Unified, AI-powered platform for digital account opening, lending and card origination

Integrated | Scalable | Secure

What is FIS Amount, and how does it modernize digital banking?

Traditional banks and credit unions have lost over $3 trillion in deposits in the last five years as fragmented systems and limited AI-driven decisioning push customers and members toward agile, digital-native competitors. FIS® Amount™ delivers an AI-powered, core-agnostic platform that combines digital experiences with strong risk mitigation. Deeply integrated into the FIS ecosystem, including core banking and digital banking platforms, it enables you to attract and retain customers and members without a costly, complex system overhaul.

Why combine deposits, lending and cards on one unified platform?

FIS Amount is a unified banking technology platform that empowers financial institutions to modernize with ease. By replacing multiple systems with one integrated ecosystem, the platform connects account opening and origination services across deposits, lending and cards for consumers and small businesses – reducing operational complexity and vendor inefficiencies.

See details

Explore all the financial technology products FIS has to offer

View all products

Let's keep our conversation going

Learn more about how FIS Amount supports banks and credit unions in serving consumer and small business needs while effectively managing risk and fraud.

FIS Amount™

Cognitive decisioning engine utilizes advanced predictive analytics to deliver superior fraud prevention and underwriting decisions

Low-code/no-code framework with self-service PCM enables rapid deployment and customization of products, branding and workflows without costly IT overhead

AI policy optimizer autonomously monitors and optimizes credit, fraud and pricing policies with state-of-the-art AI and ML, delivering bespoke recommendations from real-world data for rapid market adaptation

Intuitive program management

Launch and manage programs efficiently with a self-service design that gives teams control while reducing reliance on IT.

Intelligent risk management

Maintain seamless customer experiences and acceptable loss rates through automated systems that intelligently assess and manage risk.

Flexible core integration

Accelerate deployment and simplify operations with a core-agnostic platform that connects easily to your existing systems.

Omnichannel account opening

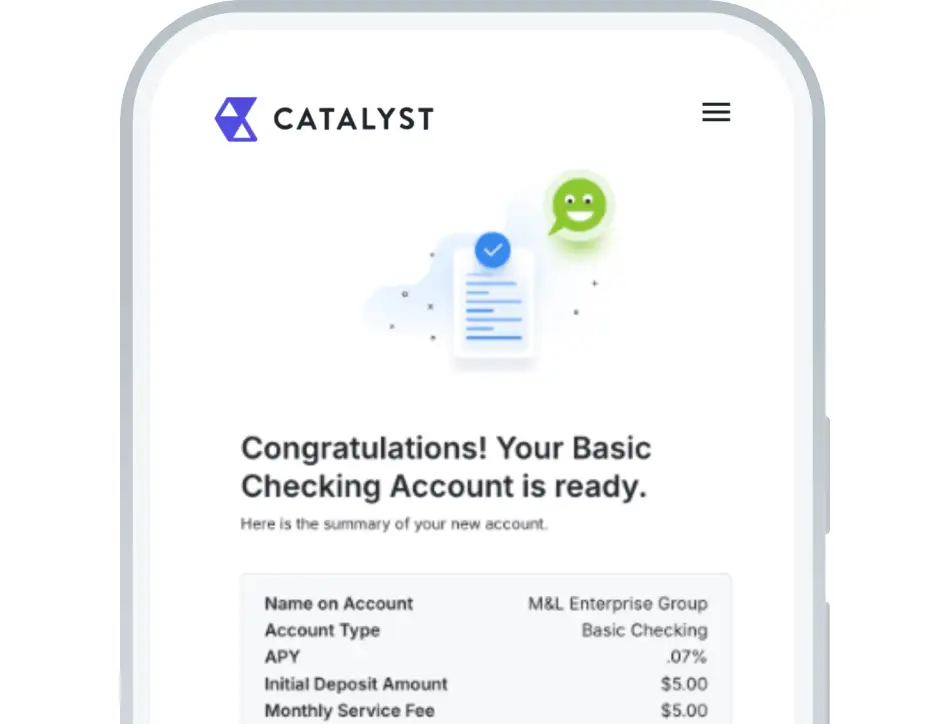

Enable customers to open multiple deposit accounts across mobile, online and branch channels while creating future opportunities to cross-sell.

Unified digital account opening, lending and card origination

FIS® Amount™ empowers institutions to migrate and launch confidently on a single, configurable platform with built-in risk orchestration, balancing seamless experiences with effective loss control to increase satisfaction and conversion.FIS Amount consumer deposit account opening

Automate manual processes for faster onboarding

FIS Amount SMB deposit account opening

Streamline application and decisioning processes

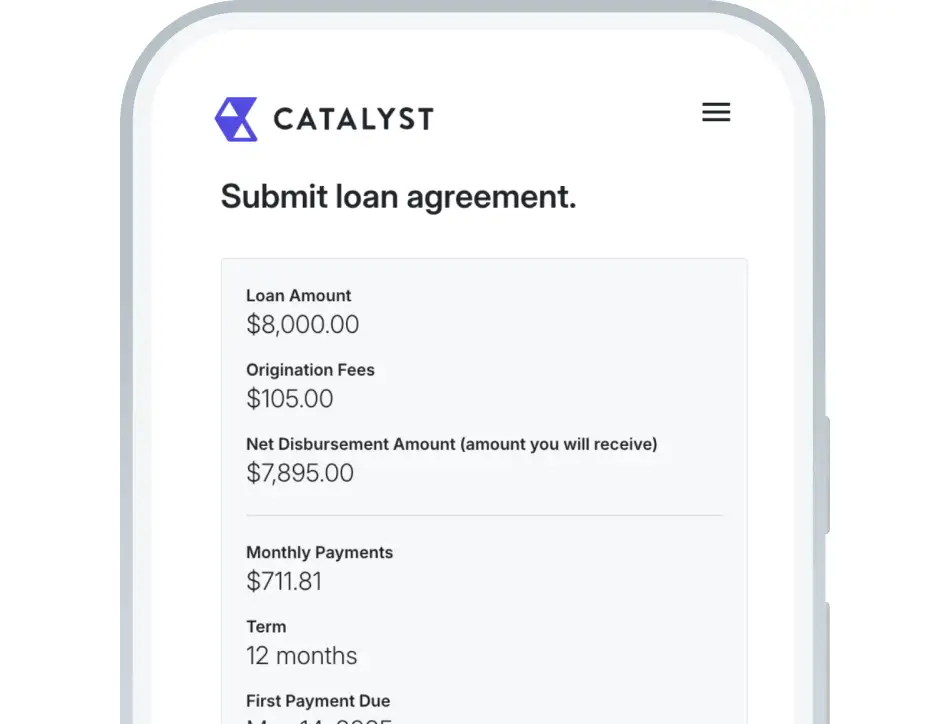

FIS Amount consumer lending origination

Accelerate loan approval and fulfillment

FIS Amount SMB lending origination

Optimize the credit application process

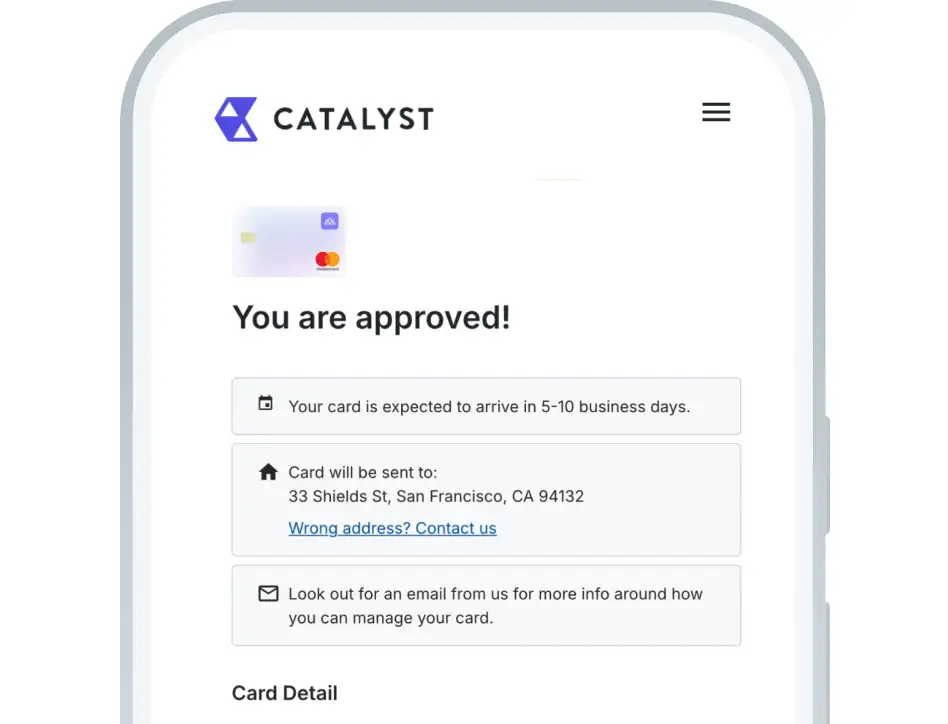

FIS Amount consumer card origination

Enable quicker consumer credit card approvals

FIS Amount SMB card origination

Digitalize business credit card approvals

Resources

FIS Amount product sheet

Migrate and launch confidently on a core-agnostic platform with configurable tools for building and managing digital-first deposit and lending journeys.

FIS Amount consumer deposit account opening product sheet

Enable efficient customer deposit account opening with mobile-first applications, prefill for existing customers, digital funding and smooth transitions between brand and digital channels.

FIS Amount consumer lending origination product sheet

Simplify consumer lending origination through digital applications, e-signature, document capture and real-time booking to boost approvals, reduce opex and deliver faster, compliant funding.

FIS Amount consumer card origination product sheet

Streamline consumer card origination through mobile-optimized applications, built-in KYC and fraud controls, and real-time integration with core systems.

FIS Amount SMB deposit account opening product sheet

Modernize SMB deposit account opening with digital journeys that capture the right data first, automate checks and accelerate time to funding.

FIS Amount SMB lending origination product sheet

Optimize SMB lending origination with digital solutions, multi-owner support, embedded compliance and real-time blocking for faster, more efficient application experiences.

FIS Amount SMB card origination product sheet

Digitalize SMB card origination with multi-owner support, workflow automation, embedded KYB and core integration for speed and compliance.

Let's keep our conversation going

Learn more about how FIS Amount supports banks and credit unions in serving consumer and small business needs while effectively managing risk and fraud.