Integrated balance sheet management software for capital and risk control

Fast | Integrated | Strategic

Strategic balance sheet management for ICAAP efficiency and capital planning

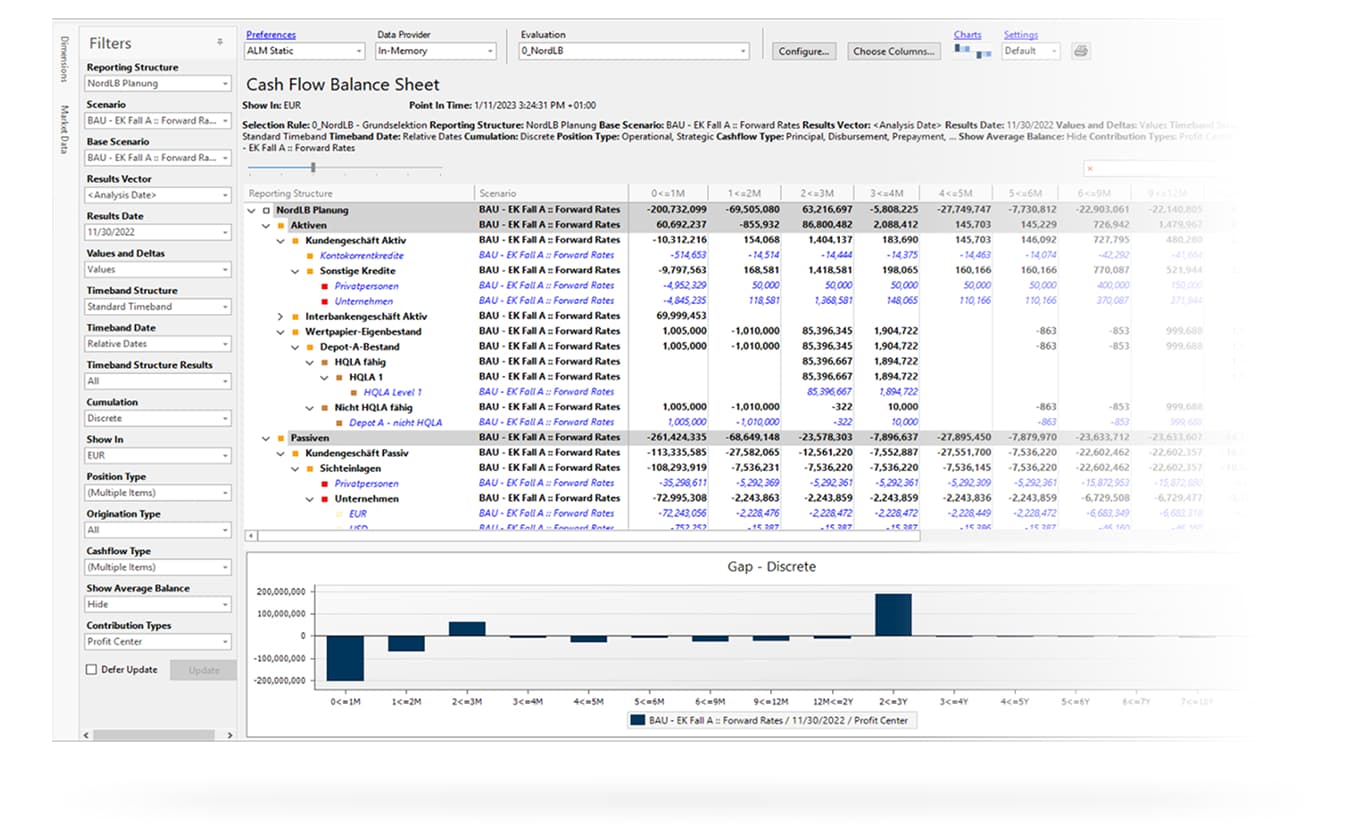

FIS® Balance Sheet Manager is an award-winning platform that enables financial institutions to manage and analyze their balance sheets with a focus on risk management, liquidity, capital and regulatory compliance. It helps banks break down silos between departments, such as finance and risk, and utilizes simulations and stress testing to forecast future performance and identify potential threats or opportunities.

See details

How Balance Sheet Manager supports interest rate risk owners

- Scenario-driven visibility: Gain clear visibility into how forecasted NII and NIM change under different interest rates shape and spread scenarios.

- Position-level visibility: Deliver position-level insights with powerful analytics and out-of-the-box dashboards across key metrics, such as NII shock changes, yield analysis, EVE, KRD/DV01, FTP, EaR, VaR, hedge effectiveness and more.

- Compliance support: Receive support in meeting regulatory expectations, including IRRBB, PRRBB, CSRBB, ALMM, IFRS13, IFRS9 Hedge Accounting, U.S. Agencies’ Supervisory/Examination Priorities, U.S. CAMELS, ASC 320 (FAS115), OSFI Guideline B-12 and APS117.

How liquidity risk owners can optimize liquidity with Balance Sheet Manager

- Cash flow visibility: Get a handle on current cash flow profiles and liquidity buffers with interactive dashboards and monitor to regularly keep it in line with the institution’s risk appetite.

- Stress testing: Analyze liquidity profile changes under stress, including deposit decay and rollovers, adverse market dynamics, customer option exercise (prepay, lines of credit and delayed payments) and other what-if scenarios.

- Pressure testing: Preview survival horizons under your CFP and alternative backup liquidity funding plans.

- Regulatory compliance: Gain support for meeting regulatory requirements, such as LCR, NSFR, ILAAP, funding plans, C66/PRA110, Canadian NCCF, U.S. Interagency Policy Statement on Funding and Liquidity Risk Management, APS210, SBV circular 13/2018 and BNM Liquidity Risk policy document.

How CFOs can improve capital efficiency with Balance Sheet Manager

- Capital buffers: Release trapped capital from Pillar 1 minimum requirements and Pillar 2 add-ons through optimized allocation strategies.

- Business value: Realize quantifiable ROI through operational efficiency and comprehensive Pillar 1 and Pillar 2 cost reduction opportunities.

- Processing efficiency: Help reduce ICAAP and enterprise risk stress testing processing time with a powerful, scalable cloud platform.

- Strategic planning: Enhance ICAAP capital planning with clear visibility into Pillar 1 and Pillar 2 business value drivers and Basel compliance requirements.

How CROs can improve risk and return with Balance Sheet Manager

- Risk visibility: Gain clear visibility into how Pillar 1 risks (credit, market and operational) interact with Pillar 2 risks (concentration, interest rate and business model) across the enterprise and under multiple scenarios.

- Operational efficiency: Streamline Pillar 1 and Pillar 2 risk assessment and ICAAP governance with automated workflows that meet Basel standards.

- Risk management: Transform complete Pillar 1 and Pillar 2 compliance from a regulatory burden to a competitive advantage.

- Risk oversight: Monitor all Pillar 1 and Pillar 2 risk categories with comprehensive, timely predictive analytics and stress testing capabilities.

- Regulatory compliance: Access support for IFRS9/JFRS9/MFRS9/PFRS9 ECL, CECL, leverage ratio, EBA stress testing and delivered regulatory templates such as CoRep Own Funds, Basel 3.1, BNM Capital Adequacy Framework and SBV circular 41.

How treasurers can optimize the balance sheet with Balance Sheet Manager

- Risk insights: Gain a deeper understanding of how Pillar 1 risks (credit, market and operational) interact with Pillar 2 risks (liquidity, concentration, interest rate and business model vulnerabilities) and their combined impact on capital adequacy and funding.

- Capital optimization: Optimize Pillar 1 minimum requirements and Pillar 2 liquidity/concentration add-ons through advanced stress testing and scenario modelling.

- Process automation: Automate ICAAP and ILAAP processes with comprehensive Pillar 1 and Pillar 2 workflows to reduce costs and deliver business value.

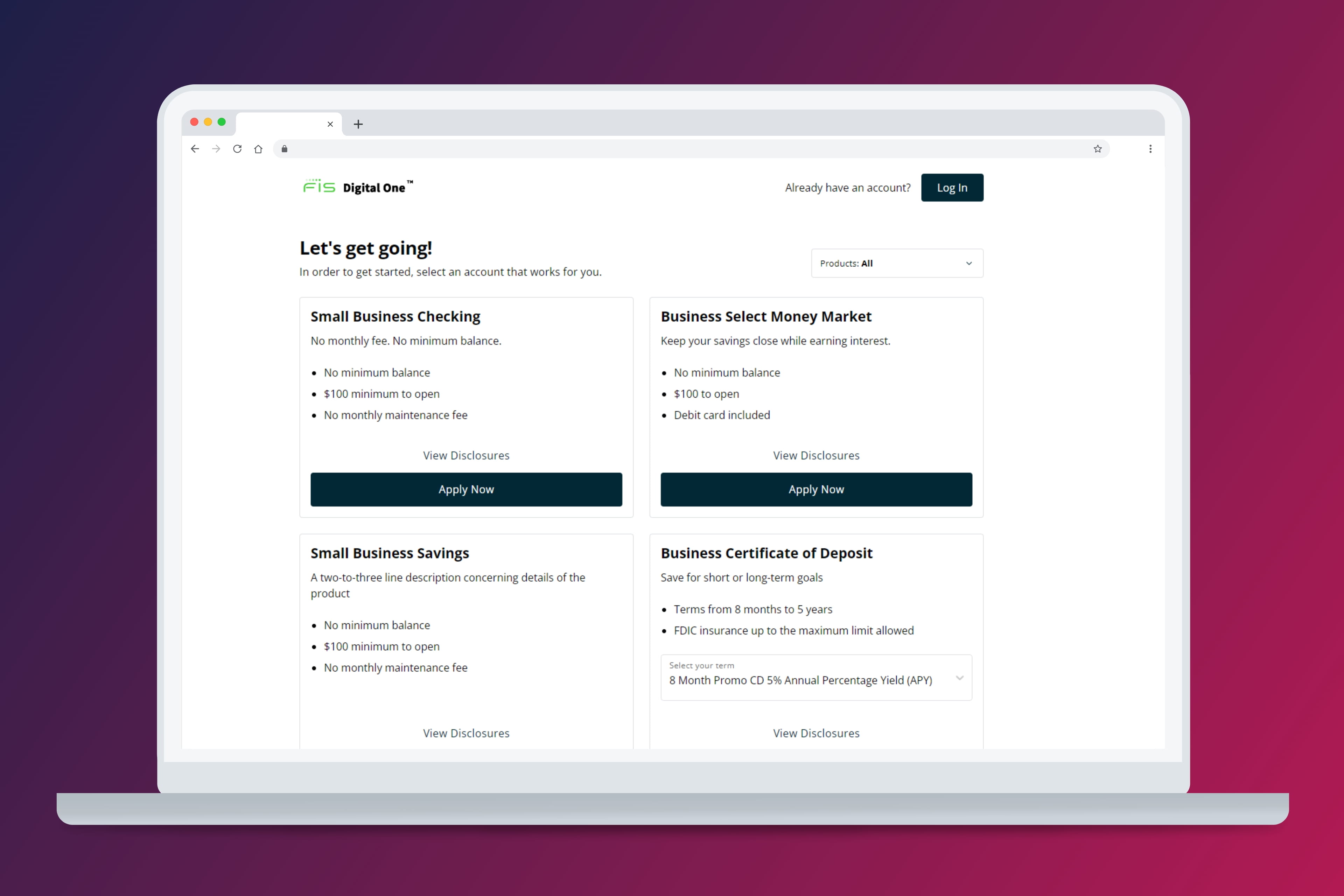

Configurable modules, scalable to your needs

With Balance Sheet Manager’s modular structure, you can implement a consistent, modern and scalable framework for enterprise management of the balance sheet through a single application. Forecast outcomes, measure impacts and develop capital strategies backed by precise, timely calculations.

See details

.jpg)

Best-in-class asset liability management

Named 2025 ALM Solution of the Year by Risk Asia, and with consecutive wins in the ALM system category and six new critical ALM leadership titles in the 2025 RiskTech Quadrant® and Vendor Capabilities report, FIS remains the trusted leader in ALM and treasury solutions.

See all awardsContinuous innovation and reinvestment

We continuously reinvest in Balance Sheet Manager, consistently innovating, adding and enhancing our capabilities to deliver faster computing performance, efficient workflows and compliance with the latest regulatory and senior management requirements.

See what's new

Let’s keep our conversation going

Learn more about how FIS can help you manage risk, protect shareholder value and make your money work harder to expand your balance sheet.

Connect with an expert to get your questions answered.

Find out how we can help you put your capital to work.

Reach out for pricing details that align with your needs.

View specifications for our Balance Sheet Manager platform.

.png)

Specs

Balance Sheet Manager

High-performance elastic cloud computing enables scalable, cost-efficient and resilient operations with managed upgrades and disaster recovery

Integrated, comprehensive alignment helps ensure consistent management of interest rate, liquidity and market risks

Strategic unified platform combines treasury, risk and finance to drive compliance, reduce unexpected risks and improve risk-adjusted returns

Risk visibility

Achieve a transparent, enterprise-level view of current and forward-looking risks tied to your balance sheet.

Scenario analysis

Stress and pivot your balance sheet by risk factor to better understand downstream business model impacts and regulatory effects.

Informed decision-making

Monitor evolving trends and disruptions to reassess risks and select the strongest course of action for your business.

Framework validation

Strengthen trust in exposure measurement, limit reporting and validation of your risk appetite reassessments.

Regulatory management

Gain agility in responding to regulatory and fiduciary demands and realize greater returns on compliance investments.

Scalable and modular by design

FIS® Balance Sheet Manager’s modular design helps ensure you only pay for what you need today, with the freedom to expand as your business grows. Whether you're starting big, small, focused or scaling rapidly, each component bolts on – giving you control, cost-efficiency and future-ready adaptability.

What’s new

Credit value at risk module

Credit risk capabilities provide unexpected loss calculations and capital requirement identification so you can evaluate and manage portfolio risks.

Predeal pricing

Predeal pricing capabilities deliver on-demand, risk-adjusted cost of funds using the same assumptions and calculation engines as risk management to support smarter lending.

Elastic cloud

Our partnership with AWS provides flexible cloud hosting with elastic scaling and performance tuning to support changing business needs.

PCAF financed emissions

Contract-level data enables financed emissions forecasting through integrated scenarios and KPIs, with clear tracking against targets in policy and steering scenarios.

Explore the latest updates, resources and software

Built for simplicity, the FIS Client Portal makes it easier to quickly navigate and access product support, security information, software releases and regulatory resources in one centralized location.

Resources

Balance Sheet Manager brochure

Manage, evaluate, control and stress test all types of financial risks, including climate, physical and traditional risks, in one platform.

Balance Sheet Manager – IFRS 9 Impairment brochure

Achieve greater consistency and alignment across impairment ECL reporting and integrated risk planning.

Balance Sheet Manager – Credit Value at Risk module brochure

Perform dynamic operations across subportfolios for targeted analysis of credit risk exposures by segment, geography, rating or other dimensions.

How to simplify enterprise wide stress testing infographic

Oversee all your EWST requirements in a single platform that integrates data, modeling and risk evaluation, and reporting.

Regulatory Reporting for EBA IRRBB product sheet

Unlock business value from reporting while demonstrating complete control of IRRBB to your regulator, now and in the future.

Balance Sheet Manager – Cloud Edition product sheet

Evaluate, forecast and control all types of financial risks while accelerating calculations with this cloud-enabled balance sheet management solution.

Transforming IRRBB into a strategic advantage white paper

Discover why banks need resilient, flexible assessment capabilities in place to evaluate the potential stress impact in different scenarios.

Lifting the game on ICAAP to unlock shareholder value guide

Find out how to overcome challenges in holistic balance sheet management and capital planning for financial institutions.

Is your ICAAP up to the challenge? White paper

Address management across the stress continuum, including recovery and resolution planning, through a holistic enterprise risk approach.

FAQ

Are current market fluctuations caused by political events, and when might volatility stabilize?

Structural changes and innovations in banking and financial markets are driving greater volatility. Read our thoughts in Independent Banker.

Does Balance Sheet Manager support US GAAP?

For over 30 years, we’ve helped U.S. banks solve their ALM challenges with BancWare solutions. We address the complexities familiar to risk managers, including CMO/ABS and negative convexity modeling, deposit stress, Federal Reserve/OCC/FDIC expectations and more.

What strategies should CFOs use to manage Pillar 1 and Pillar 2 risks?

Pillar 1 risks, like credit and market exposures, interact with Pillar 2 risks, such as liquidity gaps and concentration vulnerabilities. CFOs benefit from tools that make these interdependencies visible, allowing for more accurate scenario planning, optimized capital buffers and stronger regulatory positioning.

How does Balance Sheet Manager differ from other cloud solutions?

We’re not just adopting the cloud: We’ve launched a multiyear innovation collaboration with Amazon Web Services (AWS). Cloud experts collaborated closely with FIS business and quant teams to modernize and optimize our calculation engines. This work delivers high-volume, high-performance scalability that can be tailored to your risk management objectives and priorities. For more on our collaboration with AWS, listen here.

Can Balance Sheet Manager handle Tier 1 bank volumes?

Utilizing the elastic scalability of our cloud offering, we can run millions of positions through a suite of interest rate scenarios in minutes. Reach out to us for a demonstration.

I’m unhappy with my current system. Can I switch without major disruption?

We regularly replace competitor systems and internal builds. Contact us to learn how our solutions can modernize your risks management with minimal execution risk.

How does Balance Sheet Manager approach AI?

We have a R&D team within the balance sheet management teams that actively work on specific use-cases and enhancements.

We are a small bank and currently outsource ALM to an outside firm. Why should I bring this in house?

Post-SVB, regulators are keen for banks to “know and own” their numbers. Banks can perform customized what-if analysis tailored to their own portfolios or strategies. ALM becomes part of broader strategic planning, aligning closely with pricing, funding and risk appetite. Read more of our thoughts in Independent Banker.

How long has FIS been in the ALM and balance sheet management space?

With a long, proven history in risk management – formerly known as SunGard, which became the capital markets division of FIS in 2015 – we’ve helped clients solve balance sheet management challenges for more than 30 years. Much of the Balance Sheet Management leadership team brings over 20 years of industry experience, driven by a passion for solving the evolving complexities of balance sheet risk management.

How is FIS perceived in the balance sheet management space?

We’re regularly recognized as global leaders in balance sheet management, including ALM Solution of the Year at the 2025 Asia Risk Awards and category leader across all six quadrants of the Chartis ALM Solutions 2025 Quadrant Report, which spans ALM, liquidity risk management, FTP, capital and balance sheet optimization, hedging and risk management, and financial planning and analysis.

Let's keep our conversation going

Learn more about how FIS can help you manage risk, protect shareholder value and make your money work harder to expand your balance sheet.

Connect with an expert to get your questions answered.

Find out how we can help you put your capital to work.

Reach out for pricing details that align with your needs.

Get a brief overview of our Balance Sheet Manager platform.

Book a meeting

Schedule an appointment with a dedicated specialist who can evaluate your business needs and develop a tailored plan to align with your objectives.

Get in touch