A single software platform to transform your digital banking experience

Comprehensive | Customizable | Consistent

Purpose-built for your digital banking needs

Financial institutions differ in size and style, each with distinct digital banking needs and expectations. FIS® Digital One™ delivers consistency across digital and mobile self-service and banker-assisted channels, whether you’re supporting retail customers, business clients or employees.

Experience the impact firsthand

Get acquainted with Digital One through guided demonstrations from FIS experts, showcasing essential tasks like dashboard creation, digital document signing and mobile banking capabilities.

Watch all videos

We’re fast-paced

and ever-evolving

FIS is on a mission to enhance our offerings so you can provide your end-users with digital banking experiences that stand head and shoulders above the rest. This includes making them easier to use, investing more in user experience and design, and adding new features more often.

See what's newCustom digital solutions for your financial institution

From online account opening to mobile banking and teller processing, Digital One delivers a comprehensive ecosystem of flexible, configurable and scalable products that you can pick and choose from based on your unique needs.

See detailsLet’s keep our conversation going

Learn more about how FIS can help you take charge of your digital banking experience today and into the future.

Connect with an expert to get your questions answered.

Experience the value Digital One can bring to your institution.

View detailed specifications for our Digital One platform.

Specs

Digital One

Modern user interface ensures responsive design, efficient menus and improved navigation

Managed security, risk and compliance provide comprehensive, layered fraud and security protection

Single, integrated platform

Get all your digital banking needs to support your retail and business customers from a single, trusted provider, removing the need for piecemeal solutions.

Faster market entry

Accelerate your bank's deployment with out-of-the-box solutions that require minimal configuration and enjoy new features as they're released.

Connected experiences

Deliver the same customer experience across all your banking channels, be it branch, online or through your call center.

Flexible, open architecture

Connect API integration-ready widgets with Digital One™ APIs and other third-party APIs for additional features and innovation through our partnerships.

Digital One ecosystem

FIS® Digital One features an ecosystem of interconnected modules that allow financial institutions to modernize their customer and associate experiences at their own pace in steps or altogether with a full deployment. This way, you have control over your digital journey now and in the future.

What's new

Digital One™ Flex Mobile

Recent updates to the Flex Mobile app deliver a redesigned interface, revamped home screen and improved navigation.

FIS Business Hub

With the reimagined Business Hub solution, users now enjoy a more modern and defined user experience.

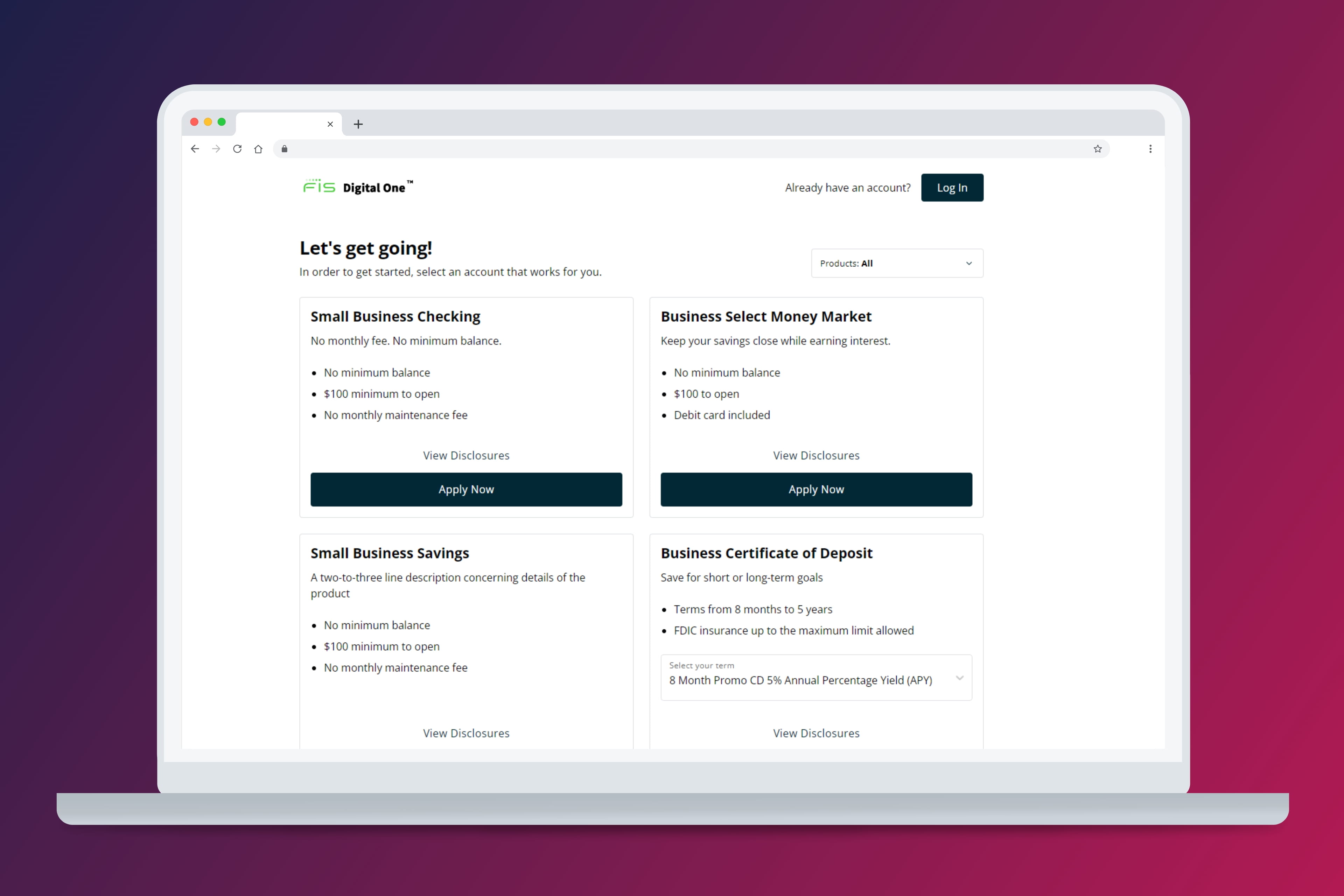

Digital One™ Business Account Open

This offering simplifies business account onboarding with an intuitive experience that reduces account setup time from hours to minutes.

Exciting new features are waiting for you

Experience the convenience of the FIS Client Portal, from managing dashboards to contacting client services and staying updated on the latest releases and alerts – all in one place.

Demonstration videos

Resources

Digital One brochure for large financial institutions

A feature-rich, highly configurable digital banking platform designed for large financial institutions and enterprises.

Digital One™ Commercial APAC product sheet

A core-agnostic, composable banking platform that enables Asia Pacific banks to meet rapidly changing demands with modern, flexible digital capabilities.

Digital One brochure for regional and community banks

An integrated, end-to-end digital banking platform tailored to serve regional and community banks.

Digital One™ Targeted Engagement product sheet

A platform that unifies customer data for omnichannel campaign orchestration and dynamic audience targeting.

Digital One™ Studio product sheet

The self-service banking management solution that is both available out-of-the-box and highly customizable.

Digital One™ Online Account Open product sheet

The easy, fast and paperless way for customers to apply for, fund and open new accounts digitally.

Digital One™ Flex product sheet

A modular approach that enables you to tailor different banking experiences for retail and small business customers.

Digital One™ Business product sheet

A single platform that supports an entire ecosystem of business features designed to use on mobile devices or the web.

Digital One™ Business Account Open product sheet

A modern solution that allows businesses to open and fund a new account online.

FIS Business Hub product sheet

The single portal that aggregates bank and fintech applications to provide a unified user experience for businesses.

Digital One™ Banker product sheet

The sales, service and origination platform that allows your staff to perform all sales, service and account origination.

Digital One™ Teller product sheet

A browser-based solution designed to streamline all monetary transactions processing, cash management and reporting.

Digital One™ Flex Mobile product sheet

An intuitive mobile banking application that enables your customers to stay connected to their finances wherever they are.

Developer resources

Code Connect

Explore our ecosystem of advanced APIs designed to revolutionize your banking solutions.

Visit Code ConnectSupport Center

Our team is ready to support your bank or financial institution. Don’t hesitate to reach out.

Get supportLet's keep our conversation going

Learn more about how FIS can help you take charge of your digital banking experience today and into the future.

Connect with an expert to get all your questions answered.

Experience the value Digital One can bring to your institution.

Reach out for pricing details that align with your needs.

Get a brief overview of our Digital One solution.

Book a meeting

Schedule an appointment with a dedicated specialist who can evaluate your business needs and develop a tailored plan to align with your objectives.

Get in touch