Access working capital by unlocking the value of receivables before maturity

Flexible | Scalable | Automated

Empowering corporates with flexible liquidity for growth

Whether easing liquidity pressure or enabling growth, FIS® Supply Chain Finance Suite (formerly Demica) connects CFOs and corporate treasurers to a network of global funders through secure, cloud-native technology. Flexible deal structures, transparent reporting and expert support also help keep your program aligned with treasury goals.

Flexible working capital solutions

Access the expert support you need to unlock liquidity and improve your working capital metrics with the Supply Chain Finance Suite. Our team works with you to deliver a working capital solution to meet your specific needs, from initial receivables analysis and data structuring through solution design, funder selection, funding delivery and ongoing reporting.

See details

Bridging risk and financial management

Meeting funder expectations for risk management requires detailed reporting, transparency and integration, making them crucial for banks offering structured solutions. Read articleLeverage expertise, ensure compliance

Partnering with third-party technology providers, banks can use their expertise to offer superior products while maintaining security and compliance standards. Read articleBrowse more articles and videos relevant to your business

Go to Fintech InsightsLooking to expand your supply chain finance offerings?

Explore all the financial technology products FIS has to offer

View all products

The Walbrook Building

25 Walbrook

London, EC4N 8AF

United Kingdom

Let's keep our conversation going

Learn more about how FIS can help you unlock liquidity and optimize cash flow with receivables finance and working capital tools.

Connect with an expert to get your questions answered.

See how Supply Chain Finance Suite can support your operations.

Reach out for pricing details that align with your needs.

View specifications for our Supply Chain Finance Suite.

Specs

Supply Chain Finance Suite

Smooth integration with existing treasury and ERP systems for improved operations

Structured programs tailored to your business cycle and customer base

Flexible financing options available through a global network of over 250 funders

Enhance capital

Increase liquidity to support daily operations and fuel future investment plans.

Limit debt

Reduce reliance on short-term borrowing and costly credit lines to strengthen cash flow stability.

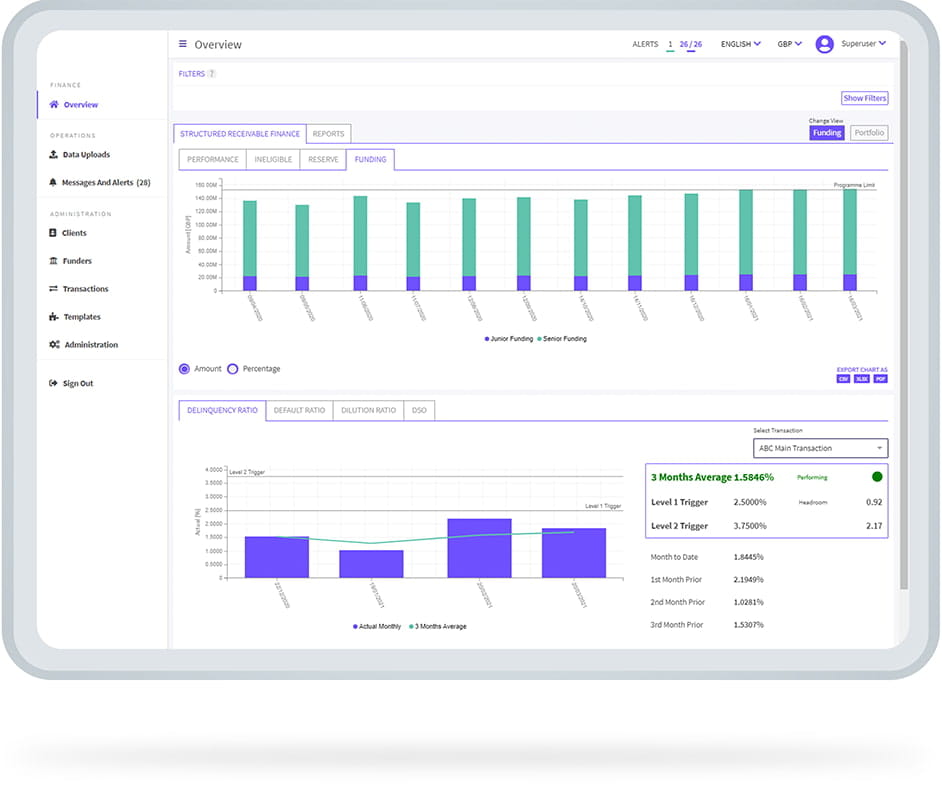

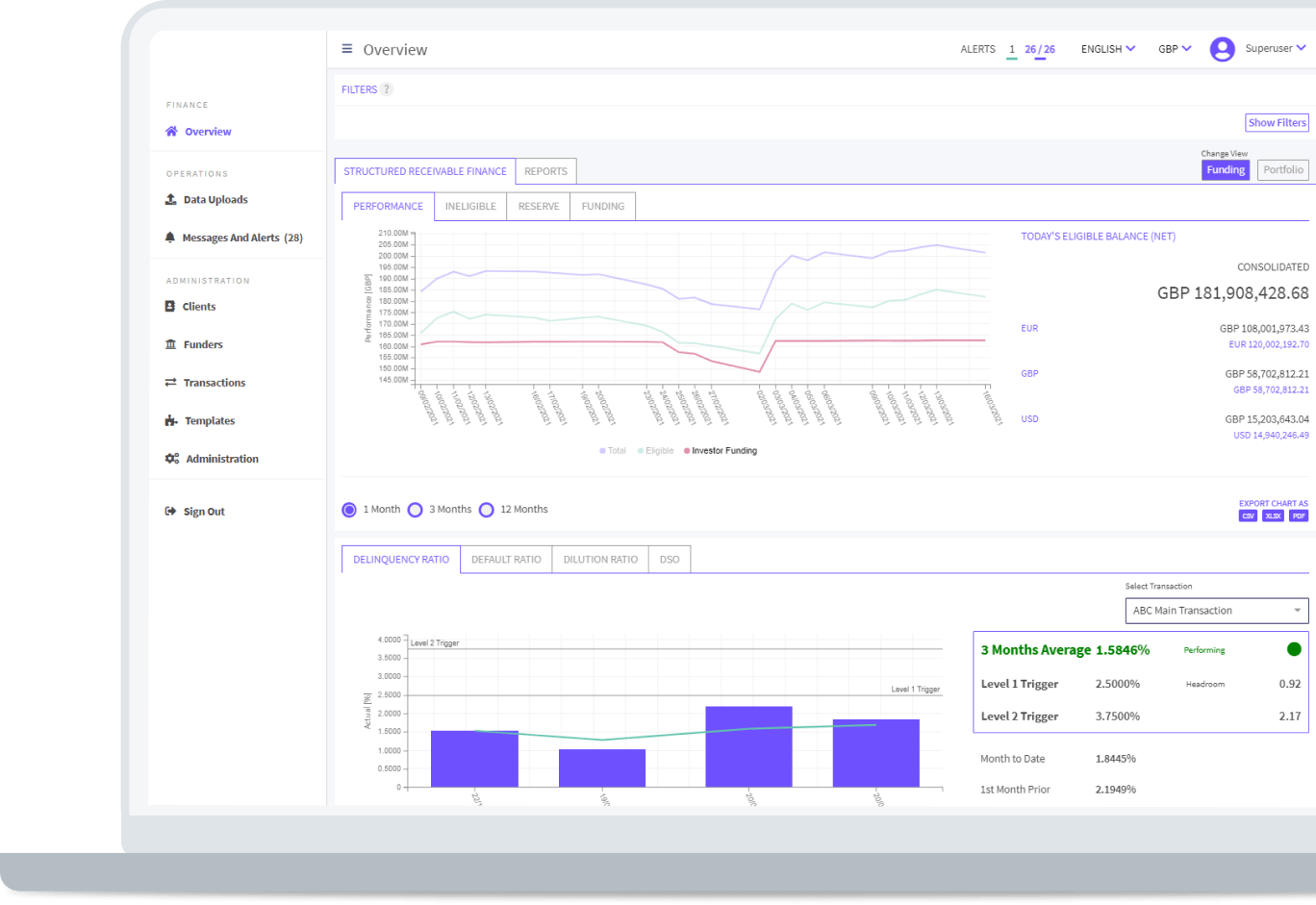

Strengthen oversight

Maintain visibility and control through centralized reporting and performance dashboards.

Supply Chain Finance Suite

Optimize working capital management across your organization with the FIS® Supply Chain Finance Suite. Sell trade receivables for early liquidity, extend supplier terms and fund distributors from one centralized platform with automation, scalability and expert-led support.

Resources

Optimizing working capital: A guide for private equity firms e-book

Effective working capital management focuses on accelerating cash conversion and using alternative funding to unlock cash and improve liquidity.

Receivables Finance product sheet

A cloud-native solution designed to help businesses unlock cash trapped in outstanding payments and reduce the cost of funds.

Trade Receivables Securitization product sheet

Next-generation supply chain finance technology designed to provide competitive, flexible financing and free up capital for strategic business growth.

FAQ

What is receivables finance, and how does it support cash flow?

Receivables finance is a way for companies to access cash tied up in outstanding invoices by selling them to a third party at a discount. This improves cash flow, reduces days sales outstanding and helps fund operations without taking on new debt.

How can working capital programs help reduce financing costs?

Working capital programs provide early payment options that are often more cost-effective than traditional borrowing. By accelerating cash inflow from customers, businesses can reduce their need for expensive short-term credit facilities.

The Walbrook Building

25 Walbrook

London, EC4N 8AF

United Kingdom

Let's keep our conversation going

Learn more about how FIS can help you unlock liquidity and optimize cash flow with receivables finance and working capital tools.

Connect with an expert to get your questions answered.

See how Supply Chain Finance Suite can support your operations.

Reach out for pricing details that align with your needs.

Get a brief overview of our Supply Chain Finance Suite.

Survey

Share your expertise and help uncover the trends shaping the supply chain finance industry.

Take the survey