Fintech Insights

APIs made easy

Maria Schuld | division executive, North America Banking Solutions, FIS

January 13, 2020

A set of robust and intuitive application programming interfaces (APIs) creates the foundation for rapid development and deployment of unique banking solutions. APIs provide your institution with data that developers have made available to outside users. You just have to know the language and ask the right questions in order to leverage this data. APIs will not replace the need for IT staff and skilled developers at a bank or third-party solution provider. But they can significantly accelerate the pace of product development and integration projects.

In meetings with bank executives they often ask me the best way to get started with APIs within their organizations. I then describe how the following elements of a comprehensive API solution helps banks realize the benefits of open banking.

Intuitive discovery and learning

A developer portal should be the first interaction your technical staff has with an API. The Developer Experience (DX) encompasses many aspects of the relationship between developers and the API platform, with a portal covering areas such as education, tools and platform usability. Open APIs should provide a DX with clean, well-documented and extremely easy-to-use APIs. APIs provided by your technology partner should contribute to the consistent developer experience in terms of API discoverability and documentation.

Aided by a portal, your developers or those of a third-party partner, can integrate applications quickly with pre-built APIs, utilize open standards for authorizations and create unique banking products. Embedded productivity and learning aids help streamline work processes.

Depth of services

Today’s developers should expect a fluid interaction with data platforms. To make this possible, they need APIs that access the full breadth and depth of bank systems. Open APIs should provide access to typical banking functions, including:

- Complete customer inquiry

- Complete account inquiry

- Account maintenance

- Loan management

- Image integration

- Funds management

- Cards management

Open APIs provide the right solution for a bank – whether the need is for additional data in a customer management app, or in a full-fledged onboarding experience. APIs can do the heavy lifting, so that developers can focus on enhancing your customer’s experience.

An environment that enables rapid development

As web and mobile app users have high technology and efficiency expectations, APIs offer a common approach for integration efforts. Open APIs should come via a banking-specific developer portal as previously mentioned. FIS offers Code Connect designed to empower financial institutions with the ability to share data quickly and securely, while growing an ecosystem of partners and customers. Many banks have already taken advantage of this fully featured API portal.

Validating our experience with APIs, Aite indicates that FIS Code Connect offers the most advanced API platform and environment of the leading U.S. core providers in recent research comparing the leading providers of U.S. core banking systems.

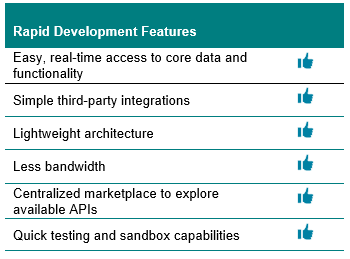

In addition to capabilities found in Code Connect, the following rapid development environment features should be provided by your bank’s API partner:

The right educational tools

A robust portal should take the guesswork out of integrations by providing developers with a centralized place for discovering all the tools they need to successfully use an API. Educational tools available through such a portal include:

- API documentation explaining all aspects of an API

- Swagger files enforcing the data dictionary in development environments

- ‘Try it out’ functionality to see the response of a particular API

- Code snippets and samples to accelerate development

- Software Development Kits (SDKs)

- Consistent search capabilities to find desired APIs

- A sandbox, with a test bank (where applicable) to interact with a live API.

API consulting as needed

If bankers need a personal touch to guide them through an API initiative, organizations like FIS offer specialized API Consulting to enable banks to take better advantage of the advantages of open banking with APIs. Consultants can help developers learn to navigate the library of FIS’ Code Connect and educate bank staff on leveraging APIs.

With high-quality, robust APIs the question bankers should ask themselves becomes: if other banks are creating unique solutions in the market, how quickly can I get started?