments across multiple digital channels.

Revenue Insight product sheet

An AI and machine learning solution for proactively identifying risk and minimizing revenue leakage.

Let's keep our conversation going

Learn more about how FIS can help turn your finance department from a cost center into a growth partner.

Connect with an expert to get all your questions answered.

Explore the benefits Automated Finance can bring to your business.

Reach out for pricing details that align with your needs.

Get a brief overview of our Automated Finance solution.