Deploy the full range of open account trade finance solutions

Intuitive | Scalable | Secure

An intuitive supply chain finance platform for banks and financial institutions

The FIS® Supply Chain Finance Platform (formerly Demica) provides the flexibility and scalability banks and financial institutions need to deliver the full range of supply chain finance solutions to their corporate clients. Intuitive deal configuration, portfolio monitoring and reporting – securely hosted on Microsoft Azure – support scalable supply chain finance delivery across industries and client sizes.

Flexible, scalable technology solutions

Gain the flexibility to easily manage and grow your trade and supply chain finance business. The Supply Chain Finance Platform supports white-label delivery and transaction-level servicing with simple onboarding, easy-to-use structuring tools and automated reporting and dashboards.

See details

Bridging risk and financial management

Meeting funder expectations for risk management requires detailed reporting, transparency and integration, making them crucial for banks offering structured solutions. Read articleLeverage expertise, ensure compliance

Partnering with third-party technology providers, banks can use their expertise to offer superior products while maintaining security and compliance standards. Read articleAre you a corporate treasurer looking for liquidity solutions?

Browse more articles and videos relevant to your business

Go to Fintech InsightsExplore all the financial technology products FIS has to offer

View all products

The Walbrook Building

25 Walbrook

London, EC4N 8AF

United Kingdom

Let's keep our conversation going

Learn more about how FIS can help banks and financial institutions provide the full range of supply chain finance services to corporate clients.

Supply Chain Finance Platform

Automated workflows and client onboarding support client growth

Modern, intuitive interface and self-service options strengthen client retention

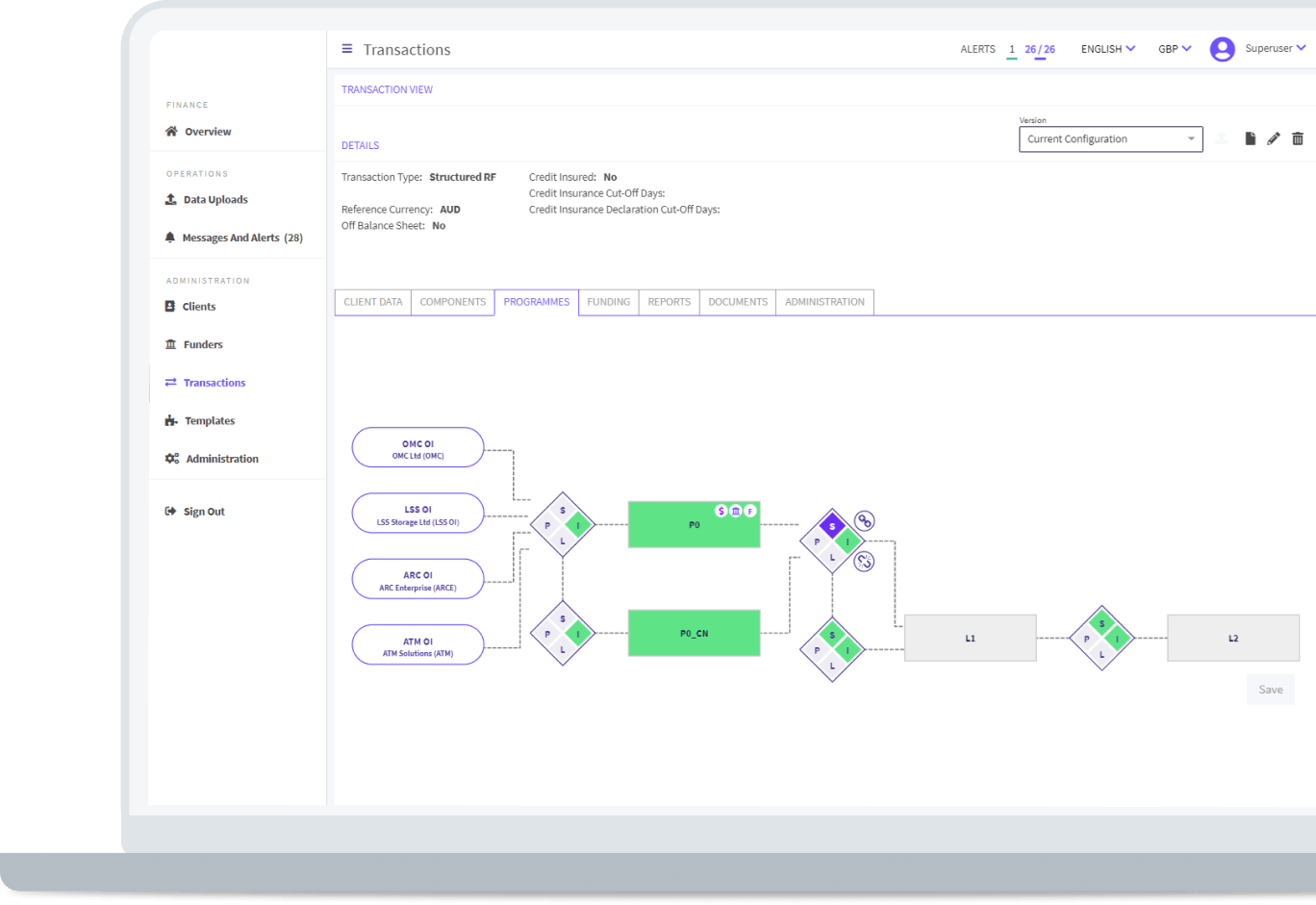

Deal flexibility

Provide your corporate clients with customizable deal configurations.

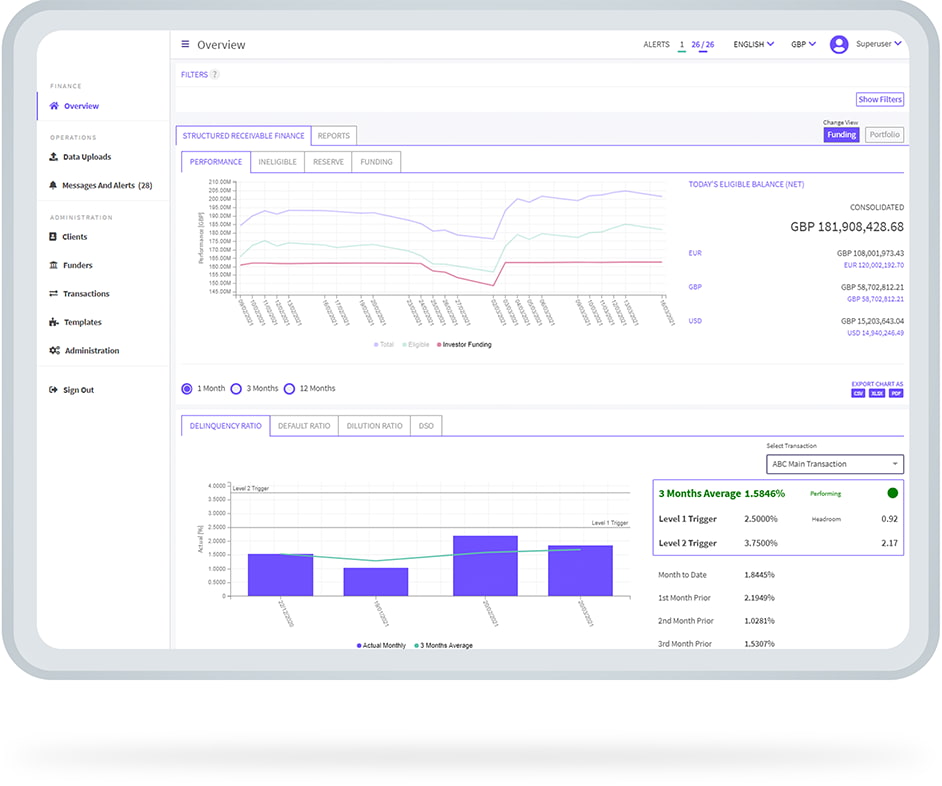

Performance monitoring

Monitor portfolio performance with advanced portfolio analytics and tracking capabilities.

Integrated reporting

Simplify compliance and audit readiness with built-in reporting features.

Cloud security

Deploy your program on a secure, cloud-native platform hosted on Microsoft® Azure.

Supply Chain Finance Platform

Manage all your supply chain finance programs in a single place or utilize our powerful technology for individual receivables deals. The FIS® Supply Chain Finance Platform offers flexible options tailored to your needs – whether through a licensed white-label setup or on a transactional servicing basis.White-label platform

License a customizable white-label platform

Transactional Deal Servicing and Reporting

Automate the management of complex transactions

FAQ

What should banks look for in a supply chain finance platform?

Key features include flexibility in deal structuring, real-time data visibility, integration capabilities and secure hosting. A scalable platform should also support onboarding, risk management and regulatory reporting requirements.

How does technology improve receivables and trade finance delivery?

Modern receivables and trade finance platforms streamline program setup, automate workflows and provide real-time monitoring. This reduces manual errors, accelerates decision-making and enables banks to offer a more competitive and responsive experience to clients.

Why is real-time portfolio monitoring important for trade finance?

Real-time monitoring allows financial institutions to track exposures, performance metrics and risk indicators across all client programs. This helps ensure compliance, optimize capital use and improve customer service.

The Walbrook Building

25 Walbrook

London, EC4N 8AF

United Kingdom

Let's keep our conversation going

Learn more about how FIS can help banks and financial institutions provide the full range of supply chain finance services to corporate clients.

Report

Download the report to see how banks are responding to global events, asset growth, governance and evolving technology.

Unlock the report