Press Release

FIS Reports Fourth Quarter and Full-Year 2020 Results

February 09, 2021

- Accelerated revenue growth sequentially in Banking and Capital Markets

- Achieved annual run-rate revenue synergies in excess of $200 million and annual run-rate expense synergies in excess of $750 million, including annual run-rate operating expense synergies of $400 million

- Generated net cash provided by operating activities of $1,417 million and $4,442 million and free cash flow of $977 million and $3,037 million in the quarter and full-year, respectively

- Announces first quarter and full-year 2021 guidance

JACKSONVILLE Fla., February 9, 2021 – FIS® (NYSE:FIS), a global leader in financial services technology, today reported its fourth quarter and full-year 2020 results.

“A year into the COVID-19 pandemic, I’m proud of how FIS has stood firm in support of our clients, colleagues and communities,” said Gary Norcross, chairman, president and chief executive officer, FIS. “The strength of our strategy and our continued investments in innovation are helping our clients rebound and thrive in an increasingly digital financial world. These successes combined with our operational efficiency gains are also delivering long-term value to our shareholders.”

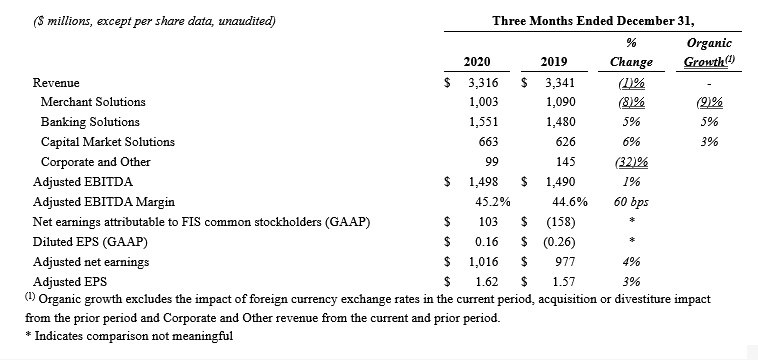

Fourth Quarter 2020

On a GAAP basis, consolidated revenue decreased 1% to $3,316 million, primarily due to negative consumer spending trends associated with the ongoing COVID-19 pandemic. Net earnings attributable to common stockholders were $103 million or $0.16 per diluted share.

On an organic basis, revenue was flat as compared to the prior year period, primarily due to negative consumer spending trends associated with the ongoing COVID-19 pandemic. Adjusted EBITDA margin expanded by 60 basis points (bps) over the prior year period to 45.2%, primarily due to short-term cost actions and the achievement of cost synergies associated with the July 31, 2019 acquisition of Worldpay, Inc. (Worldpay). Adjusted net earnings were $1,016 million or $1.62 per diluted share.

Organic growth excludes the impact of foreign currency exchange rates in the current period, acquisition or divestiture impact from the prior period and beginning this quarter and for the full year, excludes Corporate and Other revenue from the current and prior period. Corporate and Other revenue is generated by non-strategic businesses that we plan to wind down or sell.

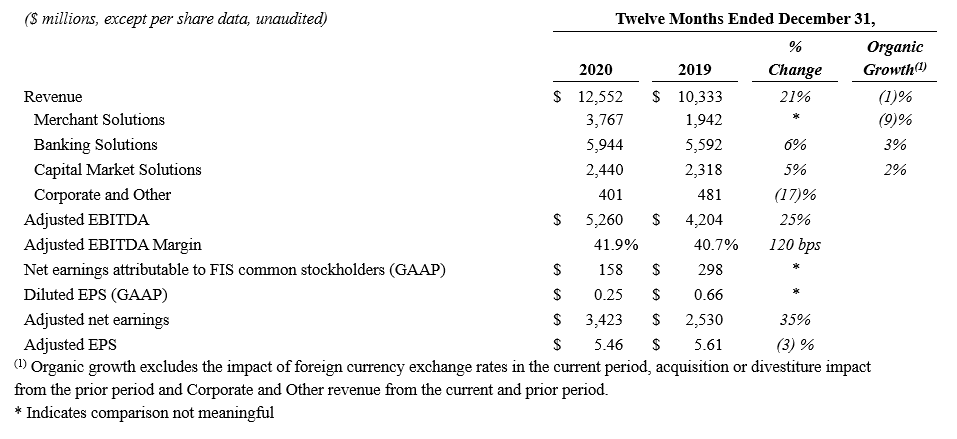

Full-Year 2020

On a GAAP basis, revenue increased 21% to $12,552 million as compared to the prior year, primarily due to the acquisition of Worldpay. Net earnings attributable to common stockholders was $158 million or $0.25 per diluted share.

On an organic basis, revenue decreased 1% as compared to the prior year period, primarily due to negative consumer spending trends associated with the ongoing COVID-19 pandemic. Adjusted EBITDA margin expanded by 120 basis points (bps) over the prior year period to 41.9%, primarily due to the achievement of Worldpay cost synergies. Adjusted net earnings were $3,423 million or $5.46 per diluted share.

Segment Information

- Merchant Solutions:

Fourth quarter revenue decreased 8% to $1,003 million. On an organic basis, revenue decreased 9% compared to the prior year period, primarily due to negative consumer spending trends associated with the ongoing COVID-19 pandemic as well as a headwind of approximately 2% associated with a step-up in debit card routing revenue synergies achieved in the prior year period following the Worldpay acquisition. Adjusted EBITDA margin was 50.9%.

Full-year revenue increased significantly to $3,767 million, primarily due to the Worldpay acquisition. On an organic basis, revenue decreased 9% compared to the prior year period. Adjusted EBITDA margin was 46.5%. - Banking Solutions:

Fourth quarter revenue increased 5% to $1,551 million. On an organic basis, revenue increased 5% compared to the prior year period, primarily due to strength in recurring revenue, partially offset by a headwind of approximately 1.5% associated with a decline in termination fees. Adjusted EBITDA margin was 44.4%.

Full-year revenue increased 6% to $5,944 million. On an organic basis, revenue increased 3% compared to the prior year period. Adjusted EBITDA margin was 43.0%. - Capital Market Solutions:

Fourth quarter revenue increased 6% to $663 million. On an organic basis, revenue increased 3% compared to the prior year period, primarily due to strength in recurring revenue, partially offset by a headwind of approximately 1% associated with the timing of license renewals. Adjusted EBITDA margin was 52.2%.

Full-year revenue increased 5% to $2,440 million. On an organic basis, revenue increased 2% compared to the prior year period. Adjusted EBITDA margin was 47.0%. - Corporate and Other:

Fourth quarter revenue decreased 32% to $99 million. Adjusted EBITDA loss was $48 million, including $78 million of corporate expenses.

Full-year revenue decreased 17% to $401 million. Adjusted EBITDA loss was $195 million, including $312 million of corporate expenses.

Consistent with historical practice, the Company regularly assesses its portfolio of assets and reclassified certain non-strategic businesses from Banking Solutions and Capital Market Solutions into the Corporate and Other segment. In total, Corporate and Other revenue represents 3% of fourth quarter and full-year 2020 revenue, and we plan to wind down or sell these non-strategic businesses.

Integration Update

The Company achieved annual run-rate synergies related to the Worldpay acquisition, exiting the fourth quarter of 2020 as follows:

- Revenue synergies in excess of $200 million on an annual run-rate basis, including ongoing execution of Premium Payback distribution, bank referral agreements, geographic expansion and broad-based cross-selling initiatives. Revenue synergies are expected to continue to increase and reach approximately $400 million on an annual run-rate basis by the end of 2021 and remain on track to exceed $550 million on an annual run-rate basis exiting 2022.

- Expense synergies in excess of $750 million on an annual run-rate basis, including $400 million of operating expense savings. The Company originally targeted $400 million in expense synergies by the end of 2022 and exceeded this target more than two years early. Operating expense synergies are expected to continue to increase and reach approximately $500 million on an annual run-rate basis exiting 2021.

Balance Sheet and Cash Flows

As of December 31, 2020, the Company had $4,600 million of available liquidity, including $1,959 million of cash and cash equivalents and $2,641 million of capacity available under its revolving credit facility. Debt outstanding totaled $20,015 million with an effective weighted average interest rate of 1.7%.

Fourth quarter net cash provided by operating activities was $1,417 million, and free cash flow was $977 million or 29% of revenue. Full-year net cash provided by operating activities was $4,442 million, and free cash flow was $3,037 million or 24% of revenue. Additionally, FIS paid dividends of $218 million during the quarter and $868 million for the full year.

The Company also recently announced an 11% increase to its annual dividend and a share repurchase authorization for 100 million shares in order to enable ongoing return of capital to its shareholders.

First Quarter and Full-Year 2021 GAAP Guidance

First Quarter and Full-Year 2021 Non-GAAP Guidance

COVID-19 Update

COVID-19 continued to impact our financial results in the fourth quarter of 2020. In certain locations, where government lockdowns and shelter-in-place orders have been tightened, consumer spending impacting our Merchant Solutions payments volume and transaction revenue has been adversely impacted after partially recovering in the third quarter of 2020. Certain verticals like travel, airlines and restaurants continue to be significantly impacted. The Company’s revenue continues to be impacted by reduced payment processing volumes within our Merchant Solutions segment and, to a lesser extent, transaction volume within our Banking Solutions segment. The Company’s liquidity remains strong and improved this quarter, as noted above.

Webcast

FIS will sponsor a live webcast of its earnings conference call with the investment community beginning at 8:30 a.m. (EST) Tuesday, February 9, 2021. To access the webcast, go to the Investor Relations section of FIS’ homepage, www.fisglobal.com. A replay will be available after the conclusion of the live webcast.

About FIS

FIS is a leading provider of technology solutions for merchants, banks and capital markets firms globally. Our employees are dedicated to advancing the way the world pays, banks and invests by applying our scale, deep expertise and data-driven insights. We help our clients use technology in innovative ways to solve business-critical challenges and deliver superior experiences for their customers. Headquartered in Jacksonville, Florida, FIS is a Fortune 500® company and is a member of Standard & Poor’s 500® Index.

To learn more, visit www.fisglobal.com. Follow FIS on Facebook, LinkedIn and Twitter (@FISGlobal).

FIS Use of Non-GAAP Financial Information

Generally Accepted Accounting Principles (GAAP) is the term used to refer to the standard framework of guidelines for financial accounting in the United States. GAAP includes the standards, conventions, and rules accountants follow in recording and summarizing transactions and in the preparation of financial statements. In addition to reporting financial results in accordance with GAAP, we have provided certain non-GAAP financial measures.

These non-GAAP measures include constant currency revenue, organic revenue growth, adjusted EBITDA, adjusted EBITDA margin, adjusted net earnings, adjusted EPS, and free cash flow. These non-GAAP measures may be used in this release and/or in the attached supplemental financial information.

We believe these non-GAAP measures help investors better understand the underlying fundamentals of our business. As further described below, the non-GAAP revenue and earnings measures presented eliminate items management believes are not indicative of FIS’ operating performance. The constant currency and organic revenue growth measures adjust for the effects of exchange rate fluctuations, while organic revenue growth also adjusts for acquisitions and divestitures and excludes revenue from Corporate and Other, giving investors further insight into our performance. Finally, free cash flow provides further information about the ability of our business to generate cash. For these reasons, management also uses these non-GAAP measures in its assessment and management of FIS’ performance.

As described below, our Adjusted EBITDA and Adjusted Net Earnings measures also exclude incremental and direct costs resulting from the COVID-19 pandemic. Management believes that this adjustment may help investors understand the longer-term fundamentals of our underlying business.

Constant currency revenue represents reported operating segment revenue excluding the impact of fluctuations in foreign currency exchange rates in the current period.

Organic revenue growth is constant currency revenue, as defined above, for the current period compared to an adjusted revenue base for the prior period, which is adjusted to add pre-acquisition revenue of acquired businesses for a portion of the prior year matching the portion of the current year for which the business was owned, and subtract pre-divestiture revenue for divested businesses for the portion of the prior year matching the portion of the current year for which the business was not owned, for any acquisitions or divestitures by FIS. When referring to organic revenue growth, revenues from our Corporate and Other segment, which is comprised of revenue from non-strategic businesses, are excluded.

Adjusted EBITDAreflects net earnings before interest, other income (expense), taxes, equity method investment earnings (loss), and depreciation and amortization, and excludes certain costs and other transactions that management deems non-operational in nature, the removal of which improves comparability of operating results across reporting periods. It also excludes incremental and direct costs resulting from the COVID-19 pandemic. This measure is reported to the chief operating decision maker for purposes of making decisions about allocating resources to the segments and assessing their performance. For this reason, adjusted EBITDA, as it relates to our segments, is presented in conformity with Accounting Standards Codification 280, Segment Reporting, and is excluded from the definition of non-GAAP financial measures under the Securities and Exchange Commission's Regulation G and Item 10(e) of Regulation S-K.

Adjusted EBITDA margin reflects adjusted EBITDA, as defined above, divided by revenue.

Adjusted net earnings excludes the impact of certain costs and other transactions which management deems non-operational in nature, the removal of which improves comparability of operating results across reporting periods. It also excludes the impact of acquisition-related purchase accounting amortization and equity method investment earnings (loss), both of which are recurring. It also excludes incremental and direct costs resulting from the COVID-19 pandemic.

Adjusted EPS reflects adjusted net earnings, as defined above, divided by weighted average diluted shares outstanding.

Free cash flow reflects net cash provided by operating activities, adjusted for the net change in settlement assets and obligations and excluding certain transactions that are closely associated with non-operating activities or are otherwise non-operational in nature and not indicative of future operating cash flows, including incremental and direct costs resulting from the COVID-19 pandemic, less capital expenditures. Free cash flow does not represent our residual cash flow available for discretionary expenditures, since we have mandatory debt service requirements and other non-discretionary expenditures that are not deducted from the measure.

Any non-GAAP measures should be considered in context with the GAAP financial presentation and should not be considered in isolation or as a substitute for GAAP measures. Further, FIS’ non-GAAP measures may be calculated differently from similarly titled measures of other companies. Reconciliations of these non-GAAP measures to related GAAP measures, including footnotes describing the specific adjustments, are provided in the attached schedules and in the Investor Relations section of the FIS website, www.fisglobal.com.

Forward-Looking Statements

This earnings release and today’s webcast contain “forward-looking statements” within the meaning of the U.S. federal securities laws. Statements that are not historical facts, including statements about anticipated financial outcomes, including any earnings guidance of the Company, business and market conditions, outlook, foreign currency exchange rates, expected dividends and share repurchases, the Company’s sales pipeline and anticipated profitability and growth, as well as other statements about our expectations, beliefs, intentions, or strategies regarding the future, are forward-looking statements. These statements relate to future events and our future results, and involve a number of risks and uncertainties. Forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Any statements that refer to beliefs, expectations, projections or other characterizations of future events or circumstances and other statements that are not historical facts are forward-looking statements.

Actual results, performance or achievement could differ materially from those contained in these forward-looking statements. The risks and uncertainties that forward-looking statements are subject to include, without limitation:

- the outbreak or recurrence of the novel coronavirus (“COVID-19”) and measures to reduce its spread, including the impact of governmental or voluntary actions such as business shutdowns and stay-at-home orders;

- the duration, including any recurrence, of the COVID-19 pandemic and its impacts, including the general impact of an economic recession, reductions in consumer and business spending, and instability of the financial markets across the globe;

- the economic and other impacts of COVID-19 on our clients which affect the sales of our solutions and services and the implementation of such solutions;

- the risk of losses in the event of defaults by merchants (or other parties) to which we extend credit in our card settlement operations or in respect of any chargeback liability, either of which could adversely impact liquidity and results of operations;

- changes in general economic, business and political conditions, including those resulting from COVID-19 or other pandemics, intensified international hostilities, acts of terrorism, changes in either or both the United States and international lending, capital and financial markets and currency fluctuations;

- the risk that the Worldpay transaction will not provide the expected benefits or that we will not be able to achieve the revenue synergies anticipated;

- the risk that other acquired businesses will not be integrated successfully or that the integration will be more costly or more time-consuming and complex than anticipated;

- the risk that cost savings and other synergies anticipated to be realized from other acquisitions may not be fully realized or may take longer to realize than expected;

- the risks of doing business internationally;

- the effect of legislative initiatives or proposals, statutory changes, governmental or other applicable regulations and/or changes in industry requirements, including privacy and cybersecurity laws and regulations;

- the risks of reduction in revenue from the elimination of existing and potential customers due to consolidation in, or new laws or regulations affecting, the banking, retail and financial services industries or due to financial failures or other setbacks suffered by firms in those industries;

- changes in the growth rates of the markets for our solutions;

- failures to adapt our solutions to changes in technology or in the marketplace;

- internal or external security breaches of our systems, including those relating to unauthorized access, theft, corruption or loss of personal information and computer viruses and other malware affecting our software or platforms, and the reactions of customers, card associations, government regulators and others to any such events;

- the risks of reduction in revenue from the elimination of existing and potential customers due to consolidation in, or new laws or regulations affecting, the banking, retail and financial services industries or due to financial failures or other setbacks suffered by firms in those industries;

- the risk that implementation of software, including software updates, for customers or at customer locations or employee error in monitoring our software and platforms may result in the corruption or loss of data or customer information, interruption of business operations, outages, exposure to liability claims or loss of customers;

- the reaction of current and potential customers to communications from us or regulators regarding information security, risk management, internal audit or other matters;

- the risk that 2020 election results in the U.S. may result in additional regulation and additional regulatory and tax costs;

- competitive pressures on pricing related to the decreasing number of community banks in the U.S., the development of new disruptive technologies competing with one or more of our solutions, increasing presence of international competitors in the U.S. market and the entry into the market by global banks and global companies with respect to certain competitive solutions, each of which may have the impact of unbundling individual solutions from a comprehensive suite of solutions we provide to many of our customers;

- the failure to innovate in order to keep up with new emerging technologies, which could impact our solutions and our ability to attract new, or retain existing, customers;

- an operational or natural disaster at one of our major operations centers;

- failure to comply with applicable requirements of payment networks or changes in those requirements;

- fraud by merchants or bad actors; and

- other risks detailed in the “Risk Factors” and other sections of our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, in our quarterly reports on Form 10-Q and in our other filings with the Securities and Exchange Commission.

Other unknown or unpredictable factors also could have a material adverse effect on our business, financial condition, results of operations and prospects. Accordingly, readers should not place undue reliance on these forward-looking statements. These forward-looking statements are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Except as required by applicable law or regulation, we do not undertake (and expressly disclaim) any obligation and do not intend to publicly update or review any of these forward-looking statements, whether as a result of new information, future events or otherwise.

For more information

Ellyn Raftery, 904.438.6083

Chief Marketing Officer

FIS Global Marketing and Corporate Communications

Ellyn.Raftery@fisglobal.com

Nathan Rozof, CFA, 866.254.4811

Executive Vice President

FIS Investor Relations

Nathan.Rozof@fisglobal.com